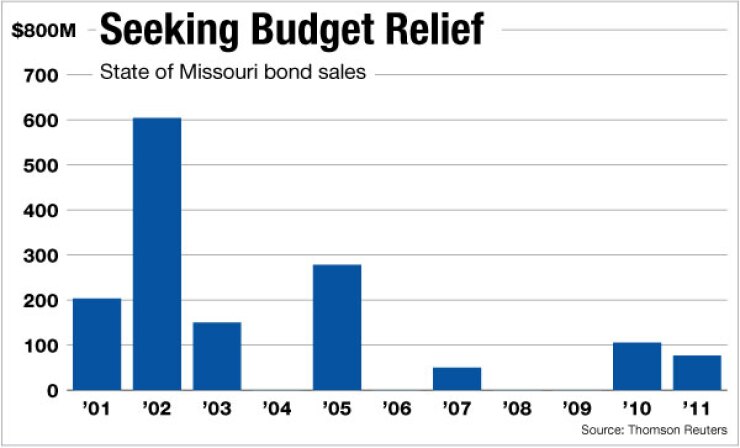

CHICAGO — Missouri, a rare issuer, will enter the market with two refundings totaling $500 million later this year to generate both ongoing present-value savings and up-front savings that are built into Gov. Jay Nixon’s proposed $23 billion fiscal 2013 budget.

The transactions are similar to refundings the triple-A rated state completed last year that generated savings for both fiscal 2012 and 2013 budgets by pushing off near-term maturities. While rating agencies frown on such one-time maneuvers as a sign of fiscal stress, the refundings also are generating significant present-value savings, and in some cases the state has shortened the final maturity schedule.

“We have such a great opportunity for savings with these refundings that we are taking advantage of the opportunity to use some of the savings for budget relief,” said Stacy Neal, director of accounting in the state’s Office of Administration.

Finance officials will seek approval in the coming months from the Board of Fund Commissioners to current refund in a competitive transaction up to $175 million of general obligation bonds with roughly 12.5% in present-value savings expected. If approved, that refunding would take place in the fall, Neal said. About $24 million in up-front savings would be taken in fiscal 2013.

Officials will also seek approval from the Board of Public Buildings for an advance refunding of up to $320 million of revenue bonds from a 2003 issue. The deal will generate 9% in present-value savings and provide $20 million in up-front budgetary relief. If approved, Neal said the state hopes to enter the market with the competitive issue over the summer.

Nixon last week unveiled a budget that erases $500 million of red ink by cutting Medicaid spending by $192 million and higher education by $100 million. In addition to the debt restructuring and other revenue collection measures, the budget relies on $52 million from a tax amnesty plan. It anticipates the elimination of more than 800 jobs, mostly through attrition.

The Democratic governor’s budget does not include any tax increases. The deficit stems primarily from declining federal aid. Republicans who control the Legislature were pleased that Nixon did not propose a tax hike, but they contend the budget shouldn’t be balanced on measures like a tax amnesty program, which they have previously blocked. They, along with some Democratic colleagues, also criticized the size of the 12% cut to higher education.

In his state of the state address, which coincided with the budget’s release last week, Nixon boasted iof the state’s success in managing its finances.

“More than 30 states have raised taxes, including Kansas and Illinois. But we have not. Because we know that Missouri families can’t afford a tax increase. … Because of our focus on fiscal responsibility and efficiency, Missouri is one of the few states with a triple-A credit rating from all three rating agencies,” he said.

The proposed budget does not include any new-money borrowing plans, but lawmakers are expected to debate measures that could influence future local government and state borrowing.

Rep. Chris Kelly, D-Columbia, has introduced two bond-related bills. One would extend the current state requirement that gives voters the say on any new GO bonding to all forms of bonds, including appropriation-backed debt. The other bill calls for a constitutional amendment barring any non-GO debt issuance backed by an appropriation.

The legislation stems from anger over the city of Moberly’s default on $39 million of bonds it put an appropriation pledge behind to help finance a sugar substitute manufacturing plant. The Chinese company behind the project, Mamtek US Inc., has abandoned it and defaulted on city payments. The city in turn said it won’t tap its own revenues to cover the debt.

The project received city help through the bond issue, and $17.6 million in state assistance was pledged though never awarded. The project is the subject of a bondholder lawsuit, and various local, state, and federal regulators are investigating it. The Legislature continues to hold hearings on the subject.

Ahead of a refunding last fall, the rating agencies affirmed Missouri’s top ratings on $500 million of outstanding GO debt, and ratings one notch lower on $790 million of appropriation and special obligation bonds.

The rating benefits from conservative financial operations, a broad and diverse economy, and a budget reserve equal to 7.5% of net general fund revenues that provides liquidity. The state closed out fiscal 2011 with an ending cash balance of $379 million, up from $184 million a year earlier. Other positives are the state’s constitutional ability to withhold spending in response to revenue shortfalls and an adequately funded pension system at 80%.

Challenges include a limited ability to raise revenue without voter approval and economic exposure to a shaky manufacturing sector.