Texas ended its fiscal year Aug. 31 with revenues 6.5% higher than those in FY 2018, state Comptroller Glenn Hegar reported.

Revenue from all sources, including federal funds, state taxes, fees and investments, hit a record $127.94 billion for the 12 months ended Aug. 31 in a state with a growing population and economy.

“Yearly revenues were in line with our projections in the revised biennial revenue

The Texas Legislature, meeting in odd-numbered years, passes two-year budgets based on the Comptroller’s revenue estimates in January and adjusted in May.

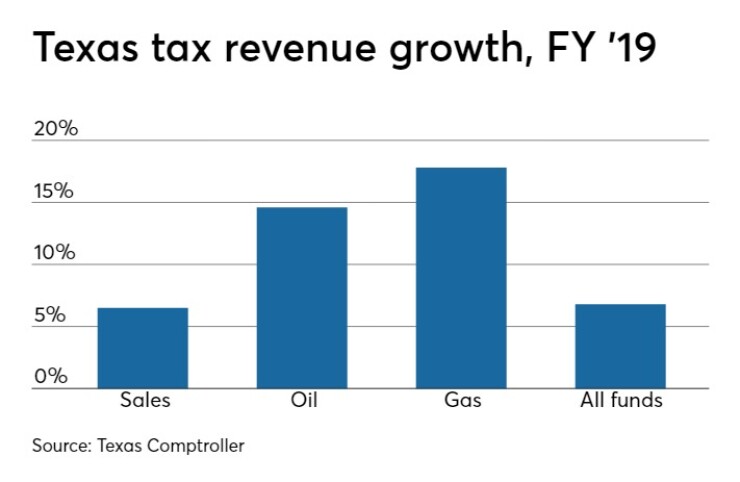

Sales tax, which accounts for 57% of the state’s tax revenue, came to $34.02 billion over the fiscal year, a 6.5% increase over fiscal 2018. Sales tax collections have hit monthly records for 23 straight months.

For August, sales tax revenue of $2.99 billion came in 4% higher than in the same month in 2018. Hegar has not reported a year-over-year decline in monthly sales tax since August 2017, when revenues were down 0.7%.

“Moderate growth in August state sales tax revenue was led by remittances from the construction, manufacturing and wholesale trade sectors,” Hegar said. “Receipts from the oil and gas mining and retail trade sectors remained at last year’s levels, while receipts from the information services sector declined.”

Total sales tax revenue for the three months ending in August 2019 was up 3.9% compared to the same period a year ago.

Despite uncertainty in the energy industry and prices drifting lower, oil production tax revenue for the fiscal year rose nearly 15% to $3.89 billion, while natural gas production tax revenue increased nearly 18% to $1.69 billion.

For August, natural gas production taxes of $102.3 million were down 19.2% from August 2018. Monthly oil production tax collections of $355.5 million were down 6.2%.

The energy sector appears headed for a slowdown as an increasing number of firms head for the bankruptcy courts amid waning investor appetite for shale plays across the nation.

“It is clear that for certain financially troubled producers wounded by the crash in 2015, some stakeholders may have given up hope that resurgent commodity prices will bail everyone out,” the law firm of Haynes & Boone said in its

As the state with the highest volume of exports to China, Texas also bears risk from President Trump’s escalating trade war.

The state appears well insulated against a recession with a rainy day fund expected to total $7.8 billion at the end of the new fiscal year.

The rainy day fund and State Highway Fund both receive funding from oil and natural gas severance taxes. In November, the Comptroller’s office will deposit $1.67 billion in each of those funds, up from the $1.38 billion deposited in each fund in November 2018. The ESF is projected to have a balance of $7.8 billion at the end of fiscal 2020.

For August, motor fuel taxes rose 5.7% to $327 million while motor vehicle sales and rental taxes natural gas production taxes of $102.3 million were down 19.2% from August 2018. Monthly oil production taxes collections of $355.5 million were down 6.2%.