Prices on some Puerto Rico bonds on Thursday continued their week-long rise as investors gained heart from some good news coming from the island government,

This week, Gov. Ricardo Rosselló submitted a financial plan to the Oversight Board in which he suggested the government could pay debt service between 8.1% and 14.1% on bonds due through fiscal 2023. An prior proposal included no debt service through fiscal 2022.

Among actively traded issues, the commonwealth’s Series 2014A GO 8s of 2035 were trading at a high price of 32 cents on the dollar on Thursday, according to the MSRB’s EMMA website, up from a high price of 30.15 cents on the dollar on Wednesday, 27.5 cents on Tuesday and 25 cents on Monday.

Thursday’s volume on this maturity at midday totaled $74.79 million, compared to $127.84 million on Wednesday and $60.58 million on Tuesday.

Among other actively traded issues on Thursday, the commonwealth’s Series 2012A GO public improvement refunding 5s of 2041 were trading at a high price of 32 cents on the dollar, up from 28 cents on Wednesday, 25.5 cents Tuesday and 23.752 cents on Monday, according to EMMA.

Volume at midday Thursday was $13.305 million compared to $560,000 on Wednesday.

The Puerto Rico Sales Tax Financing Corp.’s Series 2007B 6.05s of 2036 were trading at 52.5 cents on the dollar compared to 50.5 cents on Wednesday, 49 cents on Tuesday and 47.375 on Monday.

Volume at midday Thursday was $2.40 million compared to $3.59 million on Wednesday.

ICI: Long-term muni funds see $584M outflow

Long-term municipal bond funds saw an outflow of $584 million in the week ended Feb. 7, the Investment Company Institute reported on Wednesday.

This followed an inflow of $1.89 billion into the tax-exempt mutual funds in the week ended Jan. 31 and inflows of $2.46 billion, $2.46 billion, $3.16 billion and $509 million in the previous four weeks.

Taxable bond funds saw estimated inflows of $7.85 billion in the latest reporting week, after experiencing inflows of $7.36 billion in the previous week.

ICI said the total estimated outflows to long-term mutual funds and exchange-traded funds were $27.36 billion for the week ended Feb. 7, after inflows of $21.87 billion in the prior week.

Tax-exempt money market funds see $338.5M outflow

Tax-exempt money market funds experienced outflows of $338.5 million, bringing total net assets to $138.02 billion in the week ended Feb. 13, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $841.3 million on to $138.36 billion in the previous week.

The average, seven-day simple yield for the 197 weekly reporting tax-exempt funds fell to 0.55% from 0.62% the previous week.

The total net assets of the 827 weekly reporting taxable money funds increased $14.34 billion to $2.660 trillion in the week ended Feb. 12, after an inflow of $7.85 billion to $2.646 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.99% from 0.98% from the prior week.

Overall, the combined total net assets of the 1,024 weekly reporting money funds increased $14.00 billion to $2.798 trillion in the week ended Feb. 12, after inflows of $8.69 billion to $2.784 trillion in the prior week.

Bond Buyer 30-day visible supply at $5.13B

The Bond Buyer's 30-day visible supply calendar decreased $305.0 million to $5.13 billion on Thursday. The total is comprised of $2.42 billion of competitive sales and $2.71 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 44,918 trades on Wednesday on volume of $13.07 billion.

New York, California and Texas were the three states with the most trades, with the Golden State taking 12.325% of the market, the Empire State taking 10.206% and the Lone Star State taking 10.108%.

Treasury announces bill auctions

The Treasury Department on Thursday announced it would sell $29 billion of seven-year notes on Feb. 22; $35 billion of five-year notes on Feb. 21; $28 billion of two-year notes on Feb. 20; $45 billion of 182-day bills on Feb. 20; $51 billion of 91-day bills on Feb. 20; $55 billion of 28-day bills on Feb. 20; and $15 billion of one-year 11-month floating rate notes on Feb. 21

Gary Siegel contributed to this report.

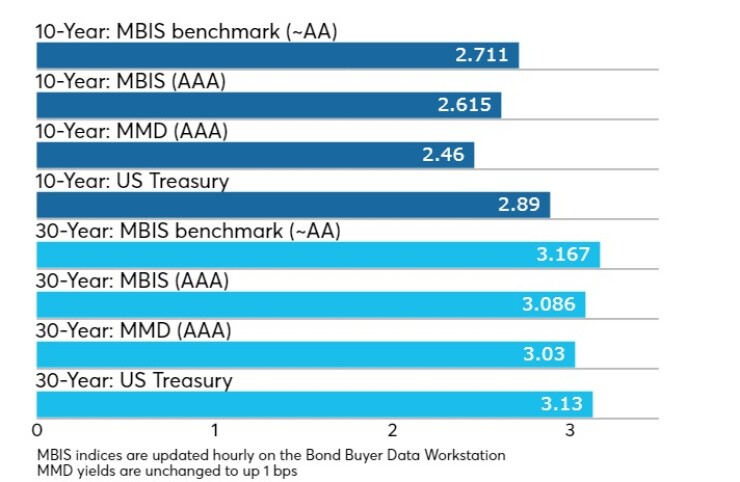

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.