SCRANTON, Pa. -- A county court on Tuesday heard the city of Scranton's preliminary arguments against a lawsuit attempting to stop it from tripling its local services tax.

Judge James Gibbons of the Lackawanna County Court of Common Pleas heard from attorneys representing the city and a group of eight taxpayers in his second-floor courtroom in downtown Scranton.

Gibbons gave no timetable for any ruling.

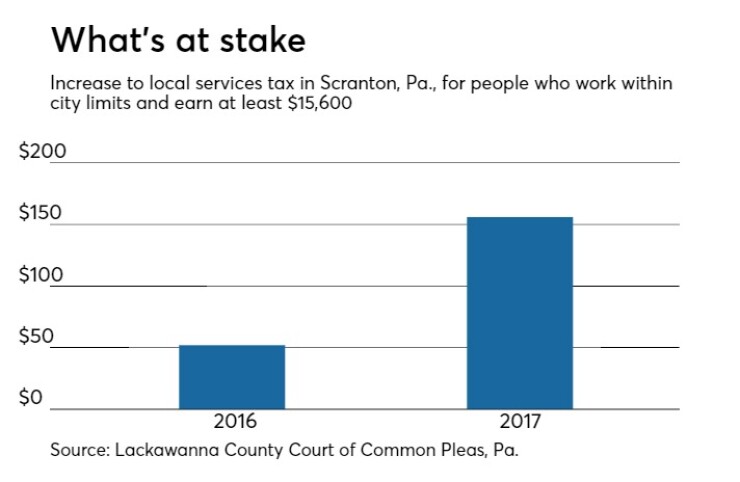

Scranton raised the levy from $52 to $156 for every person working within the city limits that earns at least $15,600. City officials defended the move under Pennsylvania's municipal planning code and called it essential for the city's recovery under the state-sponsored Act 47 for distressed communities, to which Scranton has belonged since 1992.

The taxpayer group, led by independent mayoral candidate Gary St. Fleur, is seeking a mandamus action. St. Fleur has said that lowering taxes across the board is the only way for Scranton to revive economically. He has also initiated a ballot measure to force the city to file for Chapter 9 bankruptcy.

Their lawsuit named Mayor William Courtright and business administrator David Bulzoni as defendants.

The group in February objected to the city's annual petition to the court to raise the tax. Visiting Judge John Braxton, though, ruled in favor of the city, prompting the taxpayer group to initiate

The lawsuit, filed March 2, contends that 76,000-population Scranton has been collecting taxes that exceed the legal issuance and calls for the issuance of a mandamus against the city.

City attorneys, meanwhile, say Scranton has a home-rule charter and is not subject to the cap that Pennsylvania's Act 511 -- a so-called local tax enabling act -- stipulates.

"There is no disputing that Scranton is a home-rule community, and under home rule it can impose taxes at whatever level it sees fit," said Kevin Conaboy of Abrahamsen, Conaboy and Abrahamsen PC, which is representing the city.

He also said the plea for mandamus action improperly named Bulzoni, should have included other city officials and was vague about the taxpayer status of the plaintiffs.

"The plaintiffs are in trouble as far as their complaint is concerned," said Conaboy.

John McGovern, the taxpayers' attorney, said Act 511 has two "very specific" sections that cap how much Scranton can tax.

"Call it a duck or a goose, call it a rate or a cap, but for the city to say it can tax whatever it wants, that alone is dangerous and absurd."

Speaking to reporters after the hearing, McGovern said a favorable ruling could prompt a cry for tax rollbacks. Scranton operates on a calendar-year budget. "At this point we're dealing with 2017 and the city is spending like a drunken sailor."

The taxpayer group -- all residents and subject to the local tax -- consists of St. Fleur, Nicholas Gettel, Casey Durkin, Damian Biancerelli, Rich Johnson, Ethan Green, Angela Gilgallon and Michele McGovern.

"Scranton has made progress from three years ago, in part due to the renegotiating of some city union contracts and the low interest rates on debt," said David Fiorenza, a Villanova School of Business finance professor and former chief financial officer of Radnor Township, Pa.

"The challenges this city will face will be the uncertainty of the state and federal budget as it relates to school funding and other funds that have been relied on for some many years."