WASHINGTON — The Senate won’t vote anytime this year on the Tax Reform 2.0 legislation that House Republicans are hoping to pass this month because Senate Republicans know it has no chance of passage in their chamber.

The proposed legislation would make permanent the $10,000 cap on the federal deduction for state and local taxes.

The Government Finance Officer Association opposes a permanent extension. Emily Brock, director of the federal liaison office of GFOA, described the proposal as a “short-sighted mistake” that would “unduly burden state and local government” in their ability to finance infrastructure and public safety.

Passage in the Senate would require a 60-vote supermajority because the legislation would add to the already burgeoning federal deficit.

Republicans hold only a 51-49 majority in the Senate and none of the Democrats are expected to support the legislation.

"Making these provisions permanent would cost roughly $650 billion over 2019 to 2028, according to the Joint Tax Committee,” Robert Greenstein, president of the liberal-leaning Center on Budget and Policy Priorities, said in a press statement. “Large as it is, this estimate significantly understates the long-term cost because the bill largely affects only the final three years of the 2019-2028 ‘budget window.’”

Greenstein’s organization estimates the 10-year cost would be $2.9 trillion in additional deficits from 2026-2035.

Republicans on the House Ways and Means Committee plan to vote Thursday for legislation that would make permanent all the lower individual tax rates and higher income thresholds that were part of the Tax Cuts and Jobs Act and are scheduled to expire in December 2025.

The Protecting Family and Small Business Tax Cuts Act of 2018 (H.R. 6760) also would permanently raise the threshold for the alternative minimum tax to $109,400 for couples and $70,300 for singles with a phase-out of $1 million for couples and $500,000 for singles.

Higher AMT thresholds will have some impact on the municipal bond market, making private activity bonds attractive to more investors. The tax provisions enacted in December that hit the municipal market the hardest were the halt to advance refundings after 2017, which took away a big chunk of the market and hurt issuers, and the reduction of the corporate tax rate to 21%, which made munis less attractive to banks and other investors.

Two other related bills to be considered Thursday by the committee would provide incentives for family savings and business innovation.

“There is no chance that the Senate this year will pass -- or even debate -- a bill to make the TCJA's individual tax cuts permanent,” Howard Gleckman, a resident fellow at the Tax Policy Center, said Tuesday. “But House GOP leaders did not introduce this bill to make a new law. It is merely a message bill for the November elections.”

No Democrat in either the House or the Senate voted for the tax reform legislation last December.

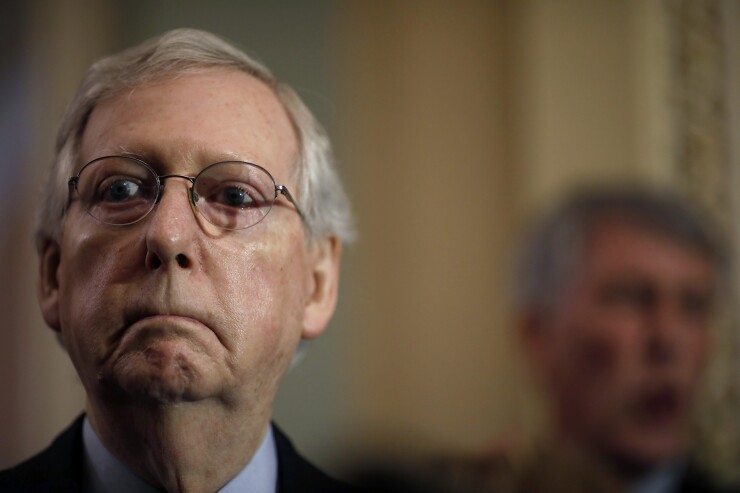

A spokesman for Senate Republican Majority Leader Mitch McConnell, R-Ky., said Tuesday that the senator’s position hasn’t changed from previous statements in which he’s pointed out that making the tax legislation permanent requires Democratic support.

“It would take 60 votes to make them permanent because, as you know, we use budget reconciliation because we have no Democratic support,” McConnell said at a Politico breakfast in June. “If the Democrats are now on board for making everything permanent and I knew we had 60 votes, then I’d go to it.”

Budget reconciliation was the parliamentary procedure used in the Senate to pass tax reform in late 2017. It requires passage of a budget resolution in the House and in the Senate that allows passage of a bill that would increase the deficit.

With Democrats positioned to possibly regain majority control of at least the House in the November election, Republicans are hoping that an election message on making the tax cuts permanent will help them retain their majorities.

In the meantime, a federal lawsuit is being pursued by Connecticut, Maryland, New Jersey and New York to challenge the constitutionality of the cap on the SALT deduction.

A spokesman for New Jersey Gov. Phil Murphy said Tuesday that Tax Reform 2.0 represents an effort to double down on harming the Garden State.

“The hardworking people of New Jersey were wrongly targeted by the Republicans' tax law, which limited the state and local tax deduction in order to pay for massive tax breaks for big corporations and the wealthy,” spokesman Mahen Gunaratna said. “Gov. Murphy will continue fighting Washington on this unfair and unconstitutional tax on middle class taxpayers.”