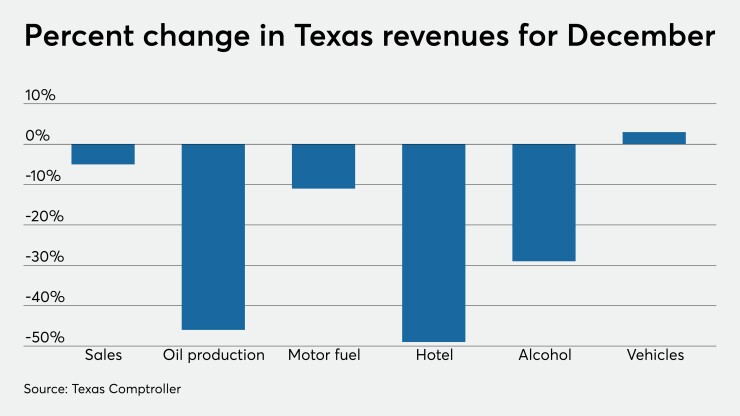

The pandemic and weakened oil prices continued to take an economic toll on Texas in December, according to data from Texas Comptroller Glenn Hegar.

December sales tax revenue of $2.86 billion fell 5% below collections from the same month last year, Hegar reported.

It was the eighth month of the year in which sales tax revenue had fallen below that of the same month the previous year.

Except for a 4.3% increase in July, every month since March showed decreases, with the biggest in May at 13.2%.

The year started with collections of a record $3.08 billion in January, an 8.9% increase year over year. Collections remained positive through March, the first month of the national emergency declaration.

The December data also showed how deeply the recession struck the state’s hotel industry. Hotel occupancy taxes of $26 million were down nearly 49% from December 2019. Those taxes support bonds for convention centers, convention hotels and sports facilities across the state.

"Receipts from restaurants, entertainment venues and personal service and tourism-related businesses continue to be depressed,” Hegar noted. “Receipts from oil- and gas-related sectors also were lower year-over-year as drilling activity remained subdued.”

Total sales tax revenue for the three months ending in December was down 5% compared to the same period a year ago.

Sales tax is the largest source of state funding for the state budget, accounting for 59% of all tax collections.

Despite the lower collections, Hegar saw encouraging signs in retail and home sales.

“Receipts from the wholesale trade sector also were slightly up, due to strength in sales by building materials vendors,” he said. “Historically low interest rates and pandemic-motivated behavior changes continue to spur a boom in single-family housing starts and home renovations.”

Texas operates on a fiscal year that begins Sept. 1.

On Monday, Hegar will issue the Biennial Revenue Estimate to the 87th Legislature ahead of its opening this month. The estimate is the base for spending in the upcoming session.

In the 2020 fiscal year that ended Aug. 31, general revenue of $56.98 billion represented a 1.5% drop from FY 2019, Hegar reported. All funds tax collections of $57.38 billion were down 3.4%. Oil production tax revenue of $3.23 billion was nearly 17% below that of the previous fiscal year.

“Yearly revenues were slightly ahead of our projections in the revised