Municipal bond buyers, while not seeing the amount of new issuance they might want or need, will have a wide variety of new deals from which to choose — from green and social bonds to some seldom-seen names and structures.

Taxable bonds one again are featured prominently on the supply slate.

IHS Ipreo estimates volume for the week of July 20 at $8.8 billion in a calendar composed of $6.5 billion of negotiated deals and $2.3 billion of competitive sales.

Municipals finished out the week on a quiet note, with yields on the MMD AAA scale steady as ICE turned stronger on Friday.

“Muni bonds are ending the week better,” ICE Data Services said. “Yields on the ICE muni curve are down about a basis point across the curve. The 10-year tenor is currently yielding 0.728%, a lifetime low for that point on the ICE muni curve.”

ICE said that trades and new issues were showing a general tightening on better rated bonds.

Primary market

The state of Maryland (Aaa/AAA/AAA/) is coming to market Wednesday with four competitive sales totaling over $1 billion.

The state and local facilities loan of 2020 deals consist of $345.76 million of taxable general obligation refunding bonds Second Series C; $290.08 million of tax-exempt Bidding Group 1 Second Series A GOs; $249.92 million of exempt Bidding Group 2 Second Series A GOs; and $117.34 million of exempt Second Series B refunding GOs.

King County, Wash., (Aa1/AA+//) is competitively selling $366 million of bonds on Tuesday consisting of $186.605 million of taxable sewer refunding revenue bonds and $179.02 million of sewer improvement and refunding revenue bonds.

“More and more issuers are thinking along the lines of taxables since rates are so low,” said John Hallacy, founder of John Hallacy Consulting LLC. “Everyone in benefiting from these low rates.”

He cited the Maryland as one example.

“The biggest of the four Maryland offerings is taxable,” Hallacy said, adding that the King County deals had a sizable taxable component as well.

The negotiated slate is filled with taxable deals.

The state of Mississippi is set to offer $569 million of taxable GO refunding bonds. Wells Fargo Securities is set to price the bonds on Thursday.

Auburn University in Alabama is issuing $300 million of taxable general fee revenue bonds. JPMorgan is set to price the deal on Wednesday.

The West Covina Public Financing Authority, Calif. is selling $204.1 million of taxable lease revenue bonds. HilltopSecurities is expected to price the deal on Wednesday.

Environmental, Social and Governance issuance is also well represented on the new-issue calendar,

Goldman Sachs is expected to price the Andrew W. Mellon Foundation’s (Aaa/AAA//) $300 million of taxable social bonds on Wednesday.

Morgan Stanley is set to price the Doris Duke Charitable Foundation Inc.’s (Aaa///) $100 million of taxable social bonds on Wednesday.

Ramirez & Co. will price the New York State Housing Finance Agency’s (Aa2///) $164 million of affordable housing revenue climate bond certified sustainability bonds on Wednesday.

Wells Fargo Securities will price the NYS Housing Finance Agency’s (Aaa/NR/NR/NR) $78.5 million of 15 Hudson Yards housing revenue green bonds with Fannie Mae Direct Pay credit enhancement.

And Piper Sandler is expected to price the Milwaukee Metropolitan Sewerage District, Wis.’ (Aa1/AA+/AAA/) $27.69 million of GO sewerage system refunding climate bond certified green bonds.

“It looks like social and green bonds are continuing their upward climb — in terms of interest and number of deals,” Hallacy said. “Issuers also like the ability to tap other buyers.”

BofA: Low yields beget low coupons

Since last August, there has been a shift toward lower-coupon bond structures in new muni issuance, according to BofA Securities and other sources.

As taxable advance refunding was taking off, the percent of issuance with 4% or lower coupons has been rising, especially for taxable munis, BofA Global Research said in a Friday market comment.

“The 3%-4% coupons have delivered better performance for most credit indexes,” BofA said.

“In mid-May, we highlighted 3% coupons’ performance relative to 5%+ coupons and observed that the 2%-3% coupon bracket generally performed better than 5%+ coupons. By now, there has been some shift to favor the 3%-4% coupon range for most indexes,” BofA said.

Theoretically it is possible that if a portfolio was concentrated in the 3%-4% coupon range, it could beat the market. In reality though, BofA said there were many difficulties in building such a portfolio since the percentage of bonds in low coupon brackets tended to be very small, except for taxable munis.

“We are seeing some primary market shifts towards lower coupon bonds beginning in mid-2019. The trend appears to have gained more momentum this year despite the market dislocation in March and April,” BofA said, adding that as of year-to-date, 63.9% of all new issuance has 4% or smaller coupons, while the percentage was 52.6% for 2019 and 43.5% for the past five years.

“Lower coupon bonds appear to be more prevalent in the taxable muni market, and year-to-date 2020, 93.5% of all new taxable muni bonds have 4% or smaller coupons,” BofA said.

"Traditionaly, smaller coupon bonds are less attractive to retail investors due to the higher dollar price. However, given the lower interest rate environment they may be more attractive to retail investors," a New York strategist said. "Through competitive pricing, though, these municipal products are likely not being offered directly to retail so it's not clear if they are trending this way or if it is a marketing approach from those that benefit most from competititve transactions as such firms do."

Lipper reports $857M inflow

Investors remained bullish on municipal bonds and continued to put cash into bond funds in the latest reporting week.

In the week ended July 15, weekly reporting tax-exempt mutual funds saw $857.321 million of inflows, after inflows of $1.024 billion in the previous week, according to data released by Refinitiv Lipper Thursday.

It was the 10th week in a row that investors put cash into the bond funds.

Exchange-traded muni funds reported inflows of $202.119 million, after inflows of $379.709 million in the previous week. Ex-ETFs, muni funds saw inflows of $655.202 million after inflows of $644.251 million in the prior week.

The four-week moving average remained positive at $1.318 billion, after being in the green at $1.318 billion in the previous week.

Long-term muni bond funds had inflows of $401.693 million in the latest week after inflows of $617.441 million in the previous week. Intermediate-term funds had inflows of $166.924 million after inflows of $73.818 million in the prior week.

National funds had inflows of $822.187 million after inflows of $951.064 million while high-yield muni funds reported inflows of $123.868 million in the latest week, after inflows of $85.577 million the previous week.

Secondary market

Municipals were steady across the curve Friday, according to readings on Refinitiv MMD’s AAA benchmark scale.

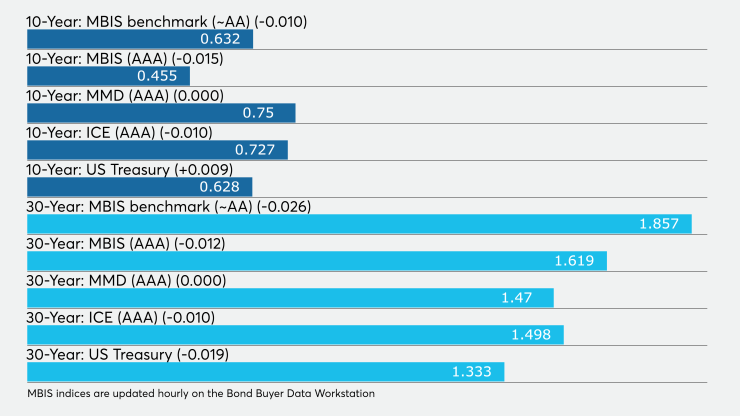

MMD reported yields on the 2021 and 2023 GO munis were unchanged at 0.15% and 0.17%, respectively. The yield on the 10-year GO muni was flat at 0.75% while the 30-year yield was steady at 1.47%.

The 10-year muni-to-Treasury ratio was calculated at 120.0% while the 30-year muni-to-Treasury ratio stood at 110.9%, according to MMD.

The ICE AAA municipal yield curve showed short yields falling one basis point to 0.140% in 2021 and 0.161% in 2022. The 10-year maturity was off one basis point to 0.727% and the 30-year was down one basis point to 1.498%.

ICE reported the 10-year muni-to-Treasury ratio stood at 121% while the 30-year ratio was at 110%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.15% and the 2022 maturity at 0.18% while the 10-year muni was at 0.74% and the 30-year stood at 1.47%.

The BVAL AAA curve showed the 2021 maturity yielding 0.13%, one basis point lower and the 2022 maturity steady at 0.17% while the 10-year muni was at 0.73% and the 30-year stood at 1.50%, both unchanged.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were mixed as stock prices also traded mixed.

The three-month Treasury note was yielding 0.119%, the 10-year Treasury was yielding 0.628% and the 30-year Treasury was yielding 1.333%.

The Dow fell 0.14%, the S&P 500 increased 0.40% and the Nasdaq gained 0.44%.

Bond Buyer indexes weaken

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell four basis points to 3.58% from 3.62% the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields fell seven basis points to 2.12% from 2.19% in the previous week.

The 11-bond GO Index of higher-grade 11-year GOs declined seven basis points to 1.65% from 1.72%.

The Bond Buyer's Revenue Bond Index decreased seven basis points to 2.54% from 2.61%.