More municipal supply is set to hit the screens on Wednesday as buyers get ready to vie for volume in a tight market.

Hearty demand continued to fuel the municipal market on Wednesday as the week’s new issues received keen attention amid hefty cash flow during July reinvestment season, and a strong bid side in the secondary market as investors search for available paper, according to a New York trader.

“It’s a strong market, especially on the front end,” he said Wednesday morning, noting the two-year municipal bond was yielding 59.7% of the comparable U.S. Treasury bond.

On the Treasury side, he said the 10-year benchmark has been range-bound at 2.80% for nearly three weeks. “There’s not a lot of volatility and the market is in good shape,” he said.

Municipal investors are flush with reinvestment proceeds and eagerly looking for a place to reinvest their cash.

“There’s a ton of cash, and not a lot of bonds,” he explained. “It’s very competitive in the new issue market, and in the secondary for bid-wanteds.”

Primary market

Ramirez & Co. priced the District of Columbia’s $515.32 million of Series 2018A general obligation bonds and Series 2018B GO refunding bonds.

Last week, Washington, D.C.'s GOs received an upgrade to Aaa from Moody’s Investors Service. D.C. received GO rating upgrades to AA-plus from AA from both S&P Global Ratings and Fitch Ratings earlier in the month.

Since 2008, D.C. has sold almost $14 billion of bonds, with the most issuance occurring in 2008 when it sold $2.099 billion. Prior to this year, the District sold the least amount of bonds in 2014 when it issued $732.1 million.

JPMorgan Securities is expected to price the City and County of San Francisco’s Public Utilities Commission’s $407.07 million of Series 2018B wastewater revenue bonds and Series 2018A green bonds.

The deal is rated Aa3 by Moody’s and AA by S&P.

Jefferies is set to price the New York State Environmental Facilities Corp.’s $327.23 million of revenue bonds.

The deal is rated triple-A by Moody’s, S&P and Fitch.

Siebert Cisneros Shank & Co. received the official award on Houston’s $569.11 million of Series 2018C airport system subordinate lien revenue refunding bonds, subject to the AMT and the Series 2018D non-AMT bonds on Tuesday. The deal is rated A1 by Moody’s and A by Fitch.

Jefferies received the written award on the Ohio Water Development Authority’s $166.41 million of fresh water Series 2018 water development revenue bonds. The deal is rated AAA by Moody’s and S&P.

In the competitive sector, North Carolina is selling $400 million of Series 2018A general obligation public improvement bonds for Connect N.C. The deal is rated triple-A by Moody’s, S&P and Fitch.

Wednesday’s sales

Washington, D.C.

Texas

Ohio

Bond Buyer 30-day visible supply at $11.36B

The Bond Buyer's 30-day visible supply calendar decreased $1.43 billion to $11.36 billion on Wednesday. The total is comprised of $3.88 billion of competitive sales and $7.49 billion of negotiated deals.

Secondary market

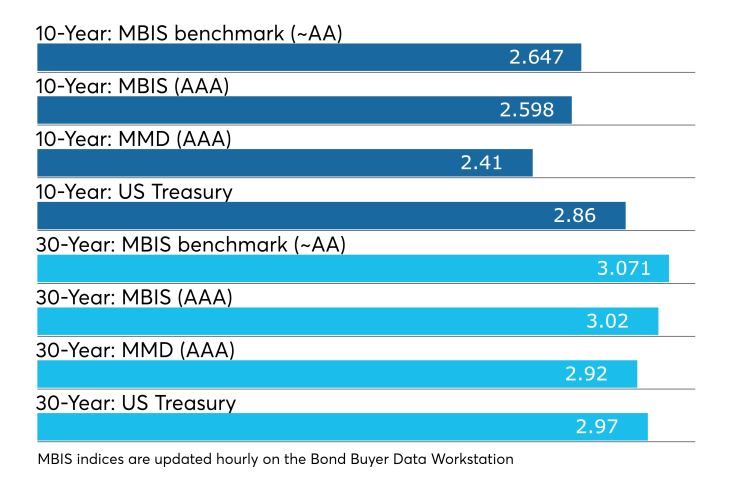

Municipal bonds were mixed on Wednesday, according to a read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the two- to seven-year and 25- to 30-year maturities, rose less than a basis point in the one-year, eight- to 11-year, and 14- to 22-year maturities, and remained unchanged in the 12- and 13-year and 23- and 24-year maturities.

High-grade munis were also mixed, with yields calculated on MBIS’ AAA scale falling less than one basis point in the one- to seven-year maturities, rising less than a basis point in the eight- to 25-year maturities and remaining unchanged in the 26- to 30-year maturities.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed both the 10-year muni general obligation yield and the yield on the 30-year muni maturity remaining unchanged.

Treasury bonds were weaker Tuesday as stocks traded mixed.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.3% while the 30-year muni-to-Treasury ratio stood at 98.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,663 trades on Tuesday on volume of $10.23 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 17.578% of the market, the Empire State taking 12.098% and the Lone Star State taking 11.287%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.