Municipal bonds saw a largely mixed week of trading in a tight range. Subsequently, so did muni bond indexes, which ranged from unchanged to up no more than five basis points on the week.

Treasury yields bounced around in response to news from Europe. This is particularly true from Wednesday to Thursday, when yields for the 10-year and 30-year Treasuries jumped nine and eight basis points, respectively. Muni yields, though, mostly outperformed those of Treasuries, particularly in the 10-year range.

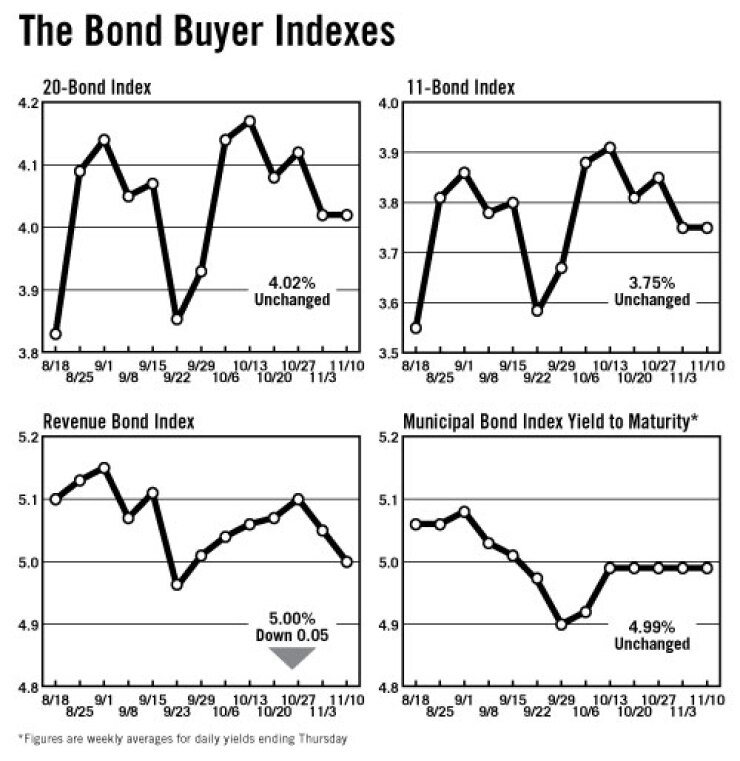

The Bond Buyer's 20-bond GO index of 20-year general obligation yields was unchanged this week, at 4.02%. It remains at its lowest level since Sept. 29, when it was 3.93%. The 11-Bond GO index of higher-grade 20-year GO yields also was unchanged this week, at 3.75%, remaining at its lowest level since Sept. 29, when it was 3.67%.

That compared with the yield on the Treasury's 10-year, which dropped two basis points this week to 2.05%. It is at its lowest level since Oct. 6, when it was 1.99%. And the yield on the Treasury's 30-year bond was unchanged this week, at 3.10%, remaining at its lowest level since Oct. 6, when it was 2.96%.

Mostly, the muni market has been well-behaved, as it has largely absorbed the week's calendar without disturbing the Municipal Market Data triple-A scale read, said Tim Pynchon, a portfolio manager at Pioneer Investments. In addition, the muni market did not show the volatility that the Treasury, corporate, and equities markets exhibited, he added.

"That's a sign of health and maturity in our marketplace," Pynchon said. "And it's a little bit of an insular quality, being shielded from direct ties to Europe."

Yields for two-year, 10-year, and 30-year munis ended Thursday's session flat, down five basis points, and up two basis points, respectively, from the start of the week. By comparison, yields for two-year, 10-year, and 30-year Treasuries ended Thursday's session up one basis point, up two basis points, and up two basis points, respectively, from the start of the week.

"We've been trading in a fairly narrow band, just very well-behaved," Pynchon said of muni yields. "We'll take that right now, particularly with what's been going on in the broader markets."

The revenue bond index, which measures 30-year revenue bond yields, fell five basis points this week, to 5.00%. This is its lowest level since Sept. 22, when it was 4.96%. The Bond Buyer's one-year note index increased one basis point this week, to 0.30%, but remained below its 0.31% level from two weeks ago.

The weekly average yield to maturity on The Bond Buyer's 40-bond muni index, which is based on prices for 40 long-term municipal issues, was unchanged for a fourth straight week at 4.99%. It continues to be the highest level for the weekly average yield since the week ended Sept. 15, when it was 5.01%.