The municipal market digested another large California issuer's debt in the primary while AAA benchmark yields rose again by as much as five basis points. Participants are still beingcautious in this market. Lipper also reported more inflows of $73 million.

Meanwhile, the recently downgraded New York Metropolitan Transportation Authority announced that it will issue $930 million of Climate Bond Certified green bonds with $680 million of fixed-rate transportation green bonds and $250 million of fixed-rate or term-rate transportation revenue bonds.

On Thursday, Morgan Stanley priced Los Angeles Unified School District’s (Aa3/NR/AA+/NR) $942.715 million of general obligation dedicated unlimited ad valorem property tax bonds, featuring tax-exempts and taxable bonds.

The $829 million of exempts were priced to yield from 1.04% with a 5% coupon in 2021 to 2.67% with a 4% coupon in 2040; a 2044 term was priced as 4s to yield 2.81%.

The $113.715 million of taxables were priced as 2.375s to yield 1.54% in a bullet 2020 maturity.

"The LA USD deal ended up being oversubscribed for by two to three times," said one portfolio manager. There was no reprice in any maturities and the overall the levels seemed in line with the State of California deal."

The cautiousness is evident, as even the highest grade credit risk is being re-evaluated and reprice, Dan Urbanowicz, director and fixed income portfolio manager at Washington Crossing Advisors, said on Thursday.

“Overall, the market feels soft, with wide bid/ask spreads, especially on the sectors hardest hit by the coronavirus and now those affected by the crash in the oil market,” he said.

"A number of people say buyers have turned disinterested again at these yields, so we will need to back up more and then perhaps inflows will turn positive to take advantage," said Greg Saulnier, municipal analyst at Refinitiv MMD.

"As for this week, the primary got back in action and everyone turned uber cautious/jittery, hence the bit of selling we have seen the past couple days. Deals came attractive yesterday for sure and balances still remain. I hearing the cash bid is still miles away, so again, looks like the trend is definitely higher in yield," Saulnier said.

The primary market continues to see many deals on day-to-day status as issuers monitor the markets and absolute yields still remain historically low, according to Urbanowicz.

“The deals that have come to market have shown definite new-issue concessions, but the good news is that the market has been tested with multiple $1 billion deals as well as deals for the hard hit hospital and airport sectors,” he added.

“Investment-grade municipal issuers will largely survive the profound challenges of the crisis intact,” said Dan Seymour, vice president at Moody’s. “Even the most strained issuers we rate generally have buffers for the next year of debt service. But with broad swaths of the economy shut down, payment defaults, debt service reserve fund draws, and financial difficulties are sure to accelerate. These material events will soon likely begin shaping a story about which types of issuers are least likely to survive the current crisis.”

One example of a larger issuer using market access is the State of New Jersey (rated A3/negative outlook), which gained consent from holders of $750 million of tax and revenue anticipation notes to extend the notes’ maturity to Sept. 25 from June 25. New Jersey also amended the interest rate from a variable rate to a fixed rate of 4%. While the move and access is credit positive for the state, the extension illustrates the challenges certain to face a growing number of municipal issuers in the months ahead.

Also on Thursday, Raymond James received the written award on Riverside County, California's (A2/AA/ / ) $719.995 million of taxable pension obligation bonds.

Muni money market funds see inflows again

Tax-exempt municipal money market fund assets gained $1.60 billion, raising their total net assets to $139.23 billion in the week ended April 20, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds declined to 0.18% from 0.53% in the previous week.

Taxable money-fund assets were up $127.44 billion in the week ended April 21, bringing total net assets to $4.440 trillion.

The average, seven-day simple yield for the 797 taxable reporting funds fell to 0.22% from 0.24% the prior week.

Overall, the combined total net assets of the 984 reporting money funds grew by $129.04 billion to $4.579 trillion in the week ended April 21.

The asset total is the largest-ever since iMoneyNet began tracking money-fund assets, replacing the record that was set the previous week.

Secondary market data

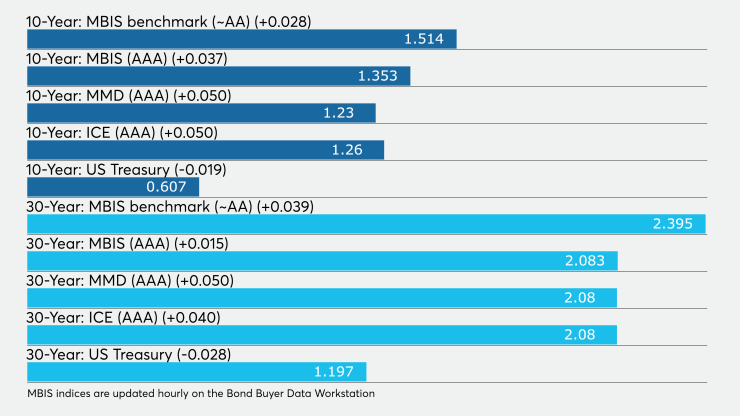

Munis were slightly weaker on the MBIS benchmark scale Thursday, with yields rising by two basis points in the 10-year maturity and by three basis points in the 30-year maturities. On the MBIS AAA scale, munis were also slightly weaker with yields increasing by as much as three basis points in the 10-year maturity and by a basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni increased five basis points to 1.23% and the 30-year rose five basis points to 2.08%.

The MMD muni to taxable ratio was 200.7% on the 10-year and 172.9% on the 30-year.

On the ICE muni yield curve late in the day, the 10-year yield was up five basis points to 1.26% while the 30-year was higher by four basis points to 2.08%.

The ICE muni to taxable ratio on the 10-year was 219% and the 30-year was 168%.

BVAL saw the 10-year moved up two basis points to 1.24% and the 30-year was higher by one basis point to 2.13%.

The IHS muni curve saw the 10-year rise to 1.25% and the 30-year increased to 2.05%.

Stocks and Tresuries were both mixed.

The Dow Jones Industrial Average rose 0.17%, the S&P 500 index decreased 0.05% and the Nasdaq was off 0.01%.

The three-month Treasury was yielding 0.127%, the Treasury two-year was yielding 0.225%, the five-year was yielding 0.372%, the 10-year was yielding 0.607% and the 30-year was yielding 1.197%.