Federal Reserve

Federal Reserve

-

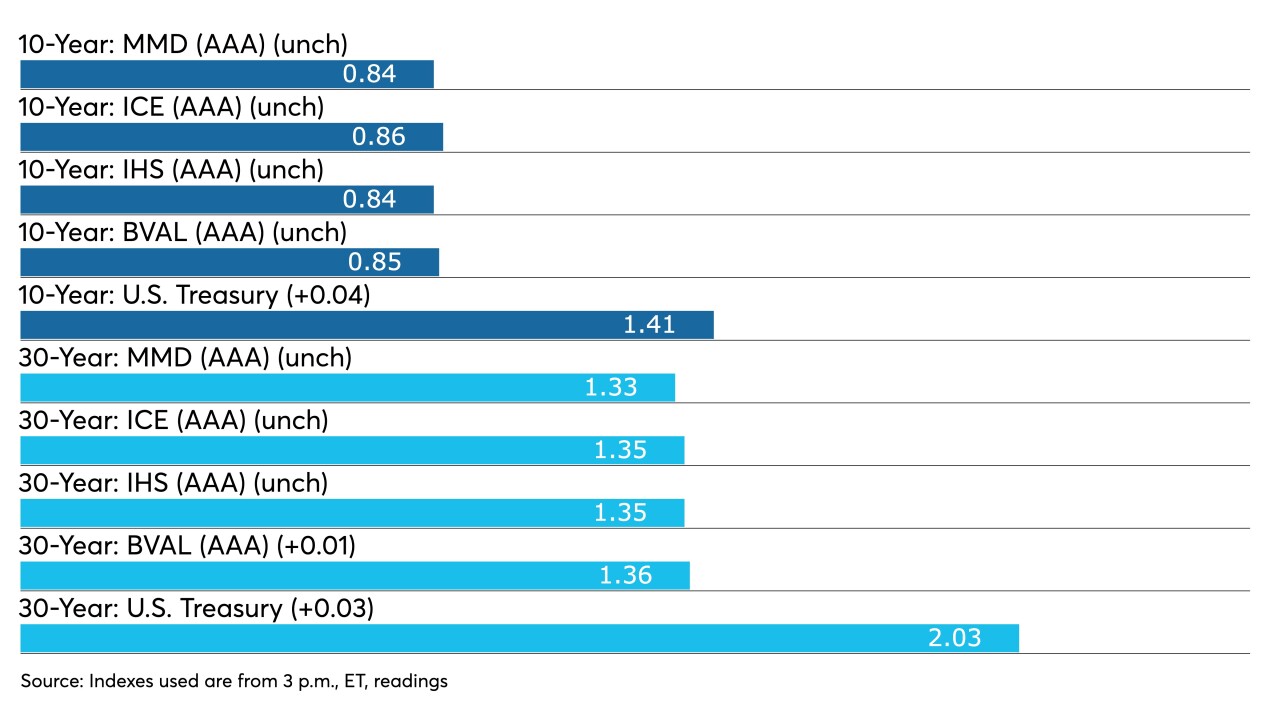

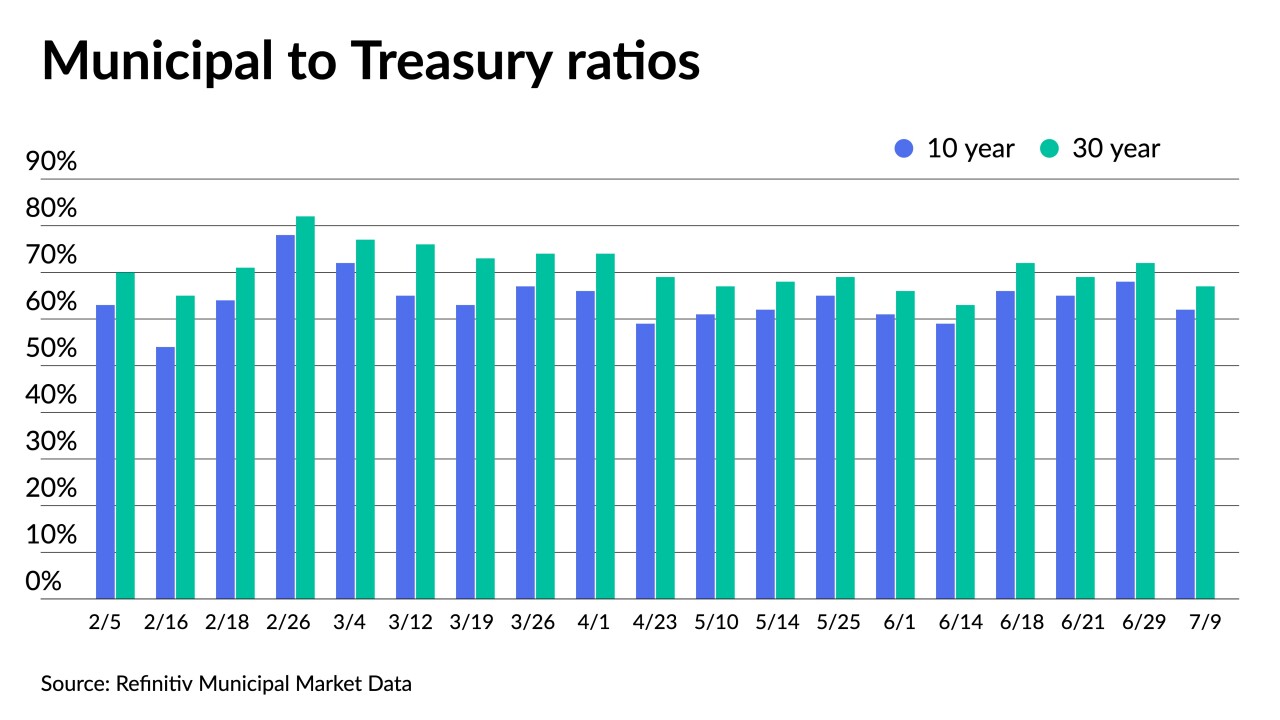

Municipals outperformed U.S. Treasuries for a third sessions moving the 10-year municipal to UST ratio below 60%.

July 13 -

The high level of incarceration in the U.S., especially among Americans of color and indigenous people, constrains the labor market and the economy’s ability to reach its full potential, Federal Reserve Bank of Atlanta President Raphael Bostic said.

July 13 -

Consumer price spikes, which in June surged the most since 2008, will likely be a temporary feature of an economy that’s quickly recovering from the pandemic, said Federal Reserve Bank of San Francisco President Mary Daly.

July 13 -

Research suggests limited effectiveness of the SEC's rules requiring disclosure of private debt.

July 13 -

"You now have a proven toolbox based on the data from the MSRB municipal trades,” says Brad Wendt of Charles River Associates.

July 13 -

Most participants expect better performance for munis in the near-term. Longer-term, a lot depends on rates, COVID and other outside factors, such as infrastructure.

July 12 -

While municipals hit the pause button Friday, the movement in yields in the first week of July marked the largest one-week decline in 2021.

July 9 -

Senate Banking Committee Chair Sherrod Brown said he expects Federal Reserve Vice Chair Randal Quarles’s oversight of the central bank’s financial supervision to end with the conclusion of his term in October.

July 8 -

As the White House weighs the potential renomination of Jerome Powell as chair of the Federal Reserve, officials are discussing the use of openings on the board to reshape the central bank.

July 7 -

President Joe Biden would be well advised to offer Jerome Powell a second term as chair of the Federal Reserve to preserve policy stability as the U.S. economy recovers from the pandemic, said former Fed Vice Chair Alan Blinder.

July 7 -

The Federal Reserve Bank of Minneapolis will require its employees to be vaccinated against COVID-19, the bank’s president, Neel Kashkari, said.

July 7 -

Edward Al-Hussainy, senior interest rate and currency analyst at Columbia Threadneedle, will discuss the economy, inflation and the Federal Reserve.

-

Federal Reserve Gov. Christopher Waller said the better-than-expected performance of the U.S. economy warrants scaling back asset purchases sooner than expected and he favors starting with mortgage-backed securities.

June 30 -

With various Federal Reserve officials airing their views since the Federal Open Market Committee’s latest meeting, it may take a while for members to reach agreement on tapering, a boon for municipals.

June 28 -

The Federal Reserve might consider an interest-rate hike from near zero as soon as late 2022 as the labor market reaches full employment and inflation is at the central bank’s goal, Federal Reserve Bank of Boston President Eric Rosengren said.

June 25 -

The U.S. economy will likely meet the Federal Reserve’s threshold for tapering its asset purchases sooner than people think, said Dallas Fed President Robert Kaplan, who has penciled in an interest-rate increase next year.

June 23 -

Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank could decide to slow its asset purchases in the next few months and he favored lifting interest rates in 2022 in response to a faster-than expected recovery from COVID-19 pandemic.

June 23 -

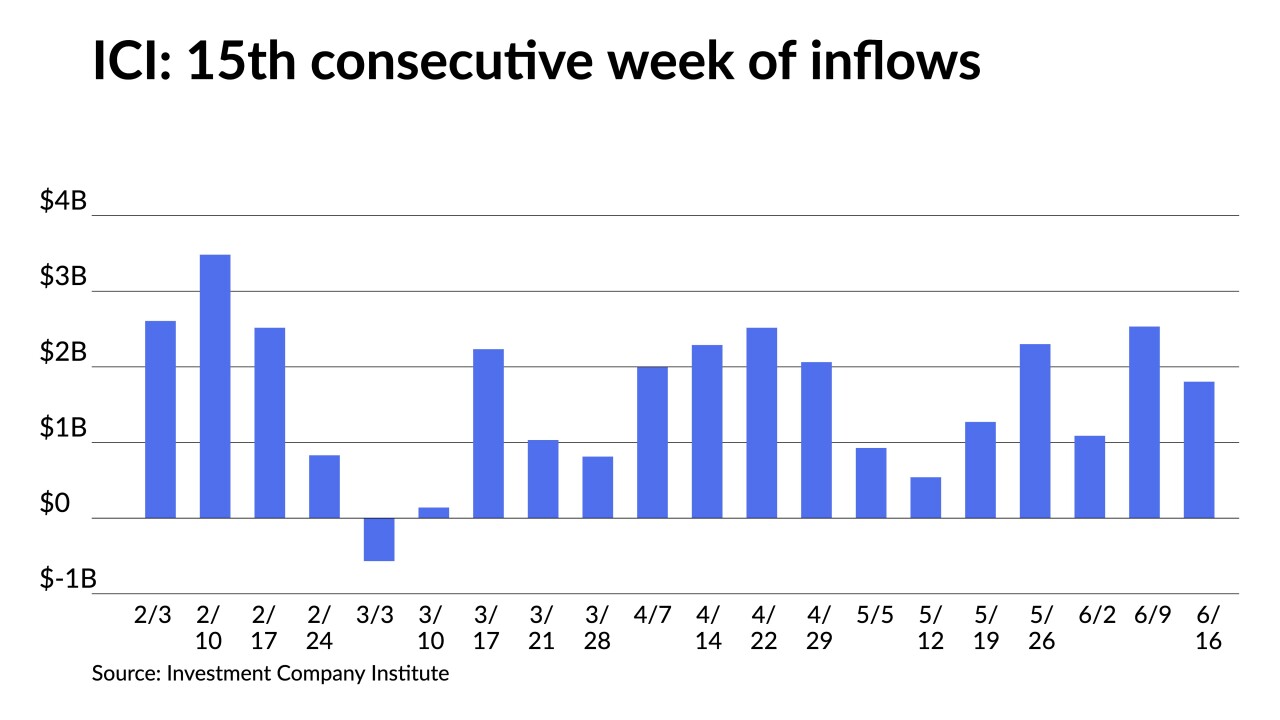

Triple-A benchmark yields moved higher by as much as five basis points while ICI reported another $1.8 billion of inflows and ETFs increase their share by $841 million.

June 23 -

Federal Reserve Chair Jerome Powell said the price increases seen in the economy recently are bigger than expected but reiterated that they will likely wane.

June 22 -

A discussion about raising interest rates is still quite a ways off as the Federal Reserve begins debating tapering its bond-buying program, New York Fed President John Williams said.

June 22