Bond yields at a glance | ||||

MBIS benchmark (~AA) | MBIS AAA | MMD AAA | U.S. Treasuries | |

10 year | 2.655 | 2.576 | 2.42 | 2.85 |

30 year | 3.107 | 3.027 | 2.97 | 3.12 |

|

MBIS indices are updated hourly on the Bond Buyer Data Workstation. | ||||

Municipal bond yields were being pressured on Monday by a lower-than-average new issue calendar as traders said selling pressure was being felt as equities rose ahead of President Trump’s budget and infrastructure announcement.

The recent wave of market volatility and investor concern was addressed by a report released on Monday by the Wells Fargo Investment Institute.

“We expect both yields and volatility to increase as the markets digest strong economic growth and higher rates,” wrote George Rusnak, co-head of Wells’ global fixed-income strategy. “We believe that bond market volatility will rise this year, which may present opportunities for active investors.”

However, he said, Wells Fargo expects this year’s interest rate increases will “only be mild” due to low inflation expectations.

Rusnak said investors should focus on three things: Rebalancing their portfolios to prepare for higher volatility in 2018; capitalizing on opportunities if markets over-correct during this volatility; and avoiding investing complacency by active portfolio evaluation.

“While recent interest-rate and equity market volatility have been concerning to some investors, we believe that it is important to prepare for a higher volatility environment this year,” Rusnak wrote. “Given this expected change, we believe that investors should actively rebalance their portfolios, buy quality holdings on markets dips, broadly and globally diversify holdings across asset classes, and capitalize on market opportunities as they present themselves.”

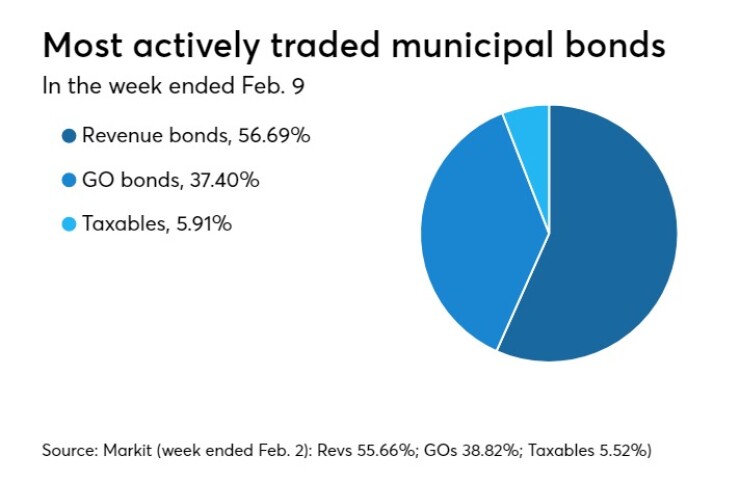

Prior week's actively traded issues

Revenue bonds comprised 56.69% of new issuance in the week ended Feb. 9, up from 55.66% in the previous week, according to

Some of the most actively traded bonds by type were from New York, Georgia and Illinois issuers.

In the GO bond sector, the New York City zeroes of 2042 traded 28 times. In the revenue bond sector, the Main Street Natural Gas Inc. of Ga.’s 4.125s of 2045 traded 25 times. And in the taxable bond sector, the Illinois 5.1s of 2033 traded 17 times.

Primary market

This week’s volume is estimated at $3.5 billion, with the slate comprised of $2.7 billion of negotiated deals and $824 million of competitive sales.

Topping the week’s slate is the Pennsylvania Commonwealth Financing Authority’s $1.39 billion of tobacco master settlement payment revenue bonds.

Jefferies is expected to price the bonds on Tuesday. The deal is rated A1 by Moody’s Investors Service A by S&P Global Ratings and A-plus by Fitch Ratings.

Also on tap is a taxable corporate CUSIP deal from Community Health Network Inc. in Indiana.

Wells Fargo Securities is expected to price the $202 million of Series 2018 bonds as a 2058 bullet on Tuesday. The deal is rated A2 by Moody’s and A by S&P.

Bank of America Merrill Lynch is set to price the Board of Governors of Wayne State University of Mich.’s $120 million of Series 2018A general revenue bonds. The deal is rated Aa3 by Moody’s and A-plus by S&P.

In the competitive arena on Tuesday, the Mounds View Independent School District No. 621, Minn., is selling $153.58 million of Series 2018A general obligation school building bonds.

The bonds are insured by the Minnesota school district credit enhancement program. The deal is rated AA-plus by S&P.

Bond Buyer 30-day visible supply at $5.47B

The Bond Buyer's 30-day visible supply calendar increased $1.14 billion to $5.47 billion on Friday. The total is comprised of $1.67 billion of competitive sales and $3.80 billion of negotiated deals.

Previous session's activity

On Friday, the 10-year muni-to-Treasury ratio was calculated at 85.6% compared with 84.8% on Thursday, while the 30-year muni-to-Treasury ratio stood at 94.7% versus 94.5%, according to MMD.

The Municipal Securities Rulemaking Board reported 35,849 trades on Thursday on volume of $8.46 billion. California, Texas and New York were the three states with the most trades, with the Golden State taking 16.332% of the market, the Empire State taking 12.062% and the Lone Star State taking 8.443%.

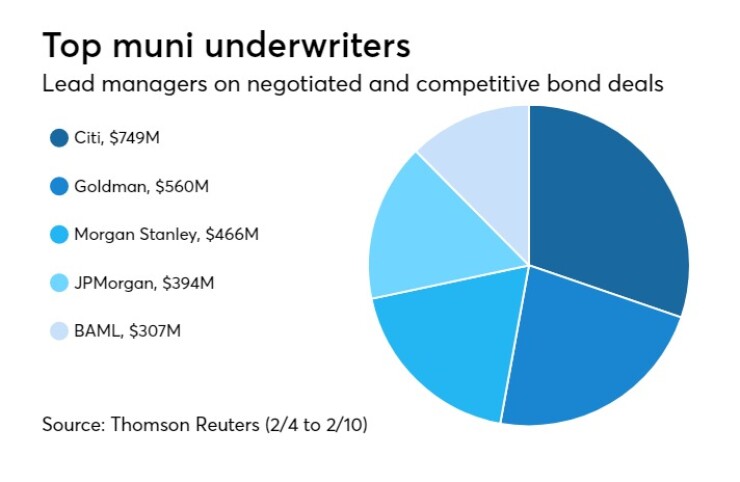

Previous week's top underwriters

The top municipal bond underwriters of last week included Citigroup, Goldman Sachs, Morgan Stanley, JPMorgan Securities and Bank of America Merrill Lynch, according to Thomson Reuters data.

In the week of Feb. 4 to Feb. 10, Citi underwrote $748.8 million, Goldman $559.9 million, Morgan Stanley $465.7 million, JPMorgan $394.0 million and BAML $307.4 million.

Treasury sells weekly bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the three-months incurred a 1.570% high rate, up from 1.500% the prior week, and the six-months incurred a 1.785% high rate, up from 1.650% the week before. Coupon equivalents were 1.598% and 1.826%, respectively. The price for the 91s was 99.603139 and that for the 182s was 99.097583.

The median bid on the 91s was 1.570%. The low bid was 1.500%. Tenders at the high rate were allotted 89.03%. The bid-to-cover ratio was 3.12.

The median bid for the 182s was 1.730%. The low bid was 1.695%. Tenders at the high rate were allotted 22.84%. The bid-to-cover ratio was 2.74.

Treasury to sell $50B 4-week bills, $50B 55-day CMBs

The Treasury Department said it will sell $50 billion of four-week discount bills Tuesday. There are currently $78 billion of four-week bills outstanding.

Treasury will auction $50 billion of 55-day bills cash management bills on Tuesday. The CMBs are dated Feb. 16 and due April 12.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.