-

Connecticut transferred about $1.5 billion in excess budget reserves to its state employees' and teachers' pensions, said State Treasurer Erick Russell.

November 19 -

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

-

The market is in a bit of a lull right now as it braces for a deluge of economic data, which could spark volatility, said Jeff Timlin, a partner at Sage Advisory.

November 19 -

Brian Bennett has been appointed director of Washington's lottery.

November 19 -

The rating agency lowered the outlook to stable on its A-plus rating, saying Pennsylvania didn't do itself many favors in its fiscal 2026 budget season.

November 18 -

Chicago Mayor Brandon Johnson is seeking City Council approval of $1.8 billion in new money general obligation bonds and $2 billion in refunding authority.

November 18 -

Federal Reserve Gov. Christopher Waller said in a speech Monday that private and public-sector data suggests that the labor market is continuing to weaken, making a 25 basis point rate cut in December a prudent choice.

November 17 -

Chicago homeowners face a record property tax hike after the city's downtown office buildings and other commercial real estate values fell again.

November 17 -

The scheme cost at least 99 victims $5.7 million, the U.S. Attorney's Office for the Eastern District of Missouri said.

November 17 -

Ten winners across five regions and five additional categories will be celebrated Dec. 2 in New York City, where one will be crowned the overall Deal of the Year.

November 17 -

For munis, the end of the shutdown helps steady the backdrop, said James Pruskowski, an investor and market strategist.

November 13 -

Multi-layered state oversight, strict fiscal safeguards and durable revenue pledges support New York City GO and TFA bonds even as investors brace for policy shifts under mayor-elect Zohran Mamdani.

November 13 The Bond Buyer

The Bond Buyer -

A state audit of the Houston-based HBCU that identified financial issues led the governor to direct state agencies to launch an investigation.

November 13 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

The city said it needed the money to be able to make payroll in November and December.

November 12 -

The Treasury secretary highlighted the impacts the bond market has on affordability and previewed regulatory tweaks the administration is eyeing to keep yields stable and credit flowing.

November 12 -

Federal Reserve Bank of Atlanta President Raphael Bostic won't seek reappointment following the end of his current term on Feb. 28, 2026.

November 12 -

Keohane was described by colleagues as a deep thinker with an encyclopedic knowledge of New York public finance law and a great sense of humor.

November 12 -

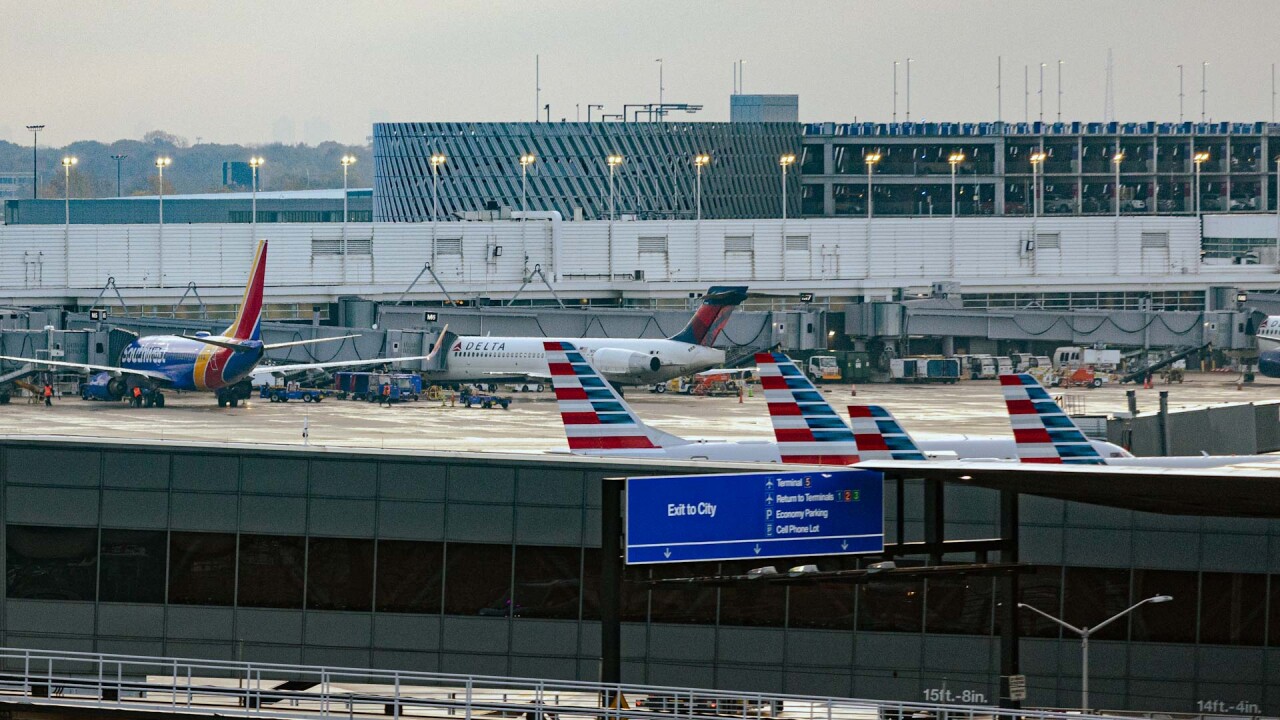

The airport's sprawling capital improvement program is expected to total $11.5 billion over the next decade, $9 billion of it bond funded.

November 12 -

Federal Reserve Governor Stephen Miran said emerging stresses in housing and private credit markets warrant a reduction to short-term interest rates. While preferring a 50 basis point cut in December, Miran said he would settle for a 25 basis point reduction.

November 10