Municipal bonds ended unchanged on Friday as the market geared up for a more manageable new issue calendar, led by issuers on different ends of the credit spectrum: AAA-rated Montgomery Co., Md., and the BBB-rated Virginia Small Business Financing Authority.

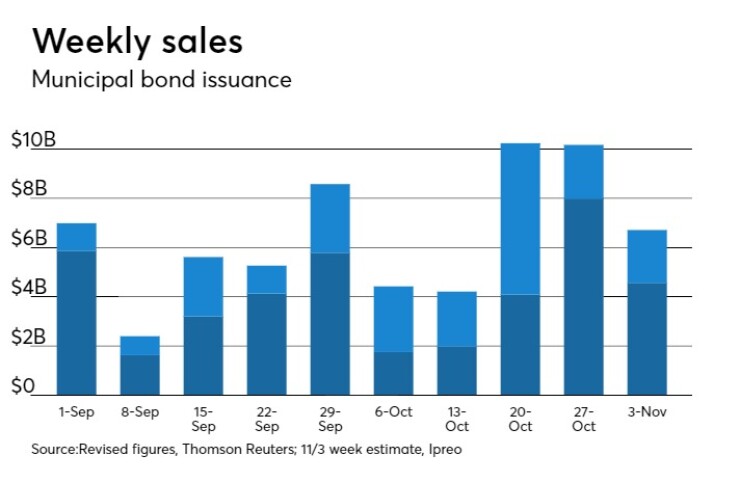

Ipreo estimates total bond volume for the week at $6.7 billion, down from a revised total of $10.19 billion in the prior week, according to data from Thomson Reuters. The upcoming slate is composed of $4.6 billion of negotiated deals and $2.1 billion of competitive sales.

“Of the largest deals, new financing tops the list, compared with heavy refunding that we saw last year. Some of this is issuers wanting to get major projects financed ahead of an expected Federal Reserve rate hike in December,” said Natalie Cohen, Managing Director of Municipal Securities Research at Wells Fargo Securities. “Also, there’s concern about volatile markets as tax reform discussions heat up in Washington and we approach a Dec. 8 deadline when the debt ceiling expires and the budget has to be renewed. The Virginia P3 [Transportation Infrastructure Finance and Innovation Act] deal is one example of large capital transaction.”

Bank of America Merrill Lynch is set to price the Virginia Small Business Financing Authority’s $737 million of Series 2017 senior lien private activity revenue bonds on Thursday.

Proceeds from the Transform 66 P3 Project bond sale will be loaned to I-66 Express Mobility Partners LLC to finance costs released to the planning, development design and construction of express lanes and related facilities along 22 miles of the I-66 corridor from I-495 to U.S. 29. Under the Virginia Public-Private Transportation Action, the DOT has the authority to allow private firms to develop to operate transportation facilities.

The tax-exempt bonds are rated Baa3 by Moody’s and BBB by Fitch Ratings.

Montgomery County, Md., is competitively selling $684 million of bonds in four separate offerings on Tuesday.

The deals consist of $291.54 million of Series C consolidated public improvement refunding bonds of 2017, $170 million of Series A consolidated public improvement bonds of 2017, $144.06 million of Series D 2019 crossover consolidated public improvement refunding bonds of 2017, and $78.72 million of Series B consolidated public improvement refunding bonds of 2017.

All four sales are rated triple-A by Moody’s, S&P Global Ratings and Fitch.

Also on Tuesday, Citigroup is expected to price the Phoenix Civic Improvement Corp.’s $401 million of senior lien airport revenue and revenue refunding bonds.

The issue is composed of Series 2017A bonds subject to the alternative minimum tax, Series 2017B non-AMT bonds, and Series 2017C taxables.

The deal is rated Aa3 by Moody’s and AA-minus by S&P.

In the competitive arena on Thursday, Santa Clara County, Calif., is selling $350 million of Election of 2008 refunding Series 2017C general obligation bonds.

“Last year around this time there was heavy issuance in August, September and October, ahead of the presidential election and also a December rate hike then but much of that was refunding,” Cohen said. “Lower volume this year is largely due to loss of refundings – refundings are down more than 43% while new issue is up 5% year over year. Month over month (as of the week ended Oct. 20) by more than 13%.”

She said that taxable munis were an area investors should look at.

“Another interesting point is a modest increase in taxable issuance over last year and next week is no exception – including smaller transactions in many sectors,” Cohen said.

Secondary market

The yield on the 10-year benchmark muni general obligation was flat from 2.02% on Thursday, while the 30-year GO yield was unchanged from 2.84%, according to the final read of Municipal Market Data`s triple-A scale.

U.S. Treasuries were stronger on Friday. The yield on the two-year Treasury declined to 1.60% from 1.63% on Thursday, the 10-year Treasury yield dropped to 2.43% from 2.45% and yield on the 30-year Treasury bond decreased to 2.94% from 2.96%.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 83.2% compared with 82.3% on Thursday, while the 30-year muni-to-Treasury ratio stood at 96.7% versus 95.9%, according to MMD.

AP-MBIS 10-year muni at 2.342%, 30-year at 2.912%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale exhibited weakness on Friday.

In late trading, the 10-year muni benchmark yield rose to 2.342% from the final read of 2.332% on Thursday, according to

AP-MBIS 30-year benchmark muni yield gained to 2.912% from 2.905% on Thursday.

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session`s activity

The Municipal Securities Rulemaking Board reported 37,497 trades on Thursday on volume of $15.35 billion.

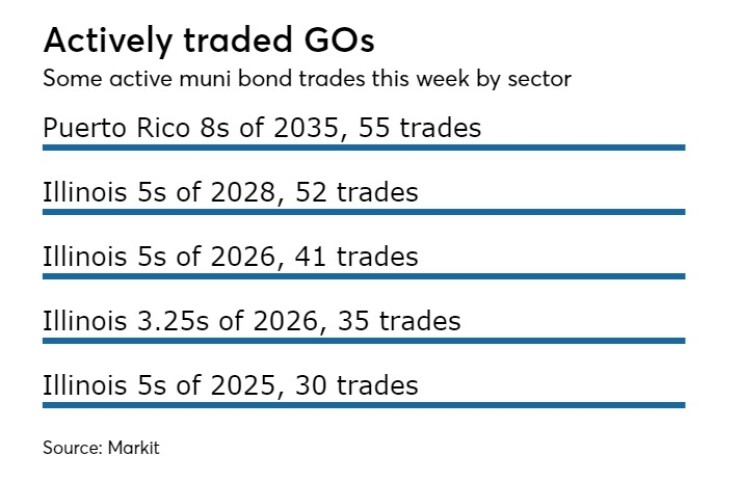

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended Oct. 27 were from California and New York issuers, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 were traded 55 times. In the revenue bond sector, the Philadelphia Hospitals and Higher Education Facilities Authority 5s of 2034 were traded 38 times. And in the taxable bond sector, the Washington Health Care Facilities Authority 4.2s of 2047 were traded 28 times.

Week's actively quoted issues

Puerto Rico and California names were among the most actively quoted bonds in the week ended Oct. 27, according to Markit.

On the bid side, Puerto Rico Commonwealth GO 8s of 2035 were quoted by 71 unique dealers. On the ask side, New York City Transitional Facilities Authority 4s of 2042 were quoted by 257 dealers. And among two-sided quotes, California 7.55s of 2039 were quoted by 26 unique dealers.

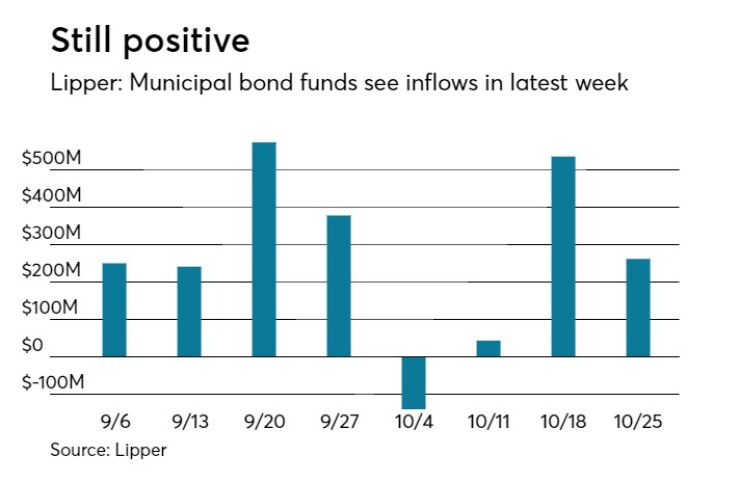

Lipper: Muni bond funds see inflows

Investors in municipal bond funds put cash into the funds in the latest week, according to Lipper data released late Thursday.

The weekly reporters saw $262.006 million of inflows in the week of Oct. 25, after inflows of $536.158 million in the previous week.

Exchange traded funds reported inflows of $151.373 million, after inflows of $184.768 million in the previous week. Ex-EFTs, muni funds saw $110.633 million of inflows, after outflows of $351.390 million in the previous week.

The four-week moving average was positive at $175.351 million, after being in the green at $204.402 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $416.137 million in the latest week after inflows of $424.977 million in the previous week. Intermediate-term funds had inflows of $527.272 million after inflows of $164.276 million in the prior week.

National funds had outflows of $41.524 million after inflows of $547.592 million in the previous week.

High-yield muni funds reported inflows of $175.779 million in the latest week, after inflows of $222.947 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.