Municipal market dynamics are so favorable right now that investors involved in tender-option bond programs can create better revenue streams compared to what they received before the financial crisis, but at half the risk or less.

But the programs, which suffered losses and contracted dramatically during the credit crisis, have not yet taken flight now that the market has recovered. The success of taxable Build America Bonds — which has limited the supply of tax-exempt debt necessary for TOB programs — is one reason. Another is demand: the program uses leverage, and investors don’t have much appetite for risk these days.

The primary factor creating a favorable climate for TOB programs is the steep yield curve. A TOB program is a financing mechanism that allows investors to make a leveraged carry trade, borrowing at short-term rates and investing in higher-yielding long-term bonds, and then pocketing the spread.

To date this month, Municipal Market Data indicated the spread between two years and 30 years in the triple-A general obligation yield curve averaged 337 basis points.

By contrast, when TOBs were booming in the first six months of 2007, that same spread averaged just 54 basis points. To earn a profit on those thin margins, TOB investors in 2007 had to increase the risk on their bets by leveraging at 10 times or more.

In today’s climate, however, such leverage isn’t possible. Not only are cautious investors adverse to assuming greater risks, but liquidity sponsors are also unlikely to lend the money.

Lower leverage means less risk, and generally that means less potential for profit. But TOB investors said the spread has been so wide recently that pre-crisis levels of revenue are still possible.

“Back in the spring of 2007 when you were allowed to leverage 10 or 12 times, the carry wasn’t very good per bond, because that spread was very thin,” said Jed McCarthy, managing member of muni-only hedge fund 1861 Capital Management in New York.

“But now, even though your allowed leverage is maybe less than half of what the liquidity sponsor used to allow you to do, the spread is so great that it even more than makes up for the fact that the leverage is down.”

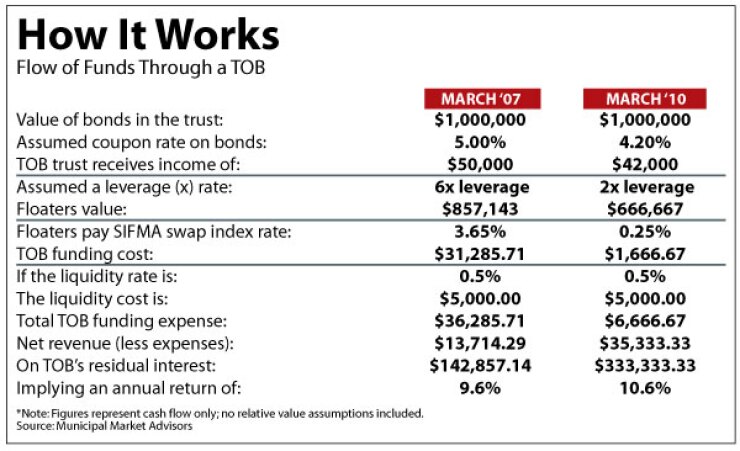

As the accompanying chart indicates, for instance, a typical TOB trade in March 2007 might use six times leverage to deliver an annual return of 9.6%. In the current climate, the investor could reduce leverage to just two times — cutting the risk of the trade by a third — and earn an annual return of 10.6%.

If market dynamics stay this favorable, more hedge funds and dealers could take advantage of the environment and the market could see “a re-leveraging scenario” in the near-term, according to Matt Fabian, managing director at Municipal Market Advisors, an independent research firm.

To some extent, that’s happening already, but only in a limited way.

Jeff Previdi, a senior analyst at Standard & Poor’s, said the agency has been rating approximately 15 to 20 new TOB trusts each week. That’s more than the five to 10 trusts rated weekly a year ago, but well below the pre-crisis days when upwards of 50 trusts were rated each week, he said.

In terms of volume, the TOB market is still about 60% lower than it once was, bankers familiar with the programs said. In its heyday in 2007, the volume of TOBs grew to more than $200 billion, representing about 8% of the municipal market.

Once the financial crisis forced investors to unwind their positions, that volume fell to about $60 billion in early 2009, but in recent months new activity has pushed the volume up to around $80 billion.

To some, the prospect of exotic products returning to the market with force might not sound too welcome, but participants familiar with the trade point out that the risks associated with TOB programs have largely been reduced.

One reason is the lower leverage, meaning there is more collateral backing the trade than there was before. Another reason is the collateral is much less reliant on bond insurance, so the quality of paper in the trade is fundamentally higher than it was before.

“Most of the problems that came about in 2008 were really brought on by very highly leveraged structures on fairly weak underlying bonds, and as a result, when things went wrong, there was not enough liquidity to unwind those vehicles, and that’s why you saw plummeting prices,” a Wall Street banker said recently.

Instead of being squeamish about the return of these products, an increase in TOB volume would likely have a positive impact on the wider market, participants said.

“When TOBs were being a force in the marketplace, one of the beneficiaries overall was muni issuers,” Previdi said. “As TOB desks were active in buying municipal bonds — particularly long term — that pushed down yields for issuers, and that was a great thing.”

Still, despite favorable dynamics and the potential to assist the broader market, it’s far from certain that TOB programs will see explosive growth in the near term. In fact, several other dynamics are holding a strong resurgence back.

Before articulating those factors, however, it may be helpful to gain a better understanding of how the product works.

PLAIN VANILLA

For investors, the attraction for the TOB program comes from the fact that the municipal yield curve is naturally steep, compared to other assets.

Retail purchasers, who make up about two-thirds of the investor base for munis, prefer to purchase short-term debt, while the financial needs of issuers tend to be long term — think of constructing roads, bridges, and schools.

So, in the past decade, the spread between two years and 30 years in the triple-A general obligation yield curve scale averaged 221.3 basis points. Compare that to Treasuries, where the average was 166.8 basis points, and you have an extra spread of 54.5 basis points, according to MMD.

So long as there is reason to believe the curve will remain steep, the investor should be able to benefit from that extra spread.

Here’s how it works: An investor, typically a hedge fund or a mutual fund, will sell a portfolio of top-grade, fixed-rate, long-term municipal securities to a TOB sponsor trust, which is typically run by a large bank. Using the long-term bonds as collateral, the trust then creates two notes, a floater certificate and a residual certificate.

The floater certificate, or senior note, provides a short-term variable-rate with a put option. The tax-exempt yield on the certificate is relatively low — usually based on the Securities Industries and Financial Markets Association swap index — but the tender option compensates by giving the floater-holder the right, on specified dates, to receive par value for it. In trader parlance, the floater certificate is known as the tender-option bond.

Tax-exempt money market funds in particular soaked up the floating-rate certificates to help meet diversification requirements and keep strong credits on their books.

So in addition to helping the broader market by purchasing long-term munis and pushing down the yield curve, TOB programs also helped meet the investor demand for short-term, tax-exempt, floating-rate debt.

The residual certificate, or junior note, is sold back to the investor. If it carries a rating at all, the residual will be graded lower than the floating rate because it is the “first-loss” certificate, but the risk is compensated by the higher yields it derives from the long-term collateral, minus the floating rate and some fees.

The yield of the residual certificate changes in opposition to the floating-rate, so it is often called the “inverse floater.”

Leverage enters the trade because when the trust issues the floating-rate note, it effectively borrows cash from the money market funds against the long-term collateral, and the investor can use that cash to finance the purchase of more bonds.

Those purchases are dependent on the cash flow created by the carry trade — the spread between the short-term borrowing rate and the bond yield — which means the investor has more volume riding on the collateral than its original value.

The degree of leverage depends on the volume ratio between the residual certificates and the floating certificates — the more floaters there are, the fewer residuals there are to back them. Prior to the credit crisis, TOB programs were using up to 10 times leverage, sometimes more.

THE COLLAPSE

Before the credit crisis, the most active time for creating new TOB trusts was in the first half of 2007, according to Standard & Poor’s.

The agency rated $23.5 billion of TOB floating-rate certificates in that period, which was more than the $22.4 billion rated in all of 2006 — then a record year for TOB activity.

The impact on long-term rates was pronounced: the triple-A GO yield in two years versus 30 years flattened to a six-month average of 54 basis points between January and June 2007, according to MMD. Three years earlier the six-month average was 311 basis points.

It should be noted, however, that the Treasury curve flattened around the same period, so other market factors were at work in addition to spread arbitrage.

But when the credit crisis hit financial markets, the once-lucrative carry trade quickly went sour, forcing those involved to unwind the trades and take heavy losses.

“When the crisis hit, all that stuff was unwound,” McCarthy said. “Different sponsors had different hurdles, but broadly speaking, it had to have two double-A ratings —¯Aa3 didn’t even work for some of the sponsors. And if you didn’t have that, they would force you to unwind the trust.”

The underlying collateral in the trade was often enhanced by bond insurance, so when the guarantors were downgraded throughout 2008, certificates derived from the collateral no longer met the high-grade requirements.

Holders of the floating-rate certificates were forced to exercise the put option and sell the certificates back to the trusts, forcing the liquidity sponsors to cough up cash.

Then, in the wake of the Lehman Brothers collapse in September 2008, short-term rates shot to record highs.

The SIFMA municipal swap index — a widely used barometer of variable-rate demand obligations — peaked at 7.96% that month, compared to its current 0.24%. That rendered the carry trade hugely unprofitable as investors were paying short-term rates far in excess of what the underling collateral was providing.

To top things off, muni-to-Treasury ratios defied all expectations as a flight to quality caused Treasury yields to fall to historic lows, making municipals far cheaper than Treasuries despite their tax-exempt status.

The muni-to-Treasury ratio for 30-year debt jumped to 208% in December 2008, compared to the decade median average of 95.6%.

That 208% was more than 17 standard deviations from the mean up to that point — or in laymen terms, a tail risk so far off the standard bell curve that the possibility of it occurring was virtually nil.

As one banker recently commented, “How the hell could that ever happen?”

THE MARKET TODAY

A great deal of stability has since returned to the municipal market.

In mid-April, the muni-to-Treasury ratio in 30-years was 88.9%. Compared to the decade average of 95.6%, this indicates that long-term tax-exempts are relatively expensive.

TOB investors follow muni-to-Treasury ratios closely because in order to reduce the possibility of a shift in the muni yield curve, a TOB program will often hedge both sides of the trade with taxable rates.

Like the unhedged carry trade, the ratio trade, as it is called, can also be beneficial to the wider municipal market by keeping relative values in check.

The reason is higher ratios indicate cheap munis, so when ratios rise more investors will be attracted to the TOB ratio trade.

“When muni-to-Treasury ratios would get out of whack, these guys would come in and buy a little more to support their money-making trade efforts,” said Tom Kozlik, municipal analyst at Janney Capital Markets. “One of the reasons things have been so volatile since the beginning of ’08 is because TOB programs, for the most part, aren’t well-capitalized.”

Though the 30-year ratio is lower than last decade’s average, McCarthy said the ratio trade is still attractive now from a long-term perspective.

He noted, for instance, that ratios are a little higher now than they were three years ago when TOB structures were booming.

In addition, “the cash-flow portion of the trade has possibly never been better,” he said, speaking of the steep yield curve.

Two problems exist, though. One is that hedging costs are greater now than when the yield curve was flatter. The other is that marketing the ratio trade remains difficult as risk appetite remains tepid among investors.

“It’s still not that long ago that you had major, major stress events, so that’s a real negative for people looking at the trade,” McCarthy said. “It’s ironic, but isn’t that just the way things work on Wall Street? The best time to be in a trade is when no one else wants to be in it.”

Another banker from a Wall Street firm, who did not want to be named, said another attraction for the ratio trade is that muni yields could fall further relative to Treasuries.

“Frankly, the tax-exempt yield curve is steeper than makes sense for a lot of reasons right now — you could easily see that flatten quite a bit more,” he said.

“And look at where financing is now on an absolute basis,” he added, referring to the SIFMA swap rate, which averaged 0.20% in the first three months of this year. “Even though money-market fund assets are negative on a week-to-week basis, financing is more attractive now than ever.”

BABS AND TOBS

A major reason why long-term tax-exempt yields have fallen recently is the advent of taxable Build America Bonds, which were created by the American Recovery and Reinvestment Act in February 2009.

When issuing BABs, issuers can opt to receive a 35% direct interest subsidy from the federal government. Because BABs are a taxable instrument, they appeal to the wider investor base, including foreign buyers.

As a result, municipalities are choosing to borrow in the taxable market, particularly on the long end where savings can be greatest.

In the first quarter of this year, for instance, total volume in the muni market was up 17.1% compared to last year, but tax-exempt supply was down by nearly one-fifth because issuers are increasingly selling BABs.

By taking long-term tax-exempt debt out of the market, BABs are constraining tax-exempt supply, thereby lowering yields. In a different fashion, then, BABs are pushing down the yield curve just as TOBs once did.

For Standard & Poor’s Previdi, this raises the question of whether TOBs could exert the same market influence they once had.

The purchase of tax-exempt bonds for TOB programs might have to rise pretty dramatically for tax-exempt yields to fall even further than BABs have pushed them, he said.

But, he added, “it could just magnify what’s taking place.”

In other words, TOB programs and BABs could work together to take long-term tax-exempt bonds out of the market — TOBs through purchase, BABs through substitution of taxable debt for tax-exempts — which would drive borrowing rates for municipal issuers even lower.

Further, McCarthy said if President Obama’s budget proposal to expand the BAB program to health care, higher education, and refunding issues is approved by Congress, that could be a major gift to the TOB ratio trade, as it would dramatically further constrain tax-exempt supply on the long end.

“Practically nothing would be issued with a tax-exempt long maturity,” he said, “as long as ratios are such that it is more attractive for an issuer to issue in the taxable market.”

But a flood of issuance in the BABs market and a dearth of issuance on the tax-exempt side would cause tax-exempt yields to fall, McCarthy said, which would then motivate issuers to borrow in the tax-exempt market. That back-and-forth would form a natural ceiling in muni-to-taxable ratios, making it increasingly unlikely that ratios would blow up as they did in 2008.

“Effectively, there will also be a floor because if muni ratios get too low you’ll have everything come to market as tax-exempt again, creating upward pressure on ratios,” he added. “So you’ll be left with a band of ratios driven by whether issuers think it’s cheaper to issue as taxable or tax-exempt.”

Whether the 35% BAB subsidy is gradually reduced to 28% or some other figure, McCarthy said that wouldn’t really matter — it would just change where the ratio ceilings and floors would go.

In either case, the outlier risk of the ratio trade would be greatly reduced, providing a degree of comfort to those playing spread arbitrage.

But while the impact of BABs may be positive for municipal-to-taxable ratios, the overall impact on tender-option bond programs may not be wholly positive.

By giving borrowers the option of issuing in the taxable market, BABs have limited the availability of traditional munis that could be placed into TOB trusts.

“Even though TOBs are an attractive way to finance munis, potentially, because of the level of financing, you have a supply disconnect,” another TOB participant said. “A majority of these long-dated, high-grade bonds are going to BABs and other programs, so you’re not getting the supply that you need to support an extension of the market.”

BABs cannot be deposited into the trusts because the tax-exempt floaters must be backed by tax-exempt collateral. However, there is a TOB equivalent in the taxable market, called a taxable repurchase agreement.

DELEVERAGING DEMAND

Problems aren’t only confined to the supply side. Even if tax-exempt issuance were flooding the market, the interest in starting TOB programs may be more tempered than in previous years as appetite for leverage has diminished.

“Remember that TOBs are just a financing mechanism,” McCarthy said. “The reason you would increase leverage is because you want to buy more muni bonds, but while the financing mechanism is attractive right now, there may be reasons why you don’t care to have more munis.”

For banks involved in proprietary trading, one such reason is that leverage isn’t a necessity given how much cash banks are sitting on.

Thanks to the Federal Reserve’s quantitative easing program — a monetary-policy effort to flood the system with liquidity — commercial banks have more cash on their books than commercial and industrial loans for the first time since 1973. In aggregate, the volume of cash held by commercial banks jumped to $1.373 trillion in late February from $310 billion in September 2008, according to the Fed.

If banks are sitting on cash, the incentive to finance through a TOB is minimal.

For example, a TOB investor could deposit $100 million in bonds into a trust with 50% to 75% proportionality, and receive $50 million to $75 million back in cash from the floater proceeds, thereby enabling the investor to purchase additional muni bonds.

The dearth of eligible long-term tax-exempt bonds in the current market, however, also reduces the incentive for banks to create leverage.

“The first source of funds to purchase bonds should be the cash an investor has on hand, such as the equity raised by mutual funds as money has migrated out the municipal curve in search of yield,” said Eric Vandercar, manager of municipal funding and liquidity at Morgan Stanley. “If an investor wants to buy additional bonds once their cash on hand is deployed, that’s when there’s an incentive to deposit bonds in a TOB.”

He added: “While first instincts would suggest that the substantial positive slope of the muni curve, expectations for higher tax rates, and favorable market technicals should result in demand for leverage in the muni market, until TOB residual holders are short on cash and identifying more bonds that they want to own, TOB volume may be less than otherwise anticipated.”

A further impediment is proposed new legislation — often dubbed the “Volcker Rule” — to restrict bank proprietary trading.

A number of market participants said the impact of that rule could be minimal. In order to be hurt, something has to be alive, and proprietary trading died in the financial crisis, they said.

“At the end of 2007 virtually every U.S. bank and a few foreign banks had very large TOB programs — now that’s gone,” according to a banker who did not want to be named. “So is the legislation going to hurt the prop desk TOB programs as they stand today? No. There’s not a lot of it out there.”

“Will it limit the potential return of that going forward? I guess. But it depends what the banks and brokers do to counter the new environment. They may just spin off brokerage houses. And in that case, then it’s 'Game On’ again.”

Without the same leverage as before, few are expecting the tender-option market to become as influential as it was before the credit crisis.

However, if market dynamics remain this auspicious, MMA’s Fabian suggested that even with moderate leverage the program could be influential in taking supply out of the market and pushing down yields, which would be a boon to issuers struggling with their finances.

“Using lower leverage means the net return per bond will be lower, so you would need more bonds to get the same kind of dollar income out of the plan,” he said. “So in theory, the market could become as big as it was before or even larger, if it continues to grow that way.”