Some issuers of transit bonds are concerned that the transportation bill pending in the House might hurt their credit ratings.

The five-year, $260 billion highway bill sponsored by House Transportation Committee chairman John Mica, R-Fla., which raised the hackles of transit officials when introduced last month, would eliminate the highway trust funds provided for transit and replace them with a one-time appropriation of $40 billion.

Mica and other top Republican supporters of his American Energy and Infrastructure Jobs Act of 2012 have contended that it makes more sense to keep the highway trust fund’s dollars dedicated to highways.

But muni issuers fear that the lack of any guarantee of transit funding beyond fiscal 2016 could hurt long-term bonds backed by federal funding.

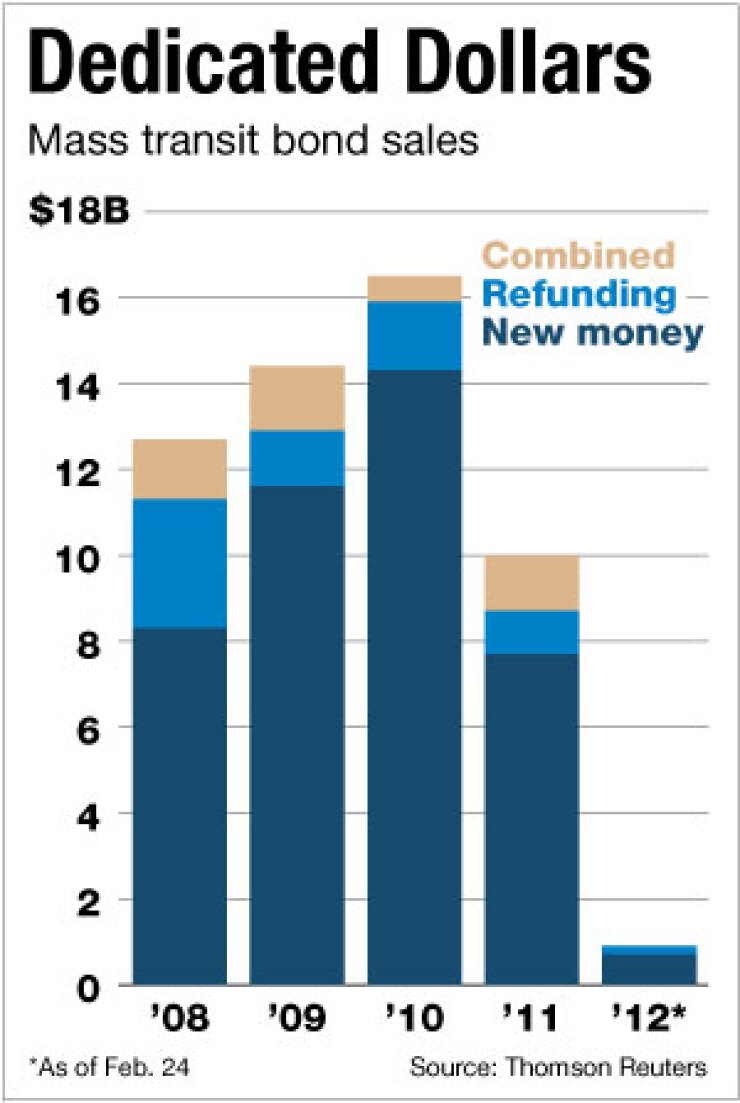

Over the previous year, transit authorities have issued more than $10.7 billion of bonds, according to Thomson Reuters data.

Joseph Casey, the general manager of the Southeastern Pennsylvania Transit Authority, told reporters during a Feb. 22 conference call that a 2011 bond issue of more than $200 million that was backed by SEPTA’s Federal Transit Administration funding could be downgraded if Mica’s proposed legislation becomes law, because of how it would change the transit funding system.

Richard Burnfield, chief financial officer at SEPTA, said that though no rating agency has explicitly predicted a downgrade of those 18-year bonds, the change seems to strike at the heart of Standard & Poor’s written rationale for assigning the bonds an A-plus.

Standard & Poor’s wrote its rating was based on the “historical precedent demonstrating federal commitment to mass transit programs,” as well as the “historical precedent and predictability in the funding formula,” which has been in place since 1981.

“The stable outlook reflects our view that Congress will continue to authorize section 5309 funding at levels that preserve bondholder security,” S&P wrote.

According to Burnfield, “That could impact things going forward.”

Carm Basile, chief executive officer of the Capital District Transportation Authority in Albany, N.Y., said he is “firmly against” the changes the measure would make.

“It would take away any predictability and stability we have enjoyed,” Basile contended. “We don’t think that the general fund is the place for infrastructure funding, and it could and probably will lead to reduced funding for transit systems in the future.”

“Never have so few done so much damage to so many,” said Mitchell Moss, director of the Rudin Center for Transportation at New York University.

Moss said the House bill would undermine the fundamental structure of infrastructure finance, and leave bond buyers in the lurch.

“They’re going to create havoc if markets have to wait for Congress to appropriate money each year,” he said

However, it is possible that the provision in Mica’s bill will be eliminated or modified.

A bipartisan group of House members have offered an amendment to restore the transit funding.

Despite the fear from transit officials about the proposal, Julius Vizner, a transportation analyst at Moody’s Investors Service, said bond issuers may not necessarily have to worry about credit-rating downgrades as a result of reduced funding.

“Agencies have options,” Vizner said. “They can delay capital projects. They can cut services. They can also increase fares.”

A less controversial two-year highway bill is also under consideration in the Senate. Both chambers are returning from a week-long recess.