-

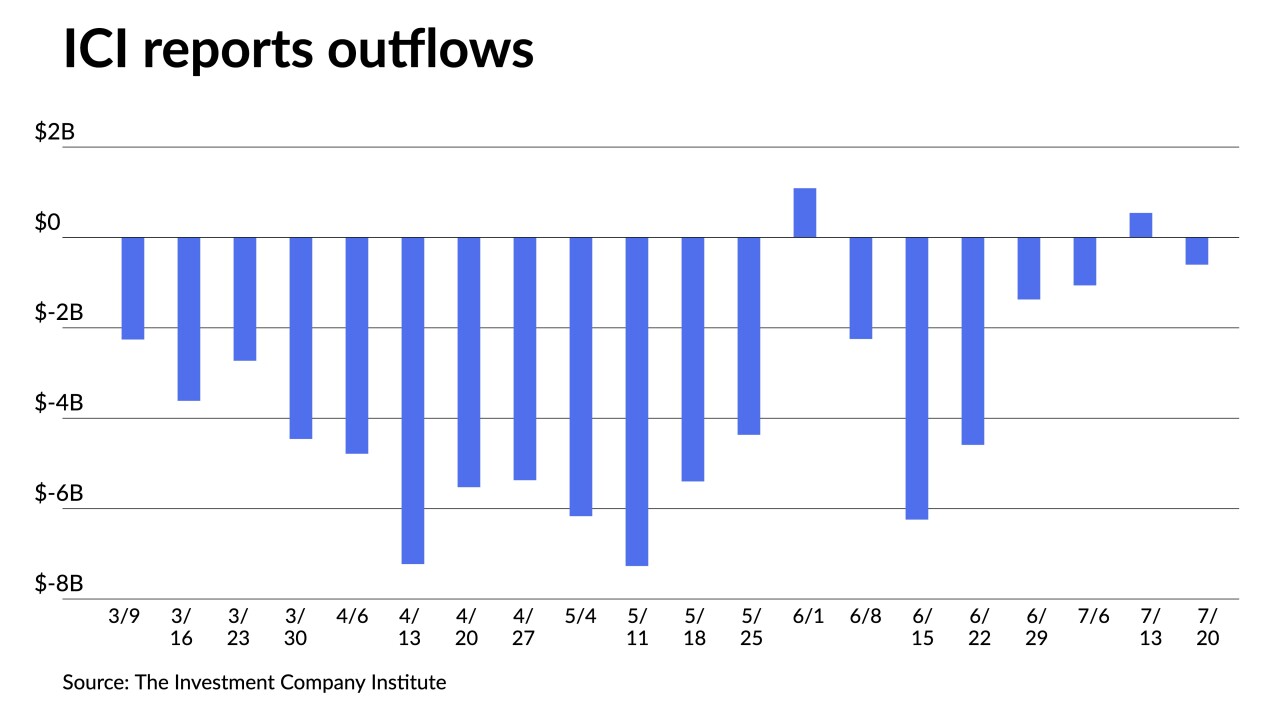

Investors added $236.491 million to municipal bond mutual funds, per Refinitiv Lipper data, versus the $698.782 million of outflows the week prior. High-yield saw inflows hit nearly $550 million.

July 28 -

Municipals are poised to end July in the black. Demand for muni product has been strong this summer, with analysts expecting supportive market technicals through August with a likely continuation of positive performance.

July 27 -

With the Fed committed to fighting inflation with aggressive rate hikes, fewer issuers want to take the risk with taxable advance refundings.

July 27 -

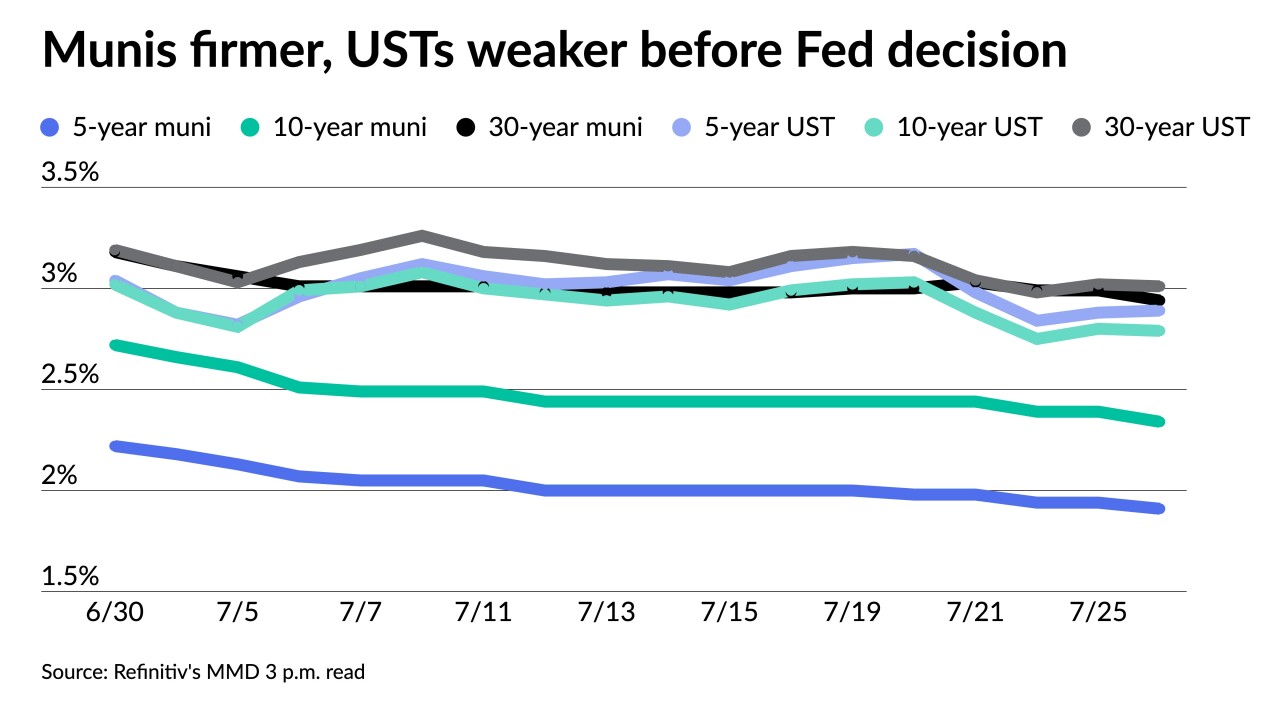

Investors sit on the sidelines, waiting to see how much the Fed will hike rates. The consensus appears to be another 75 basis point rate hike, though a full point hike could be on the table.

July 26 -

With the Fed rate decision coming this week, issuers are sitting on the sidelines in both primary and secondary Monday with little changed yield curves.

July 25 -

The Federal Reserve’s Inspector General said Chair Jerome Powell and former Vice Chair Richard Clarida’s trading activity had not broken any laws or rules, but the probe into the former heads of the Dallas and Boston regional Fed banks remained open.

July 14 -

Waller is the first Fed policy maker to explicitly express openness to an increase larger than 75 basis points at the July meeting.

July 14 -

Federal Reserve Bank of Atlanta President Raphael Bostic said “everything is in play” for policy action after data showed that U.S. inflation accelerated again to a fresh four-decade high last month.

July 13 -

Primary market takes focus for large revenue deals from the New York State Thruway Authority and the Colorado Health Facilities Authority.

July 13 -

“I am one of the guys who like the option value of deciding the week of the meeting as opposed to two weeks before the meeting,” he told reporters Tuesday.

July 12