Two of the country’s largest public power agencies may be for sale soon.

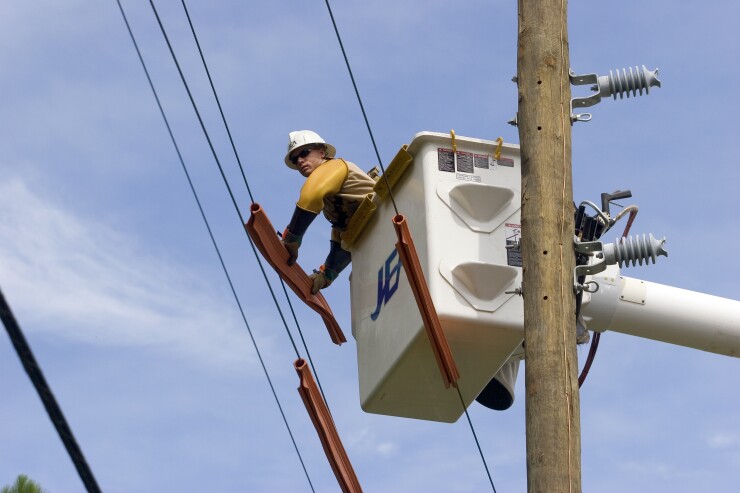

For the third time in seven years, the leaders of Florida’s largest municipal utility, Jacksonville-based JEA, plan to investigate selling or privatizing the 125-year-old community-owned water and electric system.

The announcement was made just two days after the utility’s board of director unanimously voted to pursue what they call a “non-traditional” strategic plan after rejecting two other options that involved remaining as a public utility.

“I want to make sure it is understood,” April Green, JEA’s board chairwoman, said after the directors voted, “that we did not vote today to sell JEA.”

The consultants will determine the best value for JEA from a series of options, including becoming a member-owned electric cooperative; conducting an initial public offering and selling stock; converting to a corporation and selling equity shares to investors; becoming a corporation and allowing companies to buy a controlling interest; or selling to an investor-owned utility.

“This has the opportunity to be one of the most significant events for northeast Florida, not just for our city but for each stakeholder that is a part of our community,” JEA Chief Executive Officer Aaron Zahn said at the meeting.

JEA is waging a legal battle

In South Carolina, state lawmakers are taking bids from companies interested in buying or managing Santee Cooper, an 85-year-old state-owned public utility formally known as the South Carolina Public Service Authority.

Although legislators are split on what to do with Santee Cooper, many are angered about its decision to finance the now-shuddered twin nuclear reactor project at South Carolina’s V.C. Summer Generating Station. The idea behind selling the utility, which is backed by Gov. Henry McMaster, is to shed the debt ratepayers are saddled with.

Santee Cooper has about $7 billion of outstanding bonds, more than half of which financed its share in the failed reactor project.

JEA has about $3.6 billion of debt, plus interest rate hedges that would cost about $100 million to terminate, according to a report on the value of the utility by PFM in February 2018. The report also said debt associated with JEA’s 20-year power purchase agreement with Georgia’s MEAG would cost a new owner about $1.2 billion to assume.

Jacksonville and JEA are in Georgia federal court challenging the legality of the power purchase agreement with MEAG, while work continues on two reactors being built at Plant Vogtle, a project of similar design as the canceled South Carolina reactors.

Santee Cooper and JEA are two of the largest public power agencies in the country, according to the American Public Power Association’s 2018 Public Power Statistical Report, which is based on 2016 data.

Santee Cooper ranked sixth with $1.72 billion in sales revenues, and fifth in terms of net generation with 20.41 million megawatt-hours.

JEA ranked ninth with $1.35 billion in sales revenues, and 10th in generation with 13.27 million megawatt-hours.

Sue Kelly, president of the American Public Power Association, said more communities are talking about municipalization as opposed to privatization.

Kelly cited Boulder, Colorado, where city voters approved taking their grid from Minnesota-based Xcel Energy. Boulder’s effort to pursue acquisition began in 2011 and continues this year with negotiations “and potentially condemnation to determine the value,” the city’s website says.

Boulder’s municipalization effort is aimed at providing residents and businesses with “electricity that is increasingly clean, reliable and competitively priced while allowing for more local decision-making and control,” according to the website.

In New York City, Mayor Bill De Blasio has suggested the city needs a new entity to take over the grid from Consolidated Edison after the July 13 blackout that left more than 70,000 residents without power.

In the wake of Pacific Gas and Electric’s bankruptcy, San Francisco

Legislation was proposed in Maine earlier this year to buy out the state’s two investor-owned utilities, Central Maine Power and Emera Maine, to create the publicly owned and controlled Maine Power Delivery Authority. In June, the bill was carried over to the next special or regular session of the Legislature.

When asked how South Carolina and Jacksonville could be affected by the sale of their public utilities, Kelly said she believes that a robust community conversation should take place.

“This is their local utility, which they own and is there to serve them,” Kelly said. “If they choose to sell that is certainly their right but once they’ve done that, they no longer have a local power provider that’s owned by them.”

Santee Cooper and JEA bond debt would be paid off as part of any transaction, and Kelly said alternative ownership could be more costly.

“The question is what will be the future financing mechanism of that utility and of course the customers of that utility will be on the hook most likely to pay for those subsequent financings,” she said.

The power industry, Kelly said, is experiencing a trend of reduced usage per customer, especially in the residential sector where more efficient appliances are being used and housing construction is more efficient. That applies to investor-owned utilities, rural electric cooperatives and public power agencies.

“There’s no question that we’re not seeing the double-digit increases in growth that we historically expected,” she said, adding that revenues are flat or declining and in some cases increasing but not at the rate they were before. “I think the public power sector is really doing a good job of rising to that challenge.”

The Sacramento Municipal Utility District, for example, offers customers incentives and rebates to help reduce energy use. This summer, the district offered special prices on LED light bulbs at local retailers. Rebates are offered on appliances and other energy-saving devices, and people who buy or lease a new electric vehicle can apply for two years of free charging.

“You’ve got a lot of utilities going into actively working with their customers to implement these new technologies and work for the benefit of everyone in the community,” Kelly said.

In 2017, JEA and the Jacksonville City Council began exploring the privatization of the utility.

After a year of studies on the issue, Jacksonville voters by a 73.4% margin opposed selling more than 10% of JEA’s assets in the November mid-term election.

While it was a straw vote, the City Council has said it will require a binding referendum if a sale is contemplated going forward.

Despite the November vote, JEA’s board and staff embarked on strategic studies to determine the utility’s future because of flat or declining revenues due to consumer conservation and new technology such as solar panels.

At the board of directors' July 23 meeting, staff members read a lengthy list of problems why remaining a government-owned utility wouldn’t be profitable because of legal and constitutional constraints that prevent JEA from expanding its territory and developing new revenue-generating options, including electrification or selling power for new technology such as charging stations for electric vehicles.

A future as a municipal utility would also require terminating 574 employees of the 2,000 it has now.

Melissa Dykes, JEA’s president and chief operating officer, also said the utility is constrained because of its large debt burden.

JEA has limited flexibility to cut costs with operations and maintenance, capital expenditures, debt and costly power purchase agreements that are locked in, according to documents for her presentation.

JPMorgan and Morgan Stanley & Co. will be JEA’s financial advisors in the upcoming solicitation process. Pillsbury Winthrop Shaw Pittman LLP and Foley & Lardner LLP are legal advisors.

As part of the options being considered by the consultants, JEA would require a minimum payment of $3 billion to be paid to Jacksonville, an amount that represents the net present value of expected contribution to the city over the next 20 years.

PFM’s 2018 report said JEA could expect between $7.5 billion and $11 billion to be paid for its value, an amount that would include paying off debt.

JEA is also requiring as part of any recapitalization a minimum of $400 million to be paid to its customers; at least three years of guaranteed base rate stability; commitments to renewable energy sources and water supply; and protection of employee retirement benefits.

At the same time JEA is pursuing the new strategic plan, the utility is planning to move into a new $72.2 million headquarters in downtown Jacksonville.

In June, the board approved a lease with Ryan Companies US Inc. to construct the building that JEA will lease. The lease has a 90-day exit clause if the utility decides to change course.