A $3.7 billion deal that would return an NFL franchise to Washington is closer to the goal line as the City Council Chairman and the city's independent CFO markup the fine print with revenue shifting proposals and tax incentives.

"The Office of the Chief Financial Officer finds that the tax exemptions as proposed in the Bill are not financially necessary for the team to continue to operate as a business entity," said CFO Glen Lee via a letter and an 11-page analysis of the tax abatement parameters.

"However, without the exemptions, the taxes imposed would be considered exceptionally high relative to other recent NFL stadium deals, which may be considered by the team in its relocation decision."

The broad stokes of the deal has the Washington Commanders team putting up $2.7 billion for redeveloping the stadium and surrounding 180-acre site into a mixed-used project that includes housing and hospitality.

The city would be on the hook for an estimated $1 billion in infrastructure improvements that would likely be financed by bond sales.

The CFO's analysis reveals that the value of the proposed tax exemptions is $61.3 million in fiscal years 2027-2029, "with a total value of $1.48 billion through FY 2059, which is the anticipated end of the initial term of the leases."

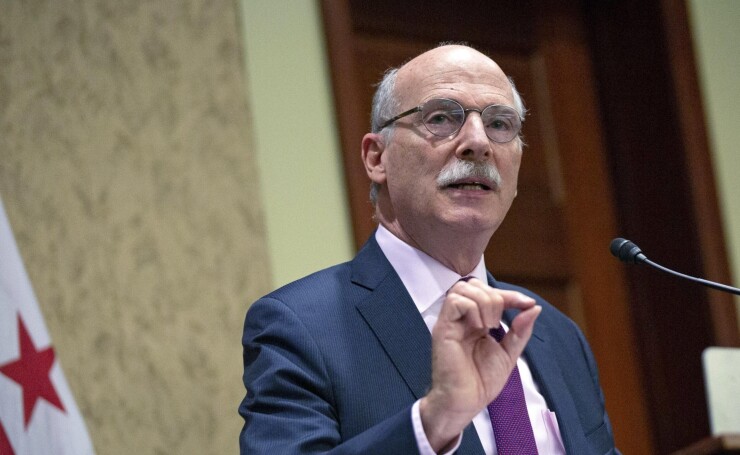

As the CFO was releasing his findings, D.C. Council Chair Phil Mendelson released the council's proposal which includes its own set of tax adjustments.

"The term sheet provided that all revenues, including tax revenues, generated at the stadium go to the Commanders or to a stadium-reinvestment fund. The Commanders have agreed that the following revenues instead will go to the district."

Per the new agreement $260 million in parking revenues from non-stadium-event days, $112 million in parking taxes, $54 million from sales taxes on merchandise, and $248 million sales taxes on food and beverages will all go to the city instead of the team.

The changes total out to $674 million over 30 years.

The revisions also specify that $50 million goes to a Community Benefits Fund and the team's senior leadership will move its offices to the city.

The Council intends to set development milestones with financial penalties for missed construction deadlines and has "restructured the debt financing by not capitalizing interest in fiscal Years 2028 & 2029. This will save District taxpayers approximately $55 million."

The Council's proposal also redirects $600 million from the "Sports Facility Fee" formerly known as the Ballpark Fee to a Transportation Improvement Fund for Metro improvements.

"Today we're scheduling a vote for Friday August 1, 2025, to consider the RFK campus legislation," said Mendelson. "We've been working with the Washington Commanders for several weeks and we feel we have a much-improved agreement that would bring the team back to their historical home, as well as develop the land around the RFK campus."

The deal is scheduled for a public hearing on Tuesday July 29, that some now see as a waste of time since the deal appears to be done.