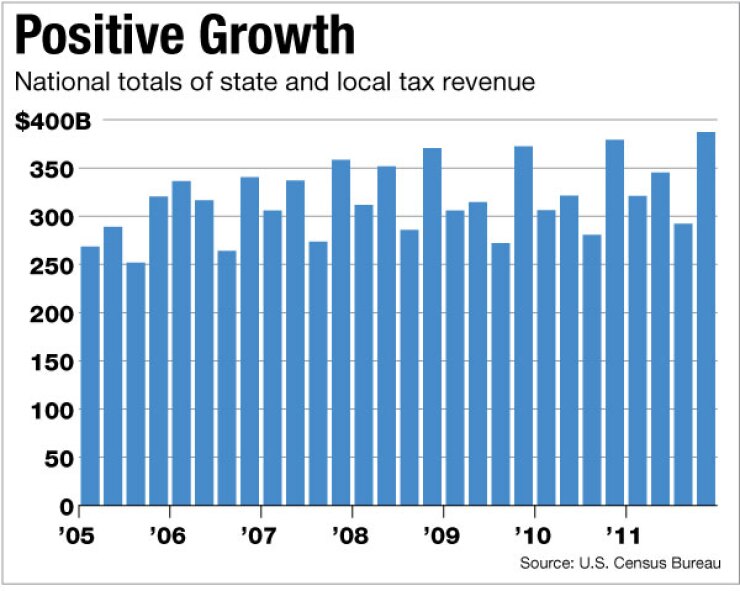

WASHINGTON — State and local tax revenues in the fourth quarter of 2011 grew by 2.1% from a year earlier, marking the ninth consecutive quarter of positive year-over-year growth, the Census Bureau said in a report issued Thursday.

Tax revenue for the quarter totaled $387.2 billion, compared to $379.0 billion for the fourth quarter of 2010, according to the report. The fourth quarter of 2011 is the highest revenue level for one quarter dating back to 1988, when the Census Bureau began collecting data on state and local tax revenues.

“What may seem like a small overall increase in tax revenues for this quarter is actually reflective of the steady economic recovery that we have been experiencing,” said Cheryl Lee, chief of the Census Bureau’s state finance and tax statistics branch.

Total state and local revenues were $1.35 trillion for the year ending in December 2011, a 4.5% increase over the previous year, which saw $1.29 trillion in revenue.

Property tax, general sales taxes and individual income taxes all showed positive growth in the last quarter, compared to the same quarter in 2010, the report said. Property taxes showed a gain of 0.2% to $177.2 billion from $176.8 billion in the last quarter of 2010.

State and local individual income taxes in the last quarter saw an increase of 4.2% to $68.8 billion from $66.0 billion in the fourth quarter of 2010.

General sales taxe revenue rose 3% to $75.2 billion during the last quarter from $73.1 billion in the last quarter of 2010.

Corporate income taxes declined 8.2% for the last quarter, falling to $9.6 billion from $10.5 billion for the previous year’s fourth quarter.

State tax revenues totalled $769.8 billion for all of 2011, the largest tax collection since 2008, according to the Census data. For the fourth quarter of 2011, state tax revenues were $183.8 billion, up 3.5% over the fourth quarter of 2010.

Individual income taxes as well as sales taxes are the largest tax-revenue generators for states, according to the Rockefeller Institute of Government. During the recession states experienced large declines in individual income taxes and the largest declines in overall tax collections since the Great Depression.

The Census Bureau data shows state individual income taxes grew 4.02% to $64.4 billion during the last quarter from $61.95% in the last quarter of 2010.

State sales taxes grew increased 2.7% to $59.5 billion from $57.98% in the fourth quarter of 2010. Nevada showed the largest gain, 69.3% in sales tax revenues from the fourth quarter of last year to the previous fourth quarter. Wyoming had the largest decline, with sales tax revenues down 19.4%.

Since the official end of the recession in late 2009, states have reduced spending and are budgeting expenditures in anticipation of less revenue. As a result, “it is more reasonable to expect better state finances going forward,” said Michael Ross, managing director at Morgan Keegan & Co.

The Center on Budget and Policy Priorities estimates that for fiscal 2013 states will have a projected budget shortfall of $49 billion, which is less than half of what states faced for fiscal 2012.