Federal Reserve

Federal Reserve

-

John Hallacy, founder of John Hallacy Consulting LLC, talks with Chip Barnett about the pandemic’s lingering credit impacts on state finances in a wide-ranging discussion of the many issues affecting the municipal market today. (17 minutes)

June 22 -

Federal Reserve Chair Jerome Powell said inflation had picked up but should move back toward the U.S. central bank’s 2% target once supply imbalances resolve.

June 21 -

The Federal Reserve must be prepared to move if inflation continues to surprise to the upside, according to one Fed president, while another again stated a desire for the Fed to pull back on its accommodation.

June 21 -

The short end of the yield curve faced pressure from a cheaper UST five-year. As the flattening trend in UST takes hold, demand for duration will also spill over into the tax-exempt space, with long-dated munis continuing to outperform, analysts say.

June 18 -

Inflation risks may warrant the Federal Reserve beginning raising interest rates next year, St. Louis Fed President James Bullard said, backing an even-earlier liftoff than penciled in by many of his colleagues.

June 18 -

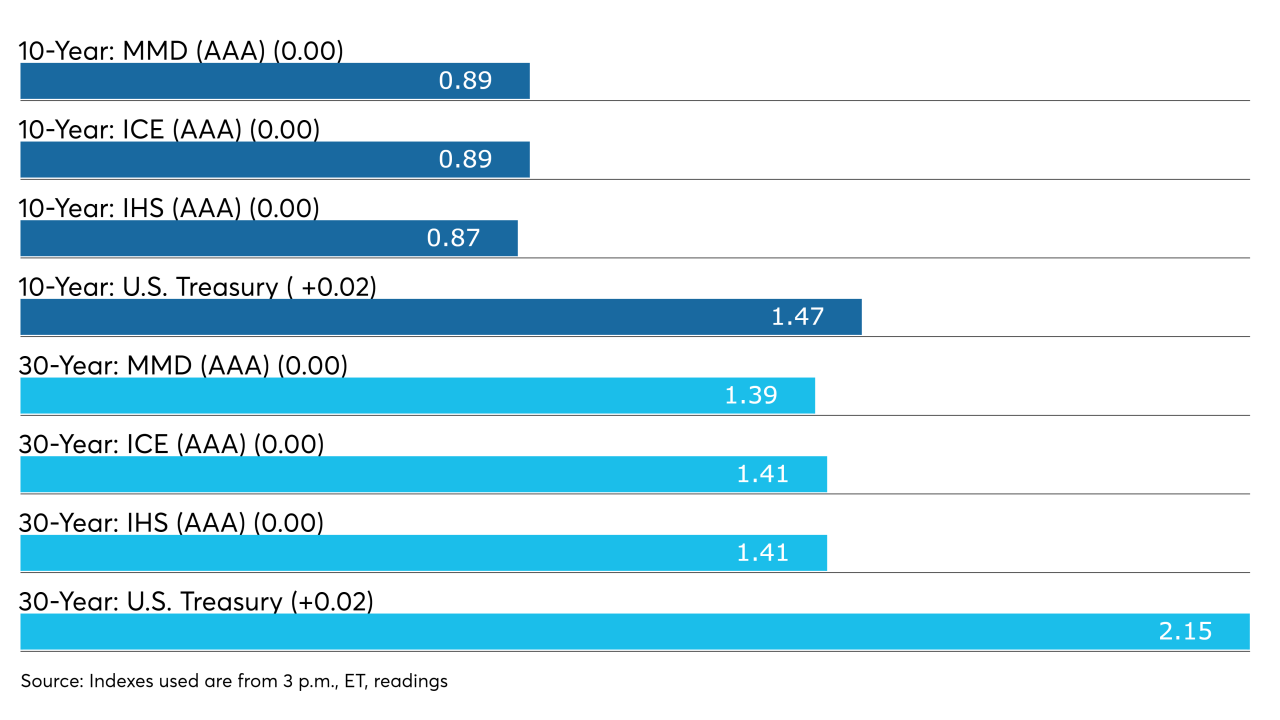

Yields on top-quality munis were flat on the AAA scales Friday; yields were seven to nine basis points lower on the week.

June 11 -

The Fed will gradually sell its portfolio of corporate debt purchased through an emergency lending facility launched as the COVID-19 pandemic spread panic through financial markets.

June 2 -

“We have to be careful in removing accommodation so that we don’t create any kind of ‘taper tantrum,’ ” Philadelphia Fed President Patrick Harker said.

June 2 -

The budget pays off Municipal Liquidity Fund loans, goes easier on local governments, cuts some corporate incentives, and begins drawing down federal relief.

June 1 -

Randal Quarles left open the possibility that he might remain in his role as a Federal Reserve governor after his tenure as vice chair for supervision expires on Oct. 13 — a move that would reduce the openings for the Biden administration to fill.

June 1 -

Municipal yields will likely stay in a narrow range with trading activity subdued unless larger interest rate volatility unexpectedly sets in, analysts say.

May 28 -

There’s so much spare cash sloshing around U.S. funding markets that investors are choosing to park almost half a trillion dollars at the central bank — earning absolutely nothing.

May 28 -

The Federal Reserve’s prestigious annual Jackson Hole policy symposium will be held in person this year, albeit in a modified form.

May 27 -

U.S. central bank officials may be able to begin discussing the appropriate timing of scaling back their bond-buying program at upcoming policy meetings, Federal Reserve Vice Chair Richard Clarida said.

May 25 -

Morgan Stanley Chief Executive Officer James Gorman said he expects the U.S. Federal Reserve to begin tapering its bond buying toward the end of this year and start raising interest rates in early 2022, faster than the Wall Street bank’s own economists forecast.

May 25 -

Raphael Bostic, Federal Reserve Bank of Atlanta president, says he hears frequent speculation that he could be nominated to lead the central bank.

May 24 -

Factors pushing U.S. inflation higher are likely to ebb at the start of 2022, said Federal Reserve Bank of San Francisco President Mary Daly.

May 21 -

The Federal Reserve should get a conversation going on tapering its bond-purchase program “sooner rather than later,” Philadelphia Fed President Patrick Harker said.

May 21 -

While cryptocurrencies could have benefits, they have “not served as a convenient way to make payments, given, among other factors, their swings in value,” said the head of the Federal Reserve. He also detailed imminent Fed research on a central bank digital currency.

May 20 -

The Federal Reserve’s policy is in a good place right now, said Cleveland Fed President Loretta Mester, while playing down signals from data that she warns will be volatile as the economy reopens.

May 14