LOS ANGELES – A financial plan Honolulu rail officials sent to the Federal Transit Administration last week suggests that the state's recent tax compromise will save $1 billion on financing costs.

Honolulu Gov. David Ige signed a bill Sept. 5 extending Honolulu’s general excise tax and increasing the state’s hotel room tax to cover cost overruns on the $9 billion Oahu elevated rail transit project.

The bill came out of a special session called after lawmakers failed to reach a solution during the regular session.

Honolulu Mayor Kirk Caldwell had placed the cost of the project at $10.1 billion leading up to the special legislative session, “because of the financing charges that would have been incurred with a 10-year extension of the half-percent GET surcharge here on Oahu,” according to Andrew Pereira, a mayoral spokesman.

But with the front-loading provided by the hotel room tax, those financing charges are decreased, Pereira said.

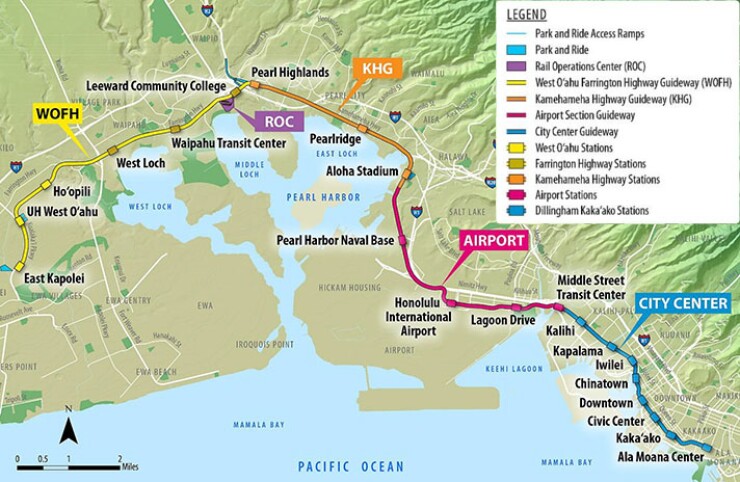

Lawmakers agreed on a funding mechanism that includes extending the county surcharge on the general excise tax and raising the transient accommodations tax to pay for the 20-mile driverless rail line.

The project was anticipated to cost $5.25 billion when work began in March 2012. It faced a series of delays from lawsuits filed by environmental groups and rail opponents, and construction prices soared during the delay.

The estimated cost is $8.16 billion, exclusive of finance costs, "with full revenue services scheduled for December 2025," according to the

With the cost overruns and delays to the project, the FTA, which has committed $1.55 billion to the project, required the Honolulu Authority for Rapid Transportation to submit a plan by Sept. 15 detailing how it plans to make up for the project’s $3 billion funding shortfall.

The rail authority projected financing charges of $858 million, bringing the total project amount to $9.023 billion, including contingency.

“This updated Recovery Plan lays out the local funding now available to meet the current cost estimate and complete the project,” HART Executive Director and CEO Andrew Robbins said in a statement. “In addition, it shows that HART has put in place the controls and procedures, robust risk management and cost containment measures that, in addition to the funding, are needed for the recovery of this exciting and important project for Honolulu.”

Despite the challenges, HART, the city and the mayor's office "are committed to construct and deliver the project as described in the full funding agreement with the FTA," officials wrote in the recovery plan.

The plan also details the development and implementation of project management, risk management and cost and schedule controls that are essential to the recovery of this project, officials wrote.

The island has only one freeway, H1, for people who live in the housing developments on the city’s west side near Kapolei to reach downtown Honolulu, where most of the jobs are.

By 2030, nearly 70% of Oahu’s population and more than 80% of the island’s jobs are expected to be located along the 20-mile rail corridor. Stops will include University of Hawaii campuses, Aloha Stadium, Honolulu International Airport and several shopping centers.

Rail will eliminate an estimated 40,000 car trips from congested streets and highways, according to HART. Honolulu has been ranked in the top 10 for traffic congestion over the past several years by various institutions that track traffic problems.

The project was once anticipated to be completed by 2019, but now the first phase of the rail system from Kapolei to Aloha Stadium may open in late 2020, according to the recovery plan. Five years later, in 2025, the entire system from Kapolei to Ala Moana Center is expected to be fully operational.

In addition to delays and cost overruns, the transportation agency has experienced management turnover.

Andrew Robbins, a Bombardier Transportation executive, began work as HART’s new CEO on Sept. 5. Krishniah Murthy, Los Angeles Metropolitan Transportation Authority’s executive director of transit project delivery for 14 years, served as interim director, after Dan Grabauskas resigned in August 2016.

On Sept. 6, the day after the governor signed the bills, Bank of America priced $350 million in general obligation floating-rate bonds for Honolulu to support the project. The rail project GO bonds were sold as part of a $767 million series issued by the city and county to pay for a variety of infrastructure projects.

The rail bonds were priced to yield 30 basis points over the SIFMA rate in 2022 to 32 basis points over the SIFMA rate in 2028.

Moody’s Investors Service rated the $767 million bond series Aa1, while Fitch rated the bonds AA-plus.

Series 2017 A through G priced during the week of August 14. The Series 2017H rail bonds were sold on Sept. 6.

Proceeds from the $236 million in series 2017A, 2017B and 2017G will be used for various capital improvement projects and equipment purchases. The proceeds of $181 million in series 2017C, 2017D, 2017E and 2017F will refund outstanding GO bonds.

The floating-rate series will be used as gap financing for the rail project and is being repaid with Oahu’s half-percent surcharge to the state’s general excise tax.

City Councilman Joey Manahan, who is also chair of the Budget Committee, said maintaining a strong bond rating is key for the city’s ability to deliver core services.

“It allows the city to borrow at a lower rate and ensures that we have the capacity to issue bonds for major infrastructure projects like rail and upgrading our sewer system,” Manahan said.

In its rating report, Moody’s said that the city has benefited from “prudent fiscal management demonstrated by conservative budgeting practices and recently improved reserve levels.”

The ratings agency also lauded the city for its “commitment to and progress toward reducing pension and OPEB liabilities, including plans to fund fully the OPEB annual required contributions.”

Moody's analysts added that they will continue to monitor the rail project to make sure it remains on track.

HART plans to ask for $350 million in additional general obligation bonds every year for the next six or seven years, which could mean adding $2 billion in additional debt to Honolulu’s balance sheet and could double the city’s debt service.

“We are aware of the city’s plans for increased debt and our rating incorporates those expectations,” said Stephen Walsh, a Fitch Ratings director. “As we understand it, the city will be reimbursing itself from GET revenues.”

Since 2007, Honolulu has issued $7.08 billion of securities, with the most issuance taking place in 2015 when it sold $1.59 billion. It did not come to market in 2013 or 2014.

During the special session on rail, lawmakers debated whether to pay for the additional costs using a property tax or by extending the general excise tax a second time.

They ultimately crafted legislation that will cover the $2.4 billion shortfall funding by extending the GET three years to provide an additional $1046 billion; raising the state’s Transient Accommodation Tax by 1% for 13 years to provide $1.326 billion; and permanently increasing the amount counties other than Honolulu get from the hotel tax.

The FTA is contributing $1.55 billion to the project through a grant agreement, but had threatened to cut off the last half of the funding if the city didn’t come up with a financial plan to complete the entire project. Caldwell had suggested shortening the rail line to cut costs.