The University of Texas System will take its triple-A credit rating to a receptive market this week in the form of $400 million of revenue bonds.

The first issue of the year for the UT System will refund outstanding bonds and convert about $300 million of commercial paper to long-term debt.

“We expect the refunding to generate in excess of 20% in present value debt service savings,” said Terry Hull, associate vice chancellor for finance. “Given the strength of the UT System’s credit, we expect strong demand for the bonds from a variety of municipal investors.”

The negotiated deal is slated to price Wednesday through book runner Wells Fargo Securities. The UT System acts as its advisor.

This week’s volume

UT System’s triple-A credit withstood the COVID-19 pandemic as it emerged with stable outlooks from the ratings agencies.

"We assessed the system's enterprise profile as extremely strong, with a robust demand profile, enrollment growth, high student quality, and exposure to health care risk," said S&P Global Ratings credit analyst Mary Ellen Wriedt.

With this deal, UT will have about $11 billion of comparable debt outstanding, according to S&P.

UT System issues debt through two primary systems, the Permanent University Fund and the Revenue Finance System.

The upcoming deal is RFS debt secured by all legally available revenues and fund balances of the UTS system. The pledge excludes state appropriations or income from the Permanent University Fund.

“UTS has maintained adjusted cash-flow margins exceeding 20% in the last four fiscal years, including a 22% margin in fiscal 2020 even with coronavirus pressures,” Fitch Ratings analyst Susan Carlson observed.

Opening its flagship campus in Austin in 1883, the University of Texas has grown statewide with eight academic campuses and six healthcare institutions.

The system’s headcount was 243,719 in fall 2020, up 1.8% from the prior year amid the pandemic.

“The system expects continued, modest enrollment growth outside of the flagship Austin campus, which is at capacity,” Carlson said. “The system enrolls about one-third of Texas' public college students and educates about two-thirds of the state's health care professionals.”

The system's medical schools and healthcare operations provided 37% of fiscal 2020 operating revenues, even with the COVID-19 pandemic crowding out many elective procedures for part of the fiscal year, Carlson said.

Another 16% of revenue comes from endowment income. UTS has a two-thirds share of the $24 billion PUF endowment, with the Texas A&M System holding the other third. Market value of all UTS endowments, including the PUF, was $40.4 billion as of Aug. 31, 2020, the end of the state’s fiscal year.

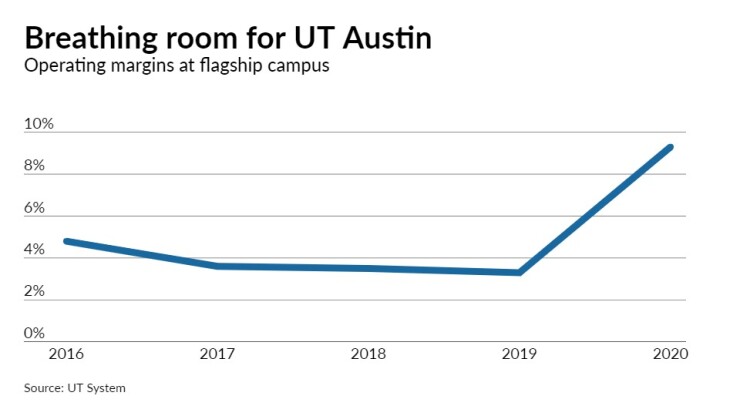

Despite COVID-19 revenue losses, the Austin campus’ overall operating revenues, operating margin, and spendable cash ratios all increased in the last year, according to the UT System's annual Analysis of Financial Condition

“Strategic investing and desirable market returns over the last several years, including moving funds from short term funds and the intermediate term fund to the long term fund, have had a positive effect on UT Austin’s overall financial position and have allowed revenues to keep pace with increasing operating expenses,” the analysis said.

In 2020, UT Austin’s new Dell Medical School graduated its first class of 49 doctors in a virtual ceremony. With the onset of the pandemic Dell students saw their clinical rotations cancelled in March 2020. Those students are now on the front lines of the COVID-19 fight as residents at hospitals across the country.

Scientists from UT Austin co-designed the coronavirus spike protein used in the COVID-19 vaccine released by multiple manufacturers in late 2020.

Creation of the Dell Medical School was authorized by the 2012 passage of Central Health Proposition 1 in Travis County that raised the property tax rate by 5 cents per $100 valuation. The increase in the tax rate would generate up to an additional $54 million to be matched by another $76 million from federal funds each year, for an additional $130 million annually over four years.

The local funds helped pay for a redesign of the healthcare delivery system in Travis County, and allowed for expansion of healthcare infrastructure and services that provide health care for uninsured residents of Travis County.

In May 2012, the UT Board of Regents approved $25 million of annual funding to the new medical school, plus another $40 million spread over eight years for faculty recruiting.

The Michael and Susan Dell Foundation earned naming rights with a pledge of $50 million over 10 years. Michael Dell, founder of Dell Computer, began the company in his dormitory room at UT Austin. It is now headquartered in the Austin suburb of Round Rock.

Adjoining the medical school on the southeast corner of the UT Austin campus is the $295 million, 211-bed Dell Seton Medical Center at The University of Texas built by Seton Healthcare.

In Dallas, the UT Southwestern Medical School and hospital are also undergoing rapid expansion. UT Southwestern’s campus includes about 14 million square feet of building space, with more than 4.5 million square feet of new construction or renovation projects underway or in planning stages.

The expansion includes a third tower at the Clements Hospital and the addition of a building to the brain research center.

At the UT Health Sciences Center at Houston, construction is underway on a $125 million building on the UTHealth Continuum of Care Campus for Behavioral Health. The new building, a 240-bed hospital, is a joint project of the university and the Texas Health and Human Services Commission.

Scheduled for completion early next year, the new building will make the UTHealth Continuum of Care Campus the largest academic psychiatric hospital in the nation.