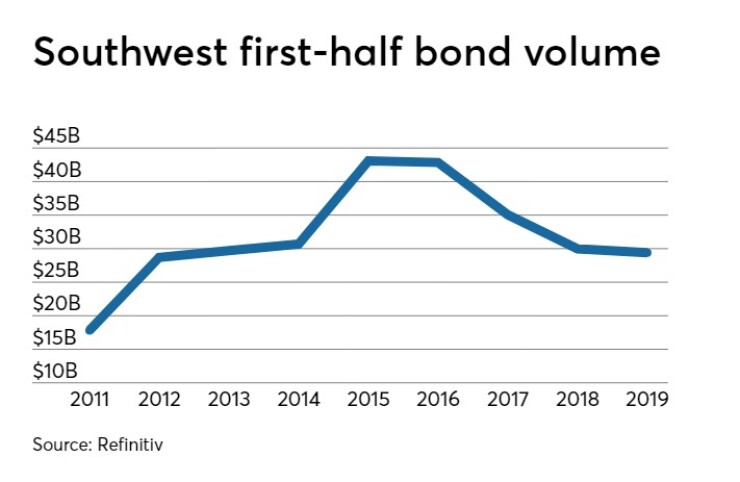

Issuers in the Southwest sold $29.4 billion of bonds in the first six months of 2019, down 1.9% from a year earlier to a six-year low for the first half, according to the data collection firm Refinitiv.

The anemic numbers mirrored a six-month period in 2018 when the loss of tax-exempt advance refundings slashed volume 16%. That was the lowest first half for the region in five years and followed a 19% drop in the first half of 2017.

The first half of 2019 brought the threat of trade wars, uncertainty about rates and plenty of political sword-sharpening ahead of next year’s presidential election.

“Curve inversion, which started before the beginning of the year, indicated to us that interesting times were about to come,” said Andre Ayala, financial adviser and director at Hilltop Securities. “But with so much unnecessary noise in the market it was hard to pinpoint a moment. The second quarter of 2019 looked good from an issuer/borrower perspective because interest rates started to fall.”

Although spreads between 10-year and two-year Treasury bonds were narrowing for months, the yield curve of the two maturities did not

“We just hit all-time lows in the MMD [Municipal Market Data yield curve],” said Rudy Mejia, senior vice president at Estrada Hinojosa & Co. “But unless you have bonds to sell, you can’t take advantage of it.”

In Texas, which accounts for more bond volume than the other seven states in the region combined, volume rose 1.4% to $16.63 billion, just enough to overtake New York as the state with the second-highest volume behind California.

“Being in Texas, we’re in a somewhat different reality because economic activity here is strong, cities are growing, developers need capital, muni bonds issued,” Ayala said. “Too bad tax-exempt advance refundings are not allowed, but on a taxable basis, some deals are making a lot of sense.”

Indeed, Texas A&M University System recently used taxable bonds to get around the 2017 law forbidding the use of tax-exempt bonds for advance refundings.

“I think you’re going to see a few more of these transactions,” Mejia said. “Taxable advance refundings are working right now, and that might be an option for you.”

Nationally, bond volume rose 2%, thanks to a 34% surge in the Midwest and 9% increase in the Southeast. The Northeast and Far West saw volume fall 7% and 7.4% respectively.

Kansas issuers sold the least debt of any Southwest state with $887 million in the first half, a 23% drop from the same period last year. It was the lowest first-half volume for the Sunflower State in eight years.

Arizona was the Southwest’s second-largest source of bonds, behind Texas, with $3.94 billion, more than doubling its output a year earlier. The Grand Canyon State also boasted the largest issuer, the Arizona Industrial Development Authority, which sold $744.5 million of bonds. It was followed by the University of Texas’ $639 million.

Colorado ranked third among states with $3.07 billion, a 10% decline, followed by Oklahoma with $1.5 billion, off 55%.

Arkansas’ 59% growth lifted the Natural State off last year’s bottom rung to $1.17 billion.

New Mexico’s volume fell 8% to $1.1 billion, edging out Utah’s $1.079 billion, which was down 39% from 2018.

In a complete inversion from last year’s first half, refunding issues climbed 61% across the region while new money issues fell nearly 12%. Industry execs don’t expect clients to skip any current refunding opportunities with rates at bargain-basement levels.

“In the third quarter things are looking good from a borrowing perspective and current refundings of bonds issued after the subprime (3% to 4% coupons) are making a lot of sense,” Ayala said. “We’re preparing for a number of attractive current refundings — early 2020 call dates — and have executed a rather small forward delivery to take advantage of this very attractive market for borrowers.”

Taxable bond volume was up 4.6% to $1.6 billion while tax-exempts dipped 5.3% to $26.4 billion.

Bonds subject to the alternative minimum tax were up to $1.3 billion from $491 million in 2018’s first half.

Fixed-rate bonds accounted for 92% of the first-half volume, off 4%.

In a bit of a rarity, New Mexico had the largest single issue with $616 million coming from the New Mexico Municipal Energy Acquisition Authority, an entity created by the New Mexico Legislature to decommission the coal-fired San Juan Generating Station power plant.

There were no issues approaching $1 billion, though that will change in the second half of the year.

The Arkansas Development Finance Authority had the second-largest deal at $487 million.

Citi came out top among senior managers, credited by Refinitiv with $3.3 billion, followed by RBC Capital Markets with $2.7 billion and JP Morgan with $2.4 billion. Bank of America Merrill Lynch & Co. ranked fourth followed by Morgan Stanley.

Hilltop Securities retained its top ranking among financial advisors, credited with $6.89 billion, followed by PFM Financial Advisors with $2.196 billion and RBC with $2 billion. Estrada Hinojosa ranked fourth followed by Samco Capital Markets.

The bond counsel ranks were again led by McCall Parkhurst, credited with $3.8 billion of deals, followed by Norton Rose Fulbright with $3.57 billion and Bracewell with $3.4 billion. Orrick Herrington & Sutcliffe billion ranked fourth, followed by Gilmore & Bell.

Although the second half of the year already includes some sizable deals, industry execs can see the caution flags, especially in Texas, Oklahoma and New Mexico as oil and gas industry firms crowd the bankruptcy courts.

“My clients like the low cost of capital, but some are starting to worry about an overall economic slowdown — if yield curves and bond yields are an indicator of that,” Ayala said. “After new legislation in Texas overhauling property taxes, an economic slowdown could prove a big challenge because a lot of issuers are now constrained on revenue raising flexibility.

“Also, the new property tax regime in our state could end up having negative credit rating implications which translate into higher cost of capital,” he added. “That’s not a big deal in this low interest rate environment, but it could be if rates end up going up in the future.”