The tax-exempt market struggled throughout most of the week with yields jumping as dealers cleaned out inventory ahead of year-end and buyers were fed up with record-low yields.

These factors, combined with firmer Treasuries on positive fiscal cliff negotiation news, pushed The Bond Buyer's weekly yield indexes higher for the second consecutive week. Before that, the indexes fell consistently since November.

"The market sold off because a combination of reasons — high ratios, the Puerto Rico downgrade, retail selling to lock in and finalize year-end price gains, and some mutual fund outflows," said Steve McLaughlin, executive vice president at R. Seelaus & Co.

While new-issue supply was the main driver of the selloff over the past few weeks, very little supply was on the calendar this week. Of those deals, many were postponed because of poor market conditions. The deals that did price saw mixed reception.

"The calendar was light at $2.8 billion and the prices on these deals had to be adjusted to match the overall market sell off," McLaughlin added. "But at the end of the day issuers were able to underwrite their debt still at generational lows."

Concerns about the future of the muni market make it hard to predict where rates might go in the immediate future, but McLaughlin says support may come back. "The fiscal cliff and the ongoing concerns of the tax treatment of munis going forward is a concern to the market and investors, but the seasonal aspect of low issuance for the next three weeks plus January reinvestment money should give the market better support."

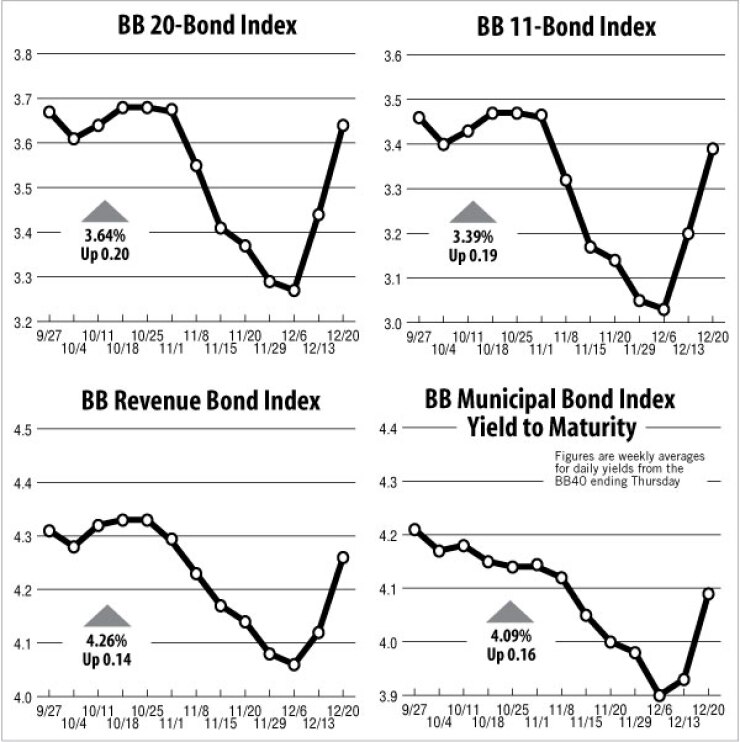

The 20-bond index of 20-year general obligation yields increased 20 basis points this week to 3.64% after jumping 17 basis points the week before. Yields on the index are now at the highest level since Nov. 1 when it was 3.67%.

The 11-bond index of higher-grade 20-year GO yields jumped 19 basis points this week to 3.39% after soaring 17 basis points the week prior. The index is now at its highest since 3.46% on Nov. 1.

The revenue bond index, which measures 30-year revenue bond yields, rose 14 basis points this week to 4.26%, the highest since 4.29% last hit on Nov. 1.

The yield on the 10-year Treasury note increased seven basis points this week to 1.80%, the highest since Oct. 25, when it was 1.83%.

The 30-year Treasury yield gained eight basis points this week to 2.98%, its highest since Oct. 25, when it was also 2.98%.

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose 16 basis points for the week ending Dec. 20 to 4.09%, its highest level in eight weeks.