Federal Reserve

Federal Reserve

-

The Fed chief said "more good data" is needed before interest rate targets are lowered.

July 9 -

Ransomware group LockBit threatened on Sunday to publish the stolen data Tuesday evening. Ransomware experts said it was likely that the group was bluffing.

June 25 -

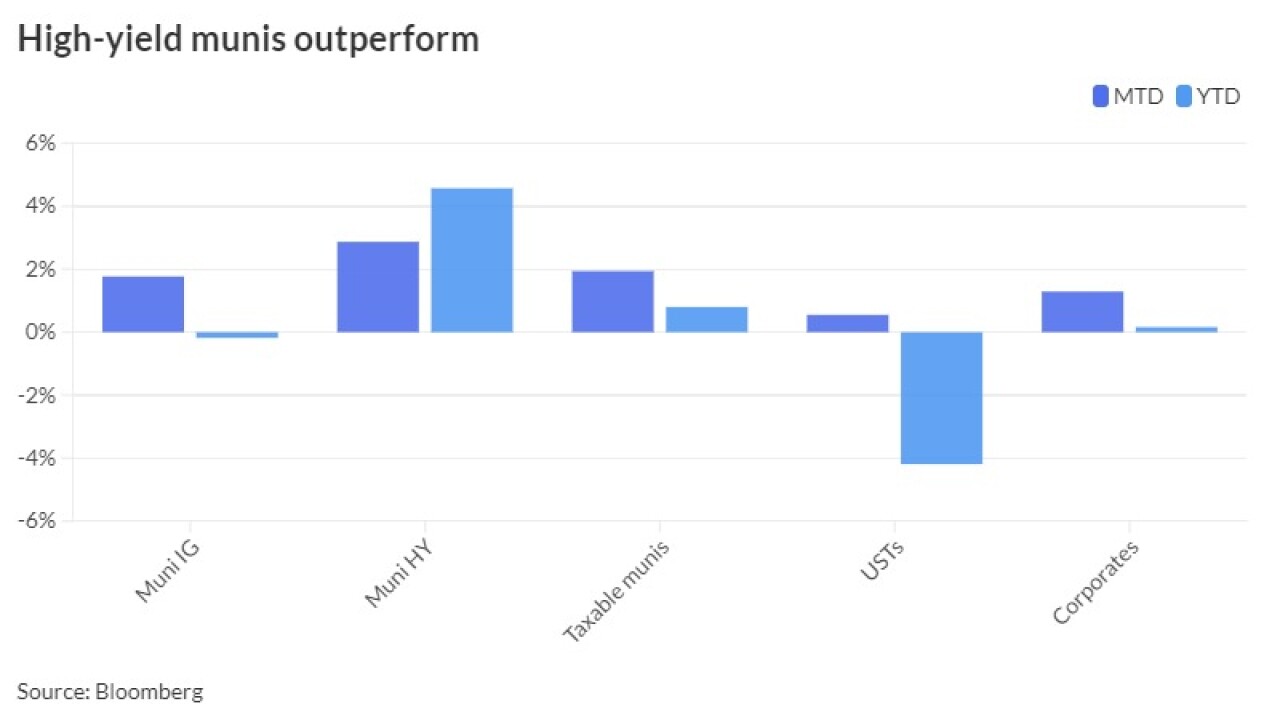

"It is hard to be overly excited about current valuations of tax-exempts relative to Treasuries; however, at tax-adjusted yields (using individual tax brackets), munis look quite attractive compared with other asset classes," noted Barclays PLC.

June 21 -

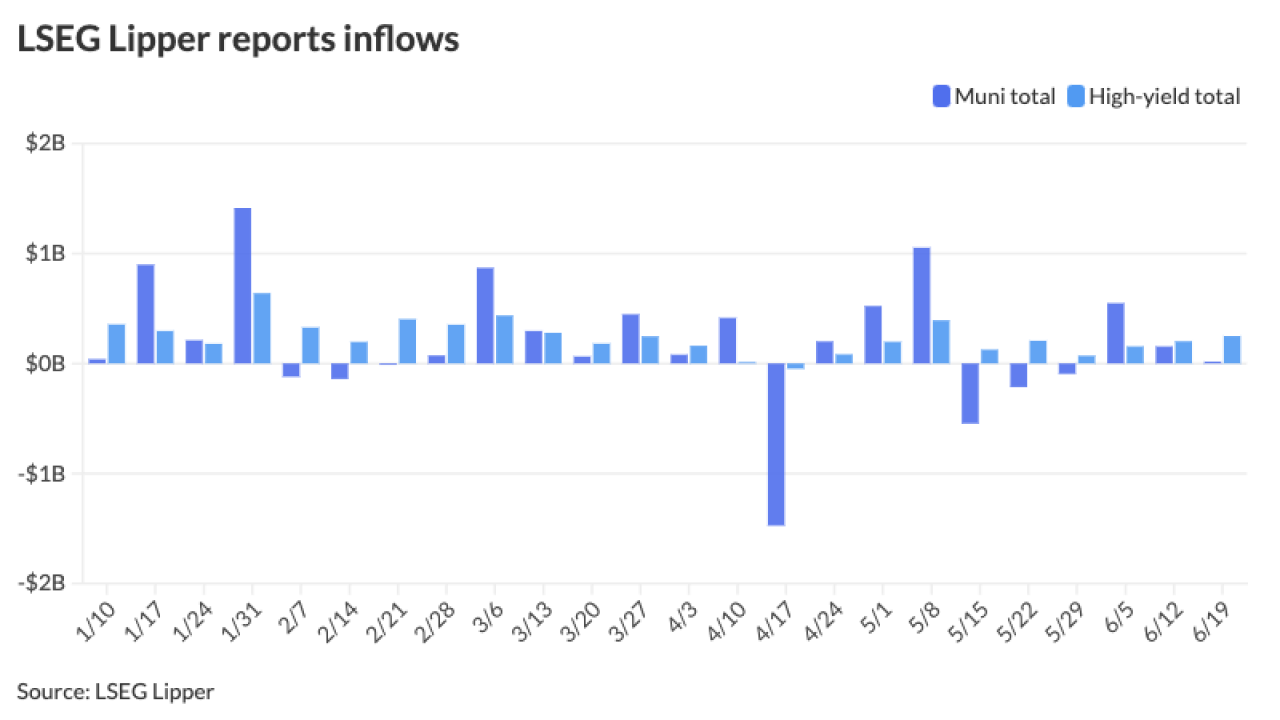

Municipal bond mutual funds saw small inflows as investors added $16.4 million to the funds after $154.4 million of inflows the week prior, according to LSEG Lipper.

June 20 -

The Philadelphia Fed president said there can be as few as no cuts or as many as two this year, but if his projections are accurate, one decrease would be appropriate this year.

June 17 -

"We need to see more evidence to convince us that inflation is well on our way back down to 2%," Federal Reserve Bank of Minneapolis President Neel Kashkari said.

June 17 -

"I think the risks to inflation are still on the upside," Federal Reserve Bank of Cleveland President Loretta Mester said. "I think the risk to the labor market is dual-sided."

June 14 -

Household ownership of munis — which includes direct ownership of individual bonds in brokerage accounts, fee-based advisory accounts and SMAs — rose to $1.779 trillion, up 0.3% from Q4 2023 and from 5.6% in Q1 2023.

June 13 -

"It is important to remember that as long as the Fed's next move is to lower policy rates, bonds will do well," said Jack McIntyre, portfolio manager at Brandywine Global. "The employment market is in better balance, which is very important for the Fed — even more than inflation."

June 12 -

With no change in rates expected, analysts are interested in the dot plot and Fed Chair Jerome Powell's press conference.

June 11 -

"The Fed is going to have to pivot — not on the basis of inflation numbers, but the basis of the real economy," Mohamed El-Erian said.

May 17 -

The CPI print keeps the possibility of the Fed cutting rates at least once this year, potentially at least two rate cuts if the data continues to point to a trend of inflation falling further, said Jeff Lipton, a research analyst and market strategist.

May 15 -

New York Fed President John Williams said the Fed "will cut rates eventually" during a fireside chat at Milken Institute's Global conference on Monday.

May 6 -

"The Fed is certainly not going to be overly concerned about the growth backdrop" at this week's Federal Open Market Committee meeting, said BMO Chief Economist Douglas Porter.

April 29 -

Recent economic data have shown inflation stubbornly above the Fed's 2% target, putting rate cuts in jeopardy. Lauren Saidel-Baker, an economist with ITR Economics, parses the FOMC meeting, Chair Powell's press conference and takes a look at future policy.

-

The minutes underscored officials' reluctance to lower rates until they have more evidence inflation is firmly on a path to 2%, the rate they see as the sweet spot in a healthy economy.

April 10 -

The ISM report "feeds into the narrative coming out of last week," whereby the economy's resilience enables the Fed "to be patient," said Gregory Faranello, head of U.S. rates trading and strategy for AmeriVet Securities. For the bond market, that means rates stay "higher for longer."

April 1 -

D.A. Davidson Director of Wealth Management Research James Ragan will review and analyze the March Federal Open Market Committee meeting.

-

"The risks to achieving our employment and inflation goals are moving into better balance," Cook said.

March 25 -

Analysts ponder what the Fed will do this year with a March cut ruled out amid recent reports of higher-than-expected inflation.

March 18