The Bond Buyer’s weekly yield indexes were mixed this week as tax-exempts erased early-week gains with Treasury-driven losses Wednesday and Thursday.

Despite the sideways week, the municipal market withstood some $11 billion of new-issue supply this week without the dramatic rise in yields that plagued it much of last month.

“The market did a superb job this week, compared to November, which was just short of an overall collapse,” said Michael Pietronico, chief executive officer at Miller Tabak Asset Management.

“It seems like the market is trying to stabilize, but it still has a little bit of wood to chop with more supply coming,” he said.

Leading the new-issue market this week, Illinois’ Railsplitter Tobacco Settlement Authority priced $1.5 billion of well-received 17-year tobacco debt. The pricing of the bonds was accelerated one day to Tuesday due to higher than expected retail demand.

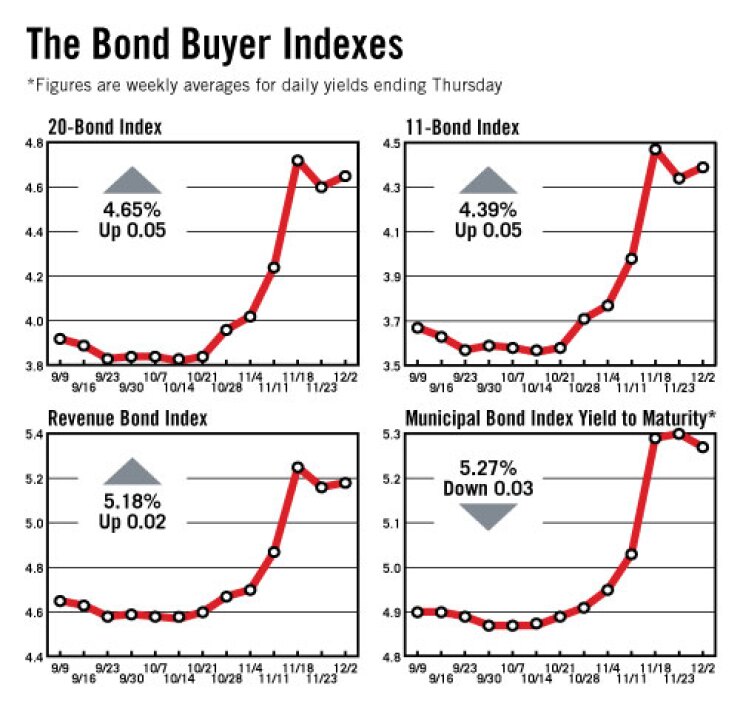

The Bond Buyer 20-bond index of 20-year general obligation bond yields rose five basis points this week to 4.65%, but remained below its 4.72% level from two weeks ago.

The 11-bond GO index of higher-grade 20-year GO yields also increased five basis points this week, to 4.39%. However, it also remained below its 4.47% level from two weeks ago.

The revenue bond index, which measures 30-year revenue bond yields, gained two basis points this week to 5.18%, but held short of the 5.25% level it posted two weeks ago.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, declined two basis points this week to 0.54% — unchanged from two weeks ago.

The yield on the 10-year Treasury note rose 23 basis points this week to 3.00%. It is at its highest level since July 29, when it was also 3.00%.

The yield on the 30-year Treasury bond increased nine basis points this week to 4.27%, but remained below its 4.29% level from two weeks ago.

The weekly average yield to maturity on The Bond Buyer’s 40-bond municipal bond index, which is based on 40 long-term municipal bond prices finished at 5.27%, down three basis points from last week’s 5.30%. This is the lowest weekly average for the yield to maturity since the week ended Oct. 10, when it was 5.03%.