DALLAS – Risk-averse investors will get a choice of top-rated taxable or tax-exempt debt this month as the University of Texas System goes to market with $600 million of revenue financing system bonds.

The first deal, scheduled to price through negotiation Thursday, will be $350 million of taxable 2017A bonds. Goldman Sachs is senior manager on the deal, led by vice presidents Ritu Kalra and John Stevenson.

Two weeks later, UT will price $250 million of Series B bonds. Both series are rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings.

"We assessed the system's enterprise profile as extremely strong, with a robust demand profile, exposure to health care risk, and good fundraising," said S&P Global Ratings credit analyst Jessica Matsumori. "We assessed the system's financial profile as very strong, with solid operating margins, a moderate debt burden, a low-risk debt profile, and adequate financial resources compared with operations and debt though cash and investments are much stronger."

Bond proceeds will permanently finance about $600 million of commercial paper and pay issuance expenses.

The deals continue a trend of strong growth in issuance from higher education in Texas.

Through the first half of 2017, volume rose nearly 36% to $2.69 billion compared to the same period in 2016. Last year brought high volume from colleges and universities after the Texas Legislature approved more than $3 billion of tuition revenue bonds statewide in the 2015 legislative session. That included nearly $1 billion for the UT System.

UT’s TRB authorizations have all been issued, and the state has appropriated related debt service in the 2017 legislative session that ended in May.

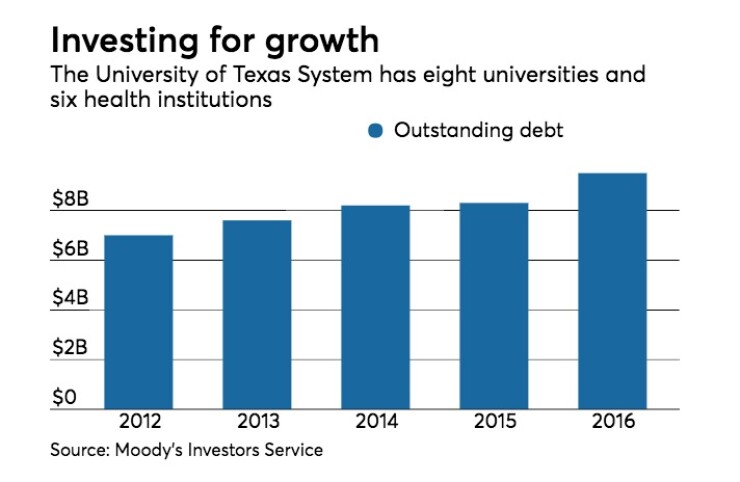

The Revenue Financing System is one of two vehicles for UT debt with about $6.2 billion outstanding. UT also issues so-called PUF bonds backed by the Permanent University Fund. Between the two, UT has $10.2 billion of outstanding debt.

RFS debt is backed by a pledge of all legally available revenues and fund balances of the UT System. Specifically excluded from the pledge are state appropriations, the Available University Fund, and the income from the Permanent Health Fund.

“The AAA RFS rating is supported by the system's substantial resource base, positive operating history and coverage, revenue diversity, stable enrollment and program demand, and an experienced management team,” according to Fitch analyst Susan Carlson.

UT is one of the nation’s largest systems of higher education, with more than 234,000 students and more than 2.9 million patients across eight universities and six health institutions. The system’s research enterprise accounts for about $2.2 billion in annual expenses.

“Demand for UT's educational services remains strong, supported by vibrant regional demographics and a relatively low-cost of attendance,” according to Moody’s analysts. “Total enrollment continues to increase, expected to be up approximately 2.6% for fall 2017 based on preliminary information.”

While UT Austin remains at capacity, all other academic institutions estimate enrollment increases generally in the 2%-5% range, with UT Tyler expecting a larger increase.

“Despite the system's global brand, it has a relatively low portion of international undergraduate students due to a requirement to admit the top 10% of students graduating from high school within the state,” Moody’s wrote.

About two-thirds of the UT System’s research is health-related, a sector earmarked for growth with the addition of medical schools in Austin and the Lower Rio Grande Valley.

“Increased diversification of funding sources contributes to annual growth compared to stagnation or contraction at other research intensive universities,” Moody’s wrote. “In fiscal 2016, federal agencies comprised over half of research funding, almost one-third from state and local governments, and 15% from private sources.”

The system's 2017-2022 capital plan calls for $6.4 billion of capital projects, of which 62% will be debt-funded. Of the $4 billion of debt-funded projects, about $1.8 billion remains authorized but unissued. The recent TRB authorizations have been issued, and the state has appropriated related debt service in the current 2018/2019 budget. UTS's self-supporting healthcare operations also support a large share of RFS debt service.

Until March 1, the UT System had worked on developing a Houston campus on land purchased last year.

Chancellor William H. McRaven said the decision to call off the project was based on his concerns that the project was “overshadowing the extraordinary work under way on the 14 campuses of the UT System” and he did not want do anything to detract from development of existing campuses.

“I accept full responsibility for the lack of progress on this initiative,” McRaven said in a memo to Regents’ Chairman Paul Foster. “I also offer my deepest apology to those members of the Houston Task Force who selflessly dedicated countless hours to develop a bold vision for the future of UT’s investment in Houston.”

McRaven also recommended to the Board of Regents that the UT System real estate office develop a plan to divest the System of the land that was bought for $215 million. Noting that it will take time, McRaven emphasized that the plan will be executed in a manner that protects the system’s investment in the property.

The Houston expansion was announced in November 2015 after the board of regents approved the purchase of 300 acres about 3.5 miles from the Texas Medical Center, the largest cluster of medical facilities in the world. UT Health operates the M.D. Anderson Cancer Research Institute at the TMC and a medical school in nearby Galveston.

Opposition to UT's expansion arose from the University of Houston, a state-supported university that has grown rapidly in recent decades and saw a new UT campus less than 7 miles away as a threat.

“This is a Trojan horse, and Houston should not let it inside the gates,” said UH Law professor Michael Olivas, who was interim president of UH’s downtown campus when the purchase was made in 2015. “Were the situation reversed and UH bought land near the Austin Airport to provide state-level experiences for its students in the state capital, UT would properly object.”

When UT announced it was halting plans for a Houston academic campus, Sen. Borris Miles, D-Houston, applauded the move, even though the campus would have been in his district.

"My greatest concern regarding the UT land deal has always been about the nontransparent method by which the land was acquired and by the system's inconsistent explanations for how the land was to be used," Miles said in a prepared statement. "I am encouraged that UT listened to the voices of concern and decided to pull the plug on proceeding with the Houston development. I understand UT will now sell the land gradually to an entity or entities that will bring economic development and jobs to the surrounding community."