With under a $1 billion of bonds and notes selling this week, municipal bond investors were looking beyond the week’s offerings — to fundamentals and performance.

So far this year, muni yields have declined to an almost shocking extent, according to George Friedlander, Managing Partner at Court Street Group.

He cites a recent report by John Mousseau, CEO of Cumberland Advisors that shows the magnitude of the decline in absolute and relative yields since the beginning of the year.

Mousseau noted that muni yields have dropped sharply when measured either using MMD or MMA benchmarks. Since the beginning of the year 10-year muni yields are down 63 basis points; 30-year muni yields are down by as much as 67 basis points; 10-year muni yields as a percentage of Treasury yields have dropped from 84% to 79% using MMD; and 93% to 90% using MMA; and 30-year yields have dropped from 100% to 90% using MMD and from 105% to 96% using MMA.

“What is particularly unusual about these patterns is that, historically, as Treasury yields have dropped sharply, munis have nearly always lagged. Individual investors eventually become ‘rate shocked’ and fear that if they put cash to work at the new, lower level of yields, they would inevitably end up with losses and lost opportunity costs as yields bounced back,” Friedlander says. “We aren’t seeing much of that this time, as investors look at the unusually flat Treasury curve, with a negative slope in the 3-month-10-year range. They thus assume that the economy is likely to weaken, possibly into recession, that risks of a bounce in yields tied to inflation fears remains small.”

He cited other factors such as declining bond debt as a factor in declining muni yields.

“The ongoing drop in the amount of muni debt, with bonds outstanding, according to Federal Reserve Data is down $49.8 billion in 2018, and virtually unchanged in the first quarter of 2019,” Friendlander wrote. “This decline of course, is the result of a drop in new-issue supply that started in 2018 after advance refundings were outlawed by tax reform and ongoing tepid new money issuance.”

He added that the attractiveness of munis has grown in high tax-states such as California and New York, where state and local tax deductions have been limited by the tax changes. This has pushed taxable equivalent yields for high-income investors higher.

Meanwhile, bank demand has quite literally collapsed, he noted.

“Unsurprisingly, commercial bank demand for municipal bonds has dwindled sharply since the end of 2017,” he wrote. “The drop in banks’ maximum marginal tax rates went from 35% to 21%, making municipal bonds far less attractive than they had been in comparison with key taxable sectors: asset-backed securities, mortgage-backed securities, agencies and Treasuries.

In effect, Friedlander said that munis and their lower tax-free yields simply don’t compete as effectively with taxable bonds at a 21% corporate tax rate as they did at a 35% rate.

Primary market

The muni market will see and early close ahead of the full close for the July 4 holiday on Thursday. And with no big sales on the slate for Friday, many market participants will call it a week and won’t return until the following Monday, July 8.

On Monday, BofA Securities priced the Los Angeles Department of Water and Power, California’s (NR/AA+:A1+/AA:F1+) $130 million of Series 2019A Subseries A-1 water system variable-rate demand revenue bonds.

The bonds, dated July 1, due July 1, 2049, were priced at par to yield 1.35% with a daily reset.

On Tuesday, the Metropolitan Water District of Southern California (NR/NR/AA+) is coming to market with two remarketing deals worth $271.255 million. JPMorgan Securities is set to remarket $175.63 million of Series 2017C subordinate water revenue bonds and Series 2017D subordinate water revenue refunding bonds in SIFMA Index mode. BofA Securities is set to remarket $95.625 million of Series 2017E subordinate water revenue bonds in SIFMA Index mode.

In the competitive arena, Salt Lake County, Utah, is selling $70 million of Series 2019 tax and revenue anticipation notes on Tuesday. Zions Public Finance is the financial advisor; Chapman and Cutler is the bond counsel.

Monday’s bond sale

NYS unveils $7.68B Q3 bond sale calendar

New York State, New York City and their major public authorities plan to sell $7.68 billion of municipal bonds in the third quarter, State Comptroller Thomas DiNapoli announced on Monday.

The muni sales include $6.43 billion of new money and $1.25 billion of refundings as follows:

- $2.18 billion scheduled for July, all of which is new money;

- $3.17 billion scheduled for August, of which $2.26 billion is new money and $910 million for refunding purposes; and

- $2.33 billion scheduled for September, of which $1.99 billion is new money and $342 million for refunding purposes.

The anticipated sales in the third quarter compare to past planned sales of $3.54 billion in the second quarter of 2019 and $9.05 billion in the third quarter of 2018.

The state calendar includes anticipated bond sales by the following issuers: NYC, the Dormitory Authority of the State of New York, the Metropolitan Transportation Authority, the NYC Municipal Water Finance Authority, the NYC Transitional Finance Authority, the NYS Environmental Facilities Corp., the NYS Housing Finance Agency, the Port Authority of N.Y. & N.J. and the State of New York Mortgage Agency.

Looking ahead in New York City, the NYC MWFA plans to offer $400 million of tax-exempt fixed-rate second general resolution revenue bonds via negotiated sale on July 10 after a retail pricing on July 9. The city plans to sell $1.4 billion of general obligation new money bonds the week of July 22 via negotiated and competitive sales. And the NYC TFA expects to offer $1.45 billion of future tax secured subordinate revenue bonds the week of Aug. 5 via negotiated and competitive sales.

BofA: 1H new money growth less than expected

The first half of 2019 saw long-term muni bond issuance total $167 billion, about $2 billion more than in the first half of 2018. But the first half total was short of BofA Securities forecast of $180 billion, Yingchen Li, BofA municipal research strategist, wrote in a Monday market comment.

“New-money volume was much lighter than we forecasted,” Li wrote. “We forecasted $133 billion new money for the first half, and by June 27, it was just $115 billion.”

He said that while January, February and April came in about as expected, the traditionally larger months of March, May and June were a short of the firm’s expectation.

“We do not have an explanation for the new money issuance slow down, especially since interest rates lowered sharply since 4Q18,” he wrote. “Some believe this may be due to the hyper new-money volume growth over the past three years when year-over-year volumes grew 15%-21%.In that case, reduced 2019 growth is natural, though slower than estimated.”

Li said the good news was that refunding volume has been better than expected almost each month in the first half.

“We forecasted $47 billion of refunding for the first half, though it totaled $52 billion as of June 27 —- $7 billion more than we expected. Clearly, rapidly declining interest rates and rich muni/Treasury ratios helped refunding activity.”

BofA said that the firm is maintaining its $365 billion issuance target for 2019, saying that low rates and healthy economic growth should foster new-money growth in the second half of the year.

“To reach our $365 billion year-end issuance target, we would need slightly stronger new money growth and continued high refunding issuance,” Li said.

Last week's actively traded issues

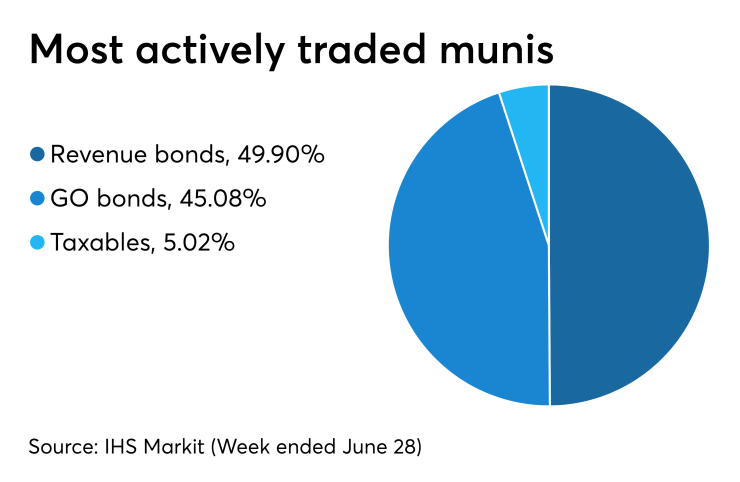

Revenue bonds made up 49.90% of total new issuance in the week ended June 28, up from 48.87% in the prior week, according to

Some of the most actively traded munis by type were from New York, California and Puerto Rico issuers.

In the GO bond sector, the Nassau County, N.Y., 5s of 2020 traded 28 times. In the revenue bond sector, the Los Angeles 5s of 2020 traded 73 times. In the taxable bond sector, the Puerto Rico GDB Debt Recovery Authority 7.5s of 2040 traded 23 times.

Secondary market

It was not a trade deal, but it was hope for one soon, according to Ipek Ozkardeskaya, Senior Market Analyst at London Capital Group.

“[U.S. President Donald] Trump and [Chinese President Xi] Jinping gave investors what they wanted at the G20 meeting in Osaka this Saturday: hope,” Ozkardeskaya wrote in a Monday market comment. “The two leaders agreed to resume the trade talks that have halted in May. … A deal is not sealed just yet, but the two countries showed mutual willpower to end the deadlock and move on with the talks.”

Morgan Stanley is remaining cautious, however.

“Talks resume and new escalatory actions are on hold,” Morgan Stanley wrote in a Monday research report. “The more important observation is that there’s no indication yet of progress on key sticking points. Hence, we would not place confidence in the idea that de-escalation of tariffs is on the horizon and/or that U.S. trade policy in general has become more accommodative or predictable. Trade tensions will either continue to drag on macro fundamentals or get resolved with a push from weaker risk markets.”

Munis were mixed in late trade, according to the

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni rose one basis point to 1.640% while the 30-year muni GO remained unchanged at 2.310%.

The 10-year muni-to-Treasury ratio was calculated at 80.6% while the 30-year muni-to-Treasury ratio stood at 90.3%, according to MMD.

Treasuries were weaker as stocks traded higher. The Treasury three-month was yielding 2.136%, the two-year was yielding 1.797%, the five-year was yielding 1.798%, the 10-year was yielding 2.040% and the 30-year was yielding 2.561%.

“The ICE muni yield curve is range-bound today,” ICE Data Services said in a market comment. “Puerto Rico, tobaccos and high-yield are quiet and unchanged. Taxables are about one basis point higher.”

Previous session's activity

The MSRB reported 29,886 trades Friday on volume of $9.62 billion. The 30-day average trade summary showed on a par amount basis of $12.54 million that customers bought $6.46 million, customers sold $4.01 million and interdealer trades totaled $2.07 million.

California, Texas and New York were most traded, with the Golden State taking 17.593% of the market, the Lone Star State taking 11.808% and the Empire State taking 9.353%.

The most actively traded security was the Los Angeles 2019 TRANs 5s of 2020, which traded 28 times on volume of $38.84 million.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 90-day and 181-day discount bills were lower, as the $36 billion of three-months incurred a 2.145% high rate, up from 2.085% the prior week, and the $36 billion of six-months incurred a 2.040% high rate, up from 2.030% the week before.

Coupon equivalents were 2.193% and 2.095%, respectively. The price for the 90s was 99.463750 and that for the 181s was 98.974333.

The median bid on the 90s was 2.120%. The low bid was 2.050%. Tenders at the high rate were allotted 56.65%. The bid-to-cover ratio was 2.66.

The median bid for the 181s was 2.020%. The low bid was 1.990%. Tenders at the high rate were allotted 29.59%. The bid-to-cover ratio was 2.91.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.