-

Chicago GOs were upsized and repriced on Wednesday to bump yields as indications of interest were taken on the Sales Tax Securitization sale.

January 15 -

Both the senior and the new second lien of Chicago's Sales Tax Securities Corp. are now rated AA-minus.

January 15 -

A healthy response to Chicago's first tender invitation is expected to bolster the savings on $1.47 billion of refinancing debt the city sells this week.

January 14 -

The Windy City is looking to add even more savings to a $1.3 billion debt refinancing with a tender invitation for some of its older, higher-yielding bonds. “The tender is just gravy,” City CFO Jennie Huang Bennett said last week.

January 13 -

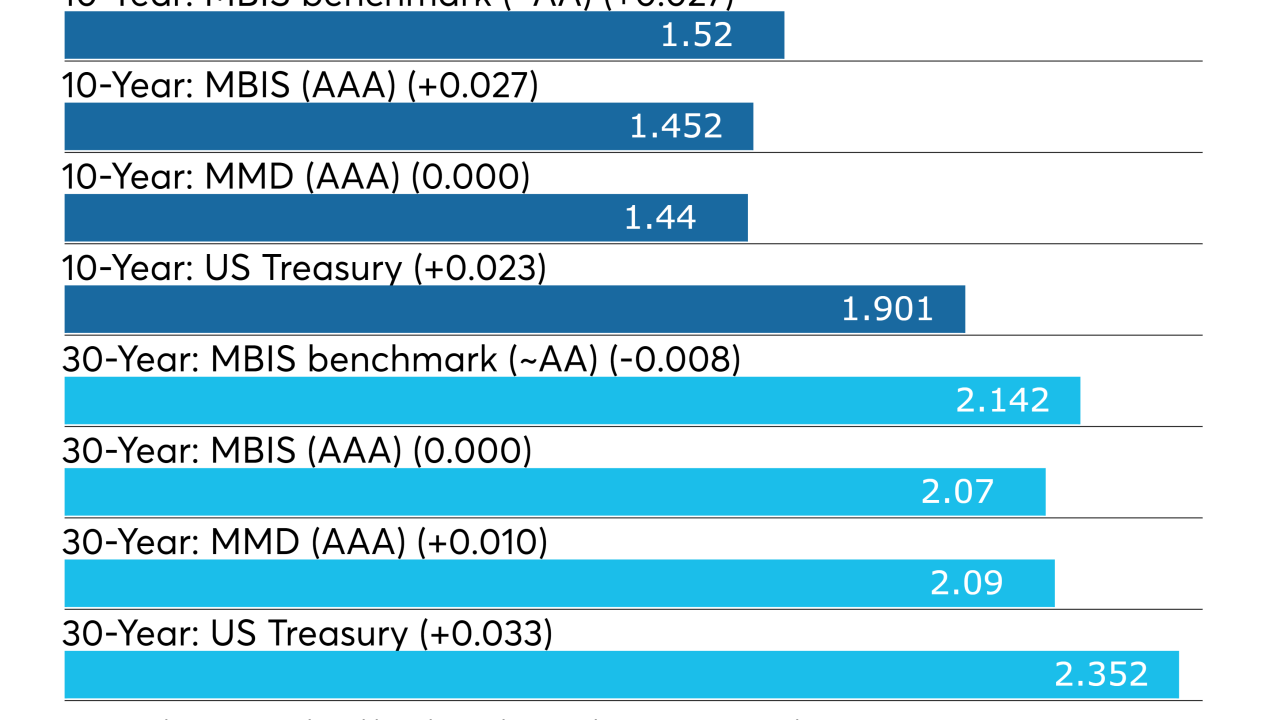

Demand for municipal bonds is much stronger in 2020 than it was to end 2019, illustrated by record inflows into the asset class in the latest reporting week.

January 10 -

Chicago is coming to market next week with its $1.3 billion debt refinancing.

January 7 -

While there are no major municipal bond sales slated for this week, next week is a different matter.

December 30 -

Chicago fared poorly in a Moody's report about the nation's largest cities and Illinois continues to stand out for budget stress and pension liabilities.

December 12 -

The city is folding together separate syndicate and advisor teams on $1.2 billion of general obligation and Sales Tax Securitization Corp. refunding deals.

December 10 -

The Illinois Finance Authority and Chicago closed on the first property assessed clean energy bond deal in the state and authorization is in place for more.

December 9