As some local power companies look to put distance between themselves and the Tennessee Valley Authority, the agency is moving closer to the state of Tennessee as it helps to create a statewide system of charging stations for electric vehicles.

Established by Congress in 1933 during the Great Depression, the TVA's first mission was to foster economic growth and job creation by bringing electricity and creating flood control for poor rural areas in the Tennessee Valley.

The TVA now operates the largest public power system in the United States, supplying wholesale power to 153 local power companies, largely nonprofit cooperatives and municipal utilities, in Tennessee, Alabama, Mississippi, Kentucky, Georgia, North Carolina and Virginia. Many of these areas today are no longer rural, or poor, and they are looking to get a better deal from the agency.

The close ties between the TVA and its local power operators have loosened in recent years, S&P Global Ratings said in a report released last week, written last week by director Jeffrey Panger and associate director Scott Sagen.

“Over the last couple of years rates have been fairly stable, but some of the local power companies have wanted to add in additional amounts of renewable generation,” Panger told The Bond Buyer. “Although power costs have been stable over the past couple of years, in other jurisdictions prices have come down as gas costs have come down. So some of the local power companies had been looking into the possibility of sourcing power from other providers.”

Part of the TVA Act includes an anti-cherry-picking provision which provides a barrier to entry for other suppliers by preventing the use of the TVA transmission system to serve power loads of the local power companies, or LPCs.

Despite this, TVA's largest LPC, Memphis Light, Gas & Water, had been considering other power supply options.

If MLGW were to leave TVA, this could lead to higher fixed costs for the remaining LPCs, according to S&P. Other large municipal utilities in the system include the Nashville Electric Service, the Chattanooga Electric Power Board, the Knoxville Utilities Board and Huntsville Utilities in Alabama.

"The barriers to exit have, in our opinion, largely kept the LPCs tethered to TVA," Panger said.

TVA, which also directly serves about 60 large industrial and federal customers, has responded to these concerns by coming up with some new programs, including offering longer-term power contracts by extending the terms to 20 years from five and 10 years, lowering the price it charges the LPCs and expanding the option for LPCs to add their own renewables, Panger said.

This strategy seems to have worked. Panger noted that 142 of the 153 LPCs opted to resign new, longer-term contracts with the TVA.

“This suggests that LPCs continue to see a value proposition in remaining with TVA,” he said.

Nevertheless, he said there were still a few holdouts including the largest, Memphis Light.

“It’s unclear whether Memphis is continuing to look at this point — after the situation that happened out in Texas through

“At this time, the future of Memphis' power supply arrangements with TVA is uncertain and we will assess the credit effects of any changes in the existing arrangement once the future supply arrangements are announced,” the report said.

The TVA is a corporate agency of the United States, but its debt is not formally government guaranteed, though its bond ratings are the same as the U.S. government's: triple-A from Moody’s Investors Service and Fitch Ratings and AA-plus from S&P Global Ratings. Moody’s and S&P assign the bonds a stable outlook while Fitch maintains a negative outlook.

The TVA is self-funded and profit-neutral. Its bonds are federally taxable, but exempt from state taxes. The authority has $10.2 billion of annual revenue and $53 billion in total assets.

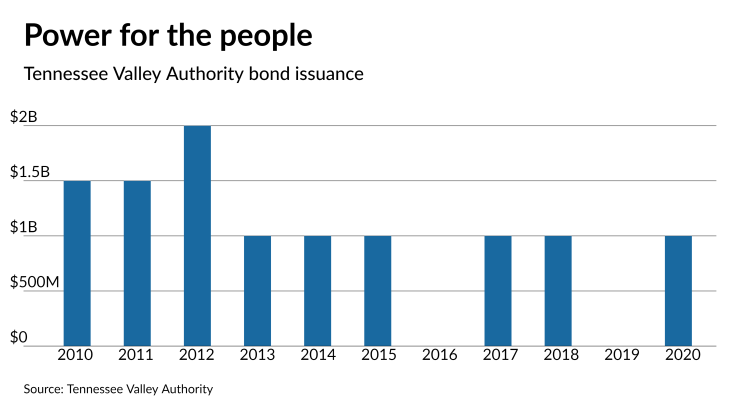

Since 2010, the TVA has sold over $11 billion of bonds backed by power revenue. Under the TVA act, the authority's bond authority is limited to $30 billion.

The last time the TVA was in the market was in May 2020 when it sold $1 billion of Series 2020A 0.75% non-callable bonds due 2025. TVA sold $1 billion of Series 2018A 2.25% two-year bonds in 2018 that matured in 2020. The TVA also sold $1 billion of 2.875% non-callable bonds in 2017, which are due 2027. In 2015, the TVA sold its longest issue to date: $1 billion of 50-year global power bonds. Those non-callable bonds were priced to yield 4.38%, achieving an interest rate of 4.25%, which at the time was the lowest on record for a 50-year bond issued by any corporate or government agency issuer. TVA also issued $386 million of long-term retail notes of varying maturities in the past 10 years, and $1.4 billion of long-term lease-backed notes.

In a move that brings it closer to the Bluegrass State, the TVA and the Tennessee Department of Environment and Conservation signed a co-operation agreement last week to create a statewide electric vehicle fast-charging network.

The aim is to add around 50 new charging locations along interstates and highways in the state to encourage electric vehicle use. Currently, there are only 24 fast-charging locations open for all drivers which can support both EV charging standards.

TDEC and the TVA will use various funding sources to fund the $20 million project, with around $5 million coming from the state’s Volkswagen Diesel Settlement Environmental Mitigation allocation and the remainder coming from the TVA and other local power company partners.

“With TVA’s partnership, we will be able to continue our work to protect our environment and improve our transportation infrastructure,” Gov. Bill Lee said in a press release.

“This agreement shows TDEC’s ongoing commitment to a clean environment,” TDEC Commissioner David Salyers said in the release. “This is an exciting development for Tennesseans, and we are pleased to partner with TVA on this project that will benefit rural and urban communities alike.”