Federal Reserve

Federal Reserve

-

Analysts are unsure what the Federal Open Market Committee will do with monetary policy in 2025. The panel projects two rate cuts, but some analysts expect more, and others see fewer.

December 26 -

Munis "continued their slide" last week as yields rose an average of 23 basis points across the curve as the Fed Chairman Jerome Powell signaled the Fed will take a "more cautious approach" on interest rate cuts next year, said Jason Wong, vice president of municipals at AmeriVet Securities.

December 23 -

"Munis are grappling with a storm of uncertainty," said James Pruskowski, chief investment officer at 16Rock Asset Management.

December 19 -

As the market prepares for 2025, there's a lot of uncertainty around what the new administration will mean for the macroeconomic environment and interest rates, the latter of which may be impacted by policy around the deficit, said Steve Shutz, portfolio manager and director of tax-exempt fixed income at Brown Advisory.

December 18 -

With investors now anticipating Wednesday's expected rate cut may be the last one for a while, "an overall bullish paradigm has been seriously weakened," noted Matt Fabian, a partner at Municipal Market Analytics, Inc.

December 17 -

A week ahead of inauguration day, Scott Colbert, executive vice president, director of fixed income and chief economist at Commerce Trust, takes a look at how the Federal Reserve and the economy will fare in President-elect Donald Trump's second run in the White House.

-

Analysts are confident the Fed will lower rates at this week's meeting, but their views on what next year holds don't share the same consensus.

December 17 -

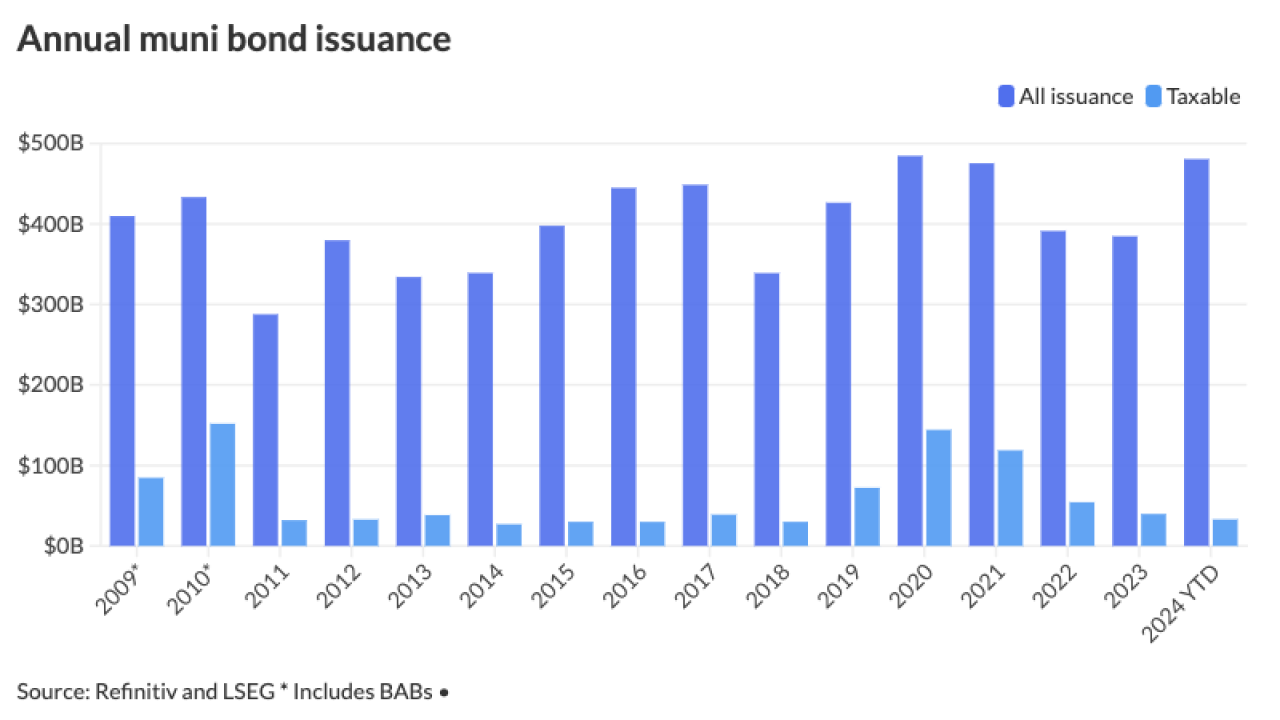

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

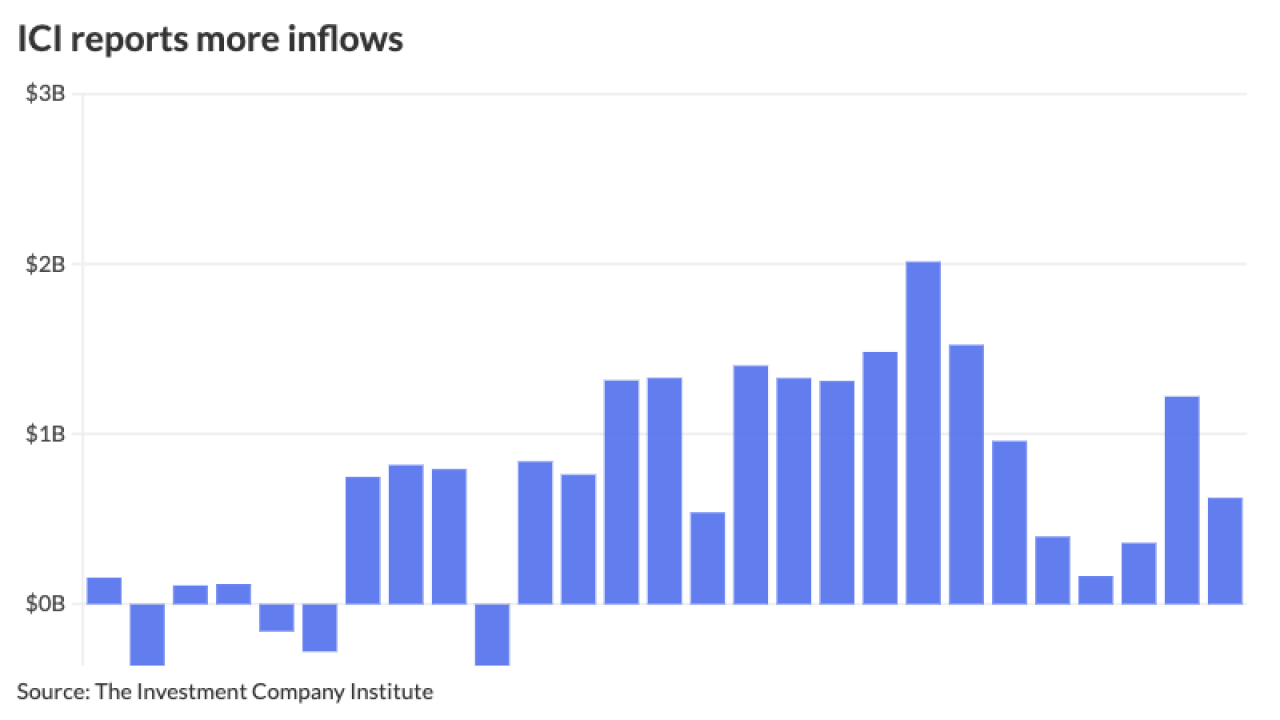

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

Economic forecasts include the possibility of higher inflation and slower growth that could stall future cuts to the federal fund rates.

December 5 -

Technicals could "break down" if there is a potential decline in risk assets or rising unemployment, particularly in white-collar jobs, said Jeff Timlin, a managing partner at Sage Advisory.

December 4 -

Muni investors hope "any move toward higher yields is steady, even dignified, such that it doesn't catalyze an outflow cycle that would countervail year-to-date total returns just before we close out the year," said Vikram Rai, head of municipal strategy at Wells Fargo.

December 3 -

"Earlier this month, Chair [Jerome] Powell noted that there was no 'hurry' to cut rates," noted BMO Senior Economist Priscilla Thiagamoorthy. The minutes, she noted, "confirm a broad support for taking a more cautious approach in easing monetary policy."

November 26 -

High-yield funds saw $608.9 million of inflows compared with inflows of $150.3 million the week prior.

November 21 -

Donald Trump discussed various items related to the Fed and its independence and stated he would not nominate Jerome Powell for another term as chair. Gennadiy Goldberg, head of U.S. rates strategy at TD Securities, discusses what a Trump presidency may mean for the Fed.

-

The Federal Reserve chair said there are no economic indicators calling for rapid rate cuts. He also addressed Fed independence, the impact of Trump's economic agenda and more.

November 14 -

In a speech, Federal Reserve Gov. Adriana Kugler said sound monetary policy comes when electoral politics are kept out of central banking.

November 14 -

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

While this meeting is a slam dunk, the election and data makes the December meeting more of a question, some analysts said.

November 5 -

The Federal Reserve began cutting rates in September. The December meeting is its last of 2024. Will the cutting continue, or will there be a pause? Doug Peta, Chief Strategist, U.S. Investment Strategy, at BCA Research, discusses the meeting and future policy.