With its classrooms closed and lower oil prices threatening its endowment, the University of Texas System plans to supply a recovering market with $400 million of top-rated bonds this week.

The deal includes $300 million of taxable and $100 million of tax-exempt revenue bonds, pricing Thursday through negotiation with co-senior managers Goldman Sachs and RBC Capital Markets.

The Revenue Finance System bonds will take out commercial paper and refund some bonds for savings, officials said.

About 14% of the $7.2 billion municipal bond supply this week is expected to be taxable, according to RBC.

Although the COVID-19 pandemic has had a serious impact on the UT System as it has on all major universities and hospitals, the system has yet to quantify most of the damage.

UT System treasurer Terry Hull said losses from health institutions fall between $300 million and $400 million, excluding any offsets from the federal government.

“University System officials are actively monitoring the COVID-19 outbreak and the directives of federal, state, and local officials to determine what additional precautions and procedures may need to be implemented,” Hull said. “To date, University System institutions have taken a number of steps to reduce expenses, including imposing hiring freezes, furloughs, budget reductions, the elimination of across-the-board salary increases, and the pausing of non-essential projects.”

The system’s eight academic institutions and six healthcare institutions cover a broad swath of the state. System enrollment was 239,312 in fall 2019, up 8.1% from fall 2015's 221,337.

With its classrooms closed for the pandemic, UTS is uncertain how many of its estimated 20,000 international students will remain on board, according to the preliminary official statement for the upcoming deal.

Also undetermined is where and how students actually take classes.

“The University System is currently planning for how to conduct in person classes on-campus for the 2020 fall semester with health and safety considerations as the first priority,” Hull said. “Currently, the University System's academic institutions are expected to announce plans for how the 2020 fall semester will be conducted by the end of June.”

With major emergency hospitals and medical schools in Austin, Dallas, Houston, Galveston, San Antonio and the Rio Grande Valley, UT Health has stood on the front lines of the COVID-19 pandemic.

Throughout Texas, hospitals suspended non-essential surgeries and procedures to preserve supplies and add bed capacity. Texas hospitals have increased the number of hospital beds available for COVID-19 patients by 117% since March 18, according to the Texas Department of State Health Services.

The American Hospital Association estimates the financial impact of COVID-19 on hospitals across the country at more than $200 billion from March through June 2020, representing average loss of $50 billion a month.

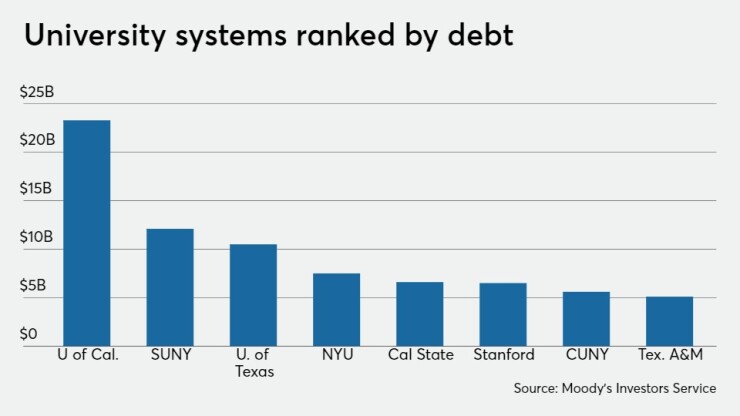

According to Moody’s Investors Service, the UT System ranks third in the nation in debt load with $10.5 billion. The University of California System tops the chart with $23.3 billion, followed by State University of New York with $12.1 billion. The top 10 issuers in the nation account for about 30% of the higher education debt, according to Moody’s May 12 sector report.

“These issuers are well positioned to manage through coronavirus-driven operational and financial disruptions, with generally strong management teams that will continue taking immediate action to reduce expenses in line with revenue disruption,” analysts said.

While UT System is dealing with the pandemic on its campuses, the managers of its endowment, the nation’s second-largest behind Harvard University’s, are keeping a wary eye on oil prices.

University Lands manages the surface and mineral interests of 2.1 million acres of land across nineteen counties in West Texas for the benefit of the Permanent University Fund. Revenue from production of oil and gas on the lands is invested and managed by the system’s UTIMCO management company.

Created in March 1996, The University of Texas/Texas A&M Investment Company (UTIMCO) was the first external investment corporation formed by a public university system.

Annual allotments from the PUF are known as the Available University Fund, or AUF, that supports the UT and Texas A&M University systems. The PUF also backs bonds issued for the UT and A&M systems that are not RFS bonds.

University Lands expects to send $700 million to the PUF this fiscal year, down from $1 billion last year. By 2021, revenue to the permanent fund could drop to $500 million if oil prices don’t rise significantly, according to University Lands estimates.

The organization sought state government intervention to preserve its interests.

“I believe it is imperative that every effort be made to ensure the viability of oil and gas operators and oilfield service companies as their existence is imperative to sustained oil and gas development,” Mark Houser, chief executive of University Lands, told the Railroad Commission of Texas, which oversees the oil and gas industry in the state.

With more than $30 billion in assets, the PUF yielded $8.2 billion in royalty income over the past decade, according to Houser.

In written testimony to the RRC, Houser cited a recent survey by the Federal Reserve Bank of Kansas City that found almost 40% of oil and natural gas producers would face insolvency within the year if crude prices remain below $30 a barrel. Oil futures for West Texas Intermediate crude hovered around $30 per barrel on Monday after briefly plunging to negative $37.63 on April 20.

“This implies that 100 companies operating on University Lands could become insolvent if there aren’t significant and quick improvements in commodity prices,” Houser said.

While Houser sought production cuts, major oil companies such as Exxon Mobil, Chevron, and Occidental Petroleum opposed cuts, arguing that the free market would be more efficient. The big companies have sufficient capital to outlast the smaller competitors.

In a May 5 meeting, the three-member Railroad Commission voted 2-1 against restricting production in the state.

Jon E. Olson, chair of the Hildebrand Department of Petroleum and Geosystems Engineering in the Cockrell School of Engineering at UT Austin, said the decision was a mistake.

“The argument, based on Texas state law, is that the commission is required to act when market conditions result in the economic waste of the state’s natural resources — a condition that current oil prices certainly meet,” Olson said in an opinion piece for UT News.

“Allowing West Texas producers to fail in record numbers due to unsustainable prices could bring back the days of excess imports and $4 per gallon gasoline,” he said.