DALLAS — Texas lawmakers will have a record $119.1 billion to work with as they begin their 2019 session this month, but Comptroller Glenn Hegar is warning against relying on stable oil revenues after prices tumbled in 2018.

“Oil prices have dropped sharply since October, financial markets have demonstrated increased volatility, interest rates have been rising and U.S. trade policy remains uncertain,”

The revenue estimate for the next two fiscal years represents an 8.1% increase from the amounts available for the 2018-19 biennium. Texas lawmakers meet in regular session only in odd-numbered years and approve two-year budgets based on the Comptroller’s revenue estimate.

Hegar said substantial supplemental appropriations could affect revenue available for the 2020-21 biennium.

“Despite this projected revenue growth, the Legislature will again face some difficult choices in balancing the budget,” Hegar said. “The most pressing and costly budget drivers for the upcoming session include a potentially large boost in education spending to reduce the property tax burden and reform school finance.”

The $119.1 billion available for general-purpose spending includes 2020-21 collections of $121.5 billion in general revenue-related funds as well as $4.2 billion in balances from the 2018-19 biennium.

The total includes $6.3 billion reserved from oil and natural gas taxes for 2020-21 transfers to the Economic Stabilization Fund, commonly known as the “Rainy Day Fund,” and the State Highway Fund under voter-approved constitutional amendments.

Texas will also set aside $211 million to cover a shortfall in the state’s original prepaid tuition plan, the Texas Tomorrow Fund.

Sales tax collections make up 55% of the state’s general revenues in 2020-21. The revenue estimate projects sales tax revenues will increase 9.5% from the 2018-19 biennium to nearly $66.3 billion for the 2020-21 biennium. That is after $5 billion is allocated to the state highway fund.

Motor vehicle-related taxes, including sales, rental and manufactured housing taxes, are expected to reach $9.8 billion, up 0.4% from 2018-19.

Oil production tax collections are projected to generate $7.4 billion, up 11.1% from 2018-19, while natural gas tax collections are expected to bring in $3.3 billion, up 9.6% from 2018-19.

State franchise tax revenue for all funds, estimated at $8.2 billion, is expected to rise 8% from 2018-19.

The Rainy Day Fund is now about $12.5 billion, not counting currently outstanding spending authority. The fund balance is expected to be $15.4 billion at the end of the 2020-21 biennium, Hegar said.

“For the 2020-21 biennium, we remain cautiously optimistic but recognize we’re unlikely to see continued revenue growth at the unusually strong rates we’ve seen in recent months,” Hegar said.

“Because of this heightened uncertainty, this revenue estimate is based on a projection of continued but slowing expansion of the Texas economy,” Hegar said.

State revenue from all sources and for all purposes is expected to reach $265.6 billion for the 2020-21 biennium, including approximately $88.7 billion in federal receipts, along with other income and revenues dedicated for specific purposes and therefore unavailable for general-purpose spending.

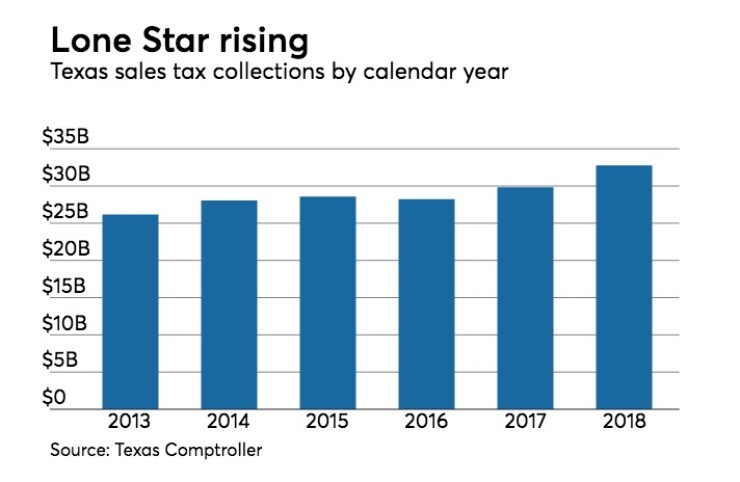

Hegar’s caution comes after a record year for sales-tax revenue in a state that has no income tax.

With oil prices rising for much of the year -- hitting a peak above $75 per barrel in October before falling more than 25% by the end of the year – Texas enjoyed a strong lift from production and refinement. The price collapse was not as severe as the 2014 downturn of 60% from a peak of more than $100 in July of that year.

Sales tax revenues set monthly records for every month of 2018, twice smashing the all-time record for any month. In November, sales tax revenues just shy of $3 billion established the latest record.

Monthly increases over the previous year averaged nearly 10%. After setting the all-time record in November, sales tax revenue grew 4.7% in December compared to the same month in 2017 to hit $2.87 billion.

“Growth in state sales tax revenue continues to be led by remittances from oil and gas-related sectors,” Hegar said. “The year-over-year rate of growth has moderated, as expected, due to strong collections from a year ago as well as the decline in the price of crude oil.”

Total sales tax revenue for the three months ending in December 2018 was up 6.5 percent compared to the same period a year ago.

In contrast to the state’s sales tax collections, which typically make small moves up or down year to year, oil and gas tax revenue has made huge swings surging to $5.7 billion in the 2014 fiscal year before falling to $2.2 billion two years later. Oil and gas production taxes rose to $4.8 billion in the 2018 fiscal year that begins Sept. 1.

In calendar year 2016, Texas recorded a rare drop in sales tax revenues.

As a rapidly growing state, Texas faces a tall challenge in funding schools, transportation and health-care, among other needs.

Hegar warned lawmakers against over-reliance on oil and gas revenues in a meeting before the 2019 session. Some state leaders have proposed using the oil and gas revenues in a multibillion-dollar public school funding reform and a way to curb local property tax increases.

Republican Gov. Greg Abbott has indicated support for using a portion of state oil and gas taxes to limit what local school districts are allowed to raise in property taxes. The state would add its revenues to the local property tax levy.

The proposal could cost the state more than $3 billion by 2023, according to an analysis by the Texas Commission on Public School Finance.

“As the Governor has made clear, utilizing the oil severance tax revenue is one potential funding strategy,” Abbott spokesman John Wittman said in a prepared statement. “The governor is committed to providing more state funding for our schools and he will work with the Legislature this session to do just that.”