-

Investors added $741.7 million to municipal bond mutual funds in the week ending Wednesday, following $2.078 billion of inflows the prior week, according to LSEG Lipper data.

January 30 -

"There are a lot of moving parts here with the potential to either help or hinder the Fed's quest for price stability and maximum employment" this year, noted BMO Deputy Chief Economist Michael Gregory, who says the Fed will "stand pat."

January 28 -

The Federal Reserve will be more cautious and slow rate cuts going forward, according to minutes of the December Federal Open Market Committee meeting, released Wednesday.

January 8 -

Investors pulled more from municipal bond mutual funds in the final reporting week of 2024, but high-yield reverted to inflows to close out the year, adding to the sector's outperformance overall.

January 2 -

Although a new administration means policy uncertainty, most analysts see the economy growing above trend next year, although inflation will remain a concern.

January 2 -

While municipals have outperformed USTs on the whole in 2024, they will close December with losses. How taxables perform in early 2025 coupled with macroeconomic and Washington policy uncertainty have municipal market participants on edge for what lies ahead.

December 31 -

The Federal Open Market Committee cut the fed funds target again in December but signaled fewer cuts in 2025. There was some dissent. The markets are watching to see if the Federal Reserve pauses its easing cycle in January. Brian Rehling, head of global fixed-income strategy at Wells Fargo Investment Institute, recaps and parses the previous day's FOMC meeting and Fed Chair Jerome Powell's press conference.

-

Analysts are unsure what the Federal Open Market Committee will do with monetary policy in 2025. The panel projects two rate cuts, but some analysts expect more, and others see fewer.

December 26 -

As the market prepares for 2025, there's a lot of uncertainty around what the new administration will mean for the macroeconomic environment and interest rates, the latter of which may be impacted by policy around the deficit, said Steve Shutz, portfolio manager and director of tax-exempt fixed income at Brown Advisory.

December 18 -

A week ahead of inauguration day, Scott Colbert, executive vice president, director of fixed income and chief economist at Commerce Trust, takes a look at how the Federal Reserve and the economy will fare in President-elect Donald Trump's second run in the White House.

-

Analysts are confident the Fed will lower rates at this week's meeting, but their views on what next year holds don't share the same consensus.

December 17 -

Donald Trump discussed various items related to the Fed and its independence and stated he would not nominate Jerome Powell for another term as chair. Gennadiy Goldberg, head of U.S. rates strategy at TD Securities, discusses what a Trump presidency may mean for the Fed.

-

Municipals ignored USTs losses, leading to lower muni to UST ratios and adding to the better performance across the curve and credit spectrum.

November 12 -

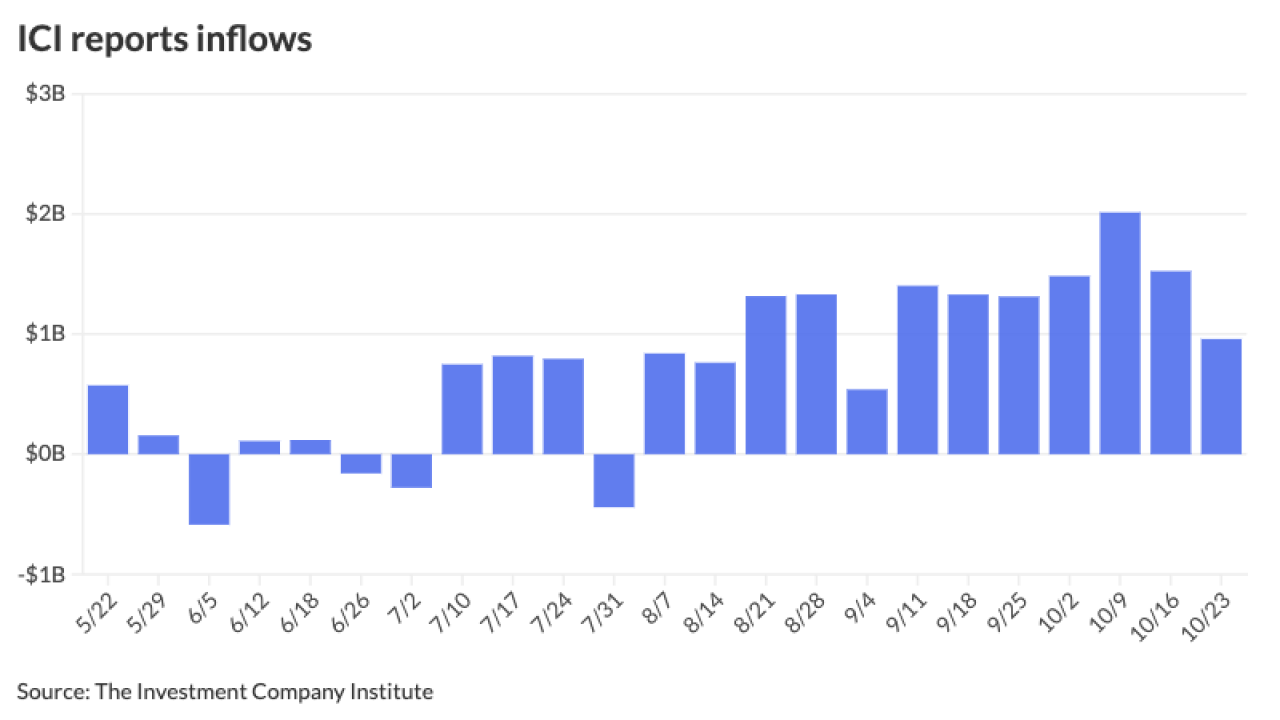

Tax-exempt money market funds reached a 2024 high of assets under management at $136.84 billion for the week ending Wednesday, according to the Investment Company Institute.

November 11 -

"A sharply lower new-issuance calendar, peak yields, large redemption money and mutual funds inflows are all positive performance factors for the market," BofA strategists said.

November 8 -

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

While this meeting is a slam dunk, the election and data makes the December meeting more of a question, some analysts said.

November 5 -

The Federal Reserve began cutting rates in September. The December meeting is its last of 2024. Will the cutting continue, or will there be a pause? Doug Peta, Chief Strategist, U.S. Investment Strategy, at BCA Research, discusses the meeting and future policy.

-

October's "price path has created wider spreads but also brought higher yields that are now in the range where a broader audience may begin to take notice," said NewSquare Capital Senior Fixed Income Portfolio Manager Kim Olsan, noting higher taxable equivalent yields for different tenors of the yield curve.

October 31 -

Municipals largely stayed in their own lane Wednesday, digesting the large slate of new issues as supply dwindles heading into election week, with Bond Buyer 30-day visible supply falling to $5.56 billion.

October 30