Muni yields are on the rise again on Friday, as yields on some maturities are as many as three basis points higher, according to traders.

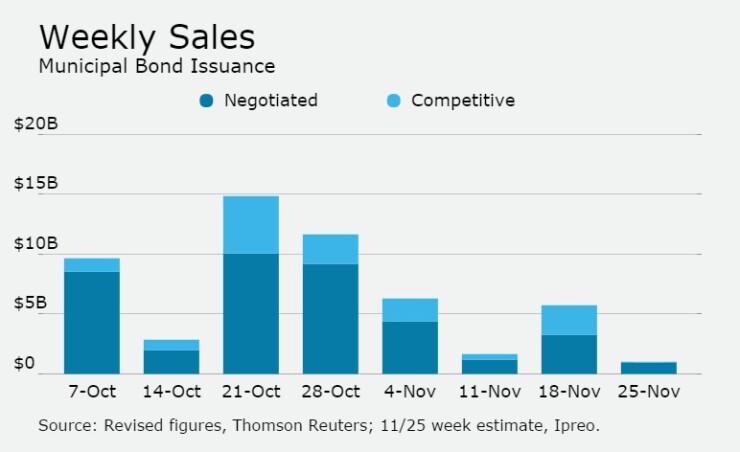

Market participants don't have much to look forward to next week, with an estimated total of only $1.04 billion on the calendar ahead of the Thanksgiving holiday.

Secondary Market

Munis were weaker on Friday around midday, as the yield on the 10-year benchmark muni general obligation was as many as two basis points higher from 2.21% on Thursday, while the yield on the 30-year increased by as many as one basis point from 3.01%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on around midday on Friday. The yield on the two-year rose to 1.04% from 1.03% from Thursday, the 10-year Treasury was higher at 2.32% from 2.28%, while the yield on the 30-year Treasury bond increased to 3.01% from 2.99%.

The 10-year muni to Treasury ratio was calculated at 97.2% on Thursday compared to 99.5% on Wednesday, while the 30-year muni to Treasury ratio stood at 100.7% versus 102.9%, according to MMD.

Lipper: Muni Bond Funds See Outflows

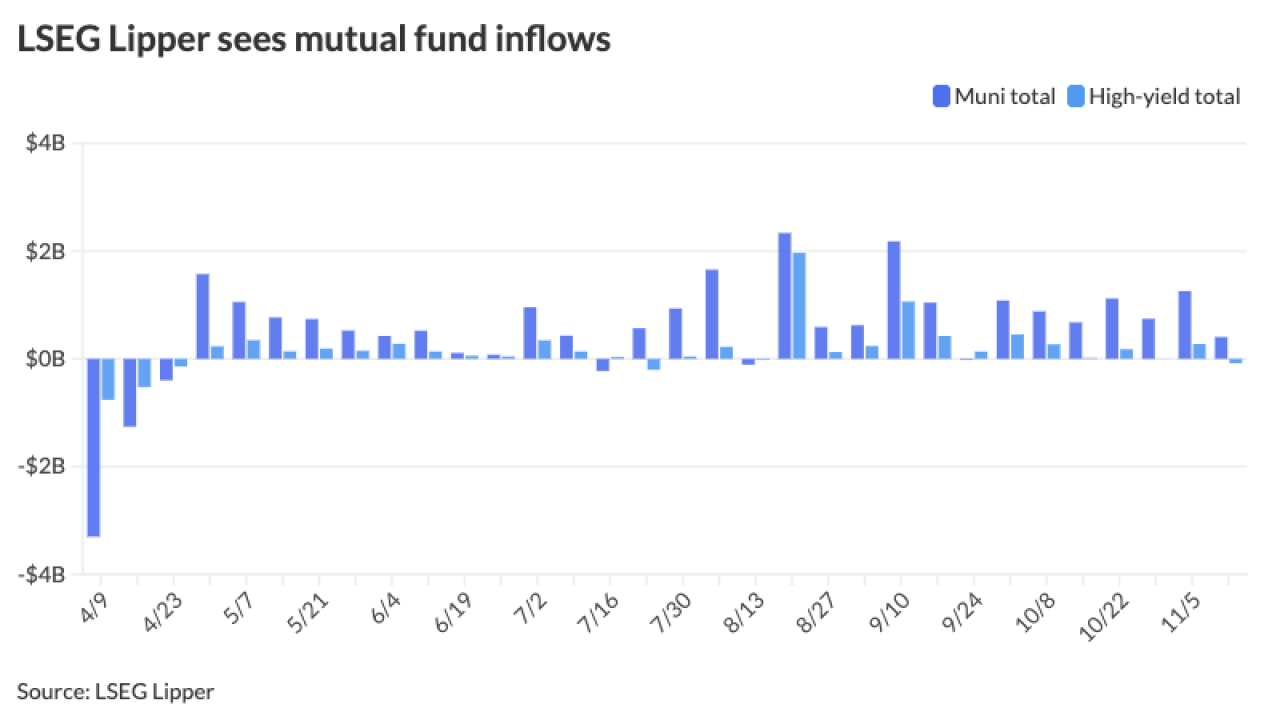

Municipal bond funds reversed course as investors pulled cash out, according to Lipper data released late Thursday.

Weekly reporters saw $3.011 billion of outflows in the week ended Nov. 16, after inflows of $62.837 in the previous week. This is the biggest outflow in more than three years, according to the release.

"I was a little surprised by the amount but not the fact that it was outflows," said Dawn Mangerson, managing director and senior portfolio manager at McDonnell Investment Management. "Retail investors took money off table after pouring money in pretty much all year long, I would call that knee jerk reaction."

The four-week moving average fell to negative $734.368 million after first turning red at $15.457 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds experienced outflows, losing $2.585 billion in the latest week after inflows of $19.396 million in the previous week. Intermediate-term funds had outflows of $332.967 million after inflows of $17.055 million in the prior week.

National funds had outflows of $2.685 billion after inflows of $57.695 million in the previous week. High-yield muni funds reported outflows of $1.585 billion in the latest reporting week, after outflows of $32.095 million the previous week. This is the biggest on record outflow for the high-yield sector, according to Lipper.

Exchange traded funds saw outflows of $212.832 million, after inflows of $25.475 million in the previous week.

"We are going to use this as an opportunity to book higher yield assets and I think other investors will be doing the same," she said.

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended Nov. 17 were from California and North Carolina, according to

In the GO bond sector, the California state 4s of 2035 were traded 20 times. In the revenue bond sector, the University of North Carolina at Chapel Hill Hospital 4s of 2046 were traded 64 times. And in the taxable bond sector, Los Angeles Department of Airports 3.887s of 2038 were traded 45 times.

Week's Most Actively Quoted Issues

Illinois issues were among the most actively quoted bonds in the week ended Nov. 17, according to Markit.

On the bid side, the Illinois state revenue 5.1s of 2033 were quoted by 77 unique dealers. On the ask side, the Chicago taxable 6.207s of 2036 were quoted by 90 unique dealers. And among two-sided quotes, the Illinois state taxable 5.1s of 2033 were quoted by 23 unique dealers.

Primary Market

The market this week saw only a fraction of deals it expected, as rising yields caused a lot of issues to be held and placed on the day-to-day calendar. Although yields calmed down as the week went on, the 22 basis point jump on Monday put a damper on issuance.

Among deals placed on day-to-day status were $1.024 billion of New York's Tobacco Settlement bonds, Katy, Texas, Independent School District's $225 million of refunding bonds, Public Hospital District No. 1 of King County, Wash.'s $186 million of limited tax general obligation bonds, Montgomery County Municipal Utility District No. 13, Texas' $141 million of road and limited tax refunding bonds and Mississippi's $223 million of GO refunding bonds.

A few issuers tested the waters despite market conditions.

Wells Fargo priced the city of Richmond, Va.'s $502.260 million of public utility revenue and refunding bonds on Tuesday.

Citi priced the Alabama Federal Aid Highway Finance Authority's $236.395 million of special obligation revenue bonds.

Morgan Stanley priced the Board of Governors of the University of North Carolina at Chapel Hill Hospital's $99.945 million of revenue bonds.

In the competitive arena, the Washington Suburban Sanitary District, Md., sold $381.81 million of consolidated public improvement bonds.

The commonwealth of Massachusetts sold $200 million of transportation fund revenue bonds for the rail enhancement and accelerated bridge programs.

The Board of Trustees for the University of Alabama at Birmingham sold two issues totaling roughly $116.54 million.

On Wednesday, Morgan Stanley priced the Salt River Project Agricultural Improvement and Power District, Az.'s $767.82 million of electric system refunding revenue bonds.

Raymond James priced the city of Columbia, S.C., Waterworks and Sewer System's $122.295 million of refunding revenue bonds.

Morgan Stanley also priced Cincinnati, Ohio's $120.02 million of water system refunding and revenue bonds.

On Thursday, Bank of America Merrill Lynch priced the Los Angeles County Metropolitan Transportation Authority's $513.99 million of measure R senior sales tax revenue bonds.

Barclays priced the Massachusetts Development Finance Agency's $207.56 million of revenue bonds for Emerson College.

RBC Capital Markets priced the city and county of Denver, Colo.'s Department of Aviation Airport System's $257.905 million of revenue bonds.

Morgan Stanley priced Bexar County, Texas's $112.23 million of combination tax and revenue certificates of obligation.

In the competitive arena, Clark County, Nev., sold three issues totaling roughly $362.895 million and the state of New Hampshire sold a total of $113.52 million in two separate sales.