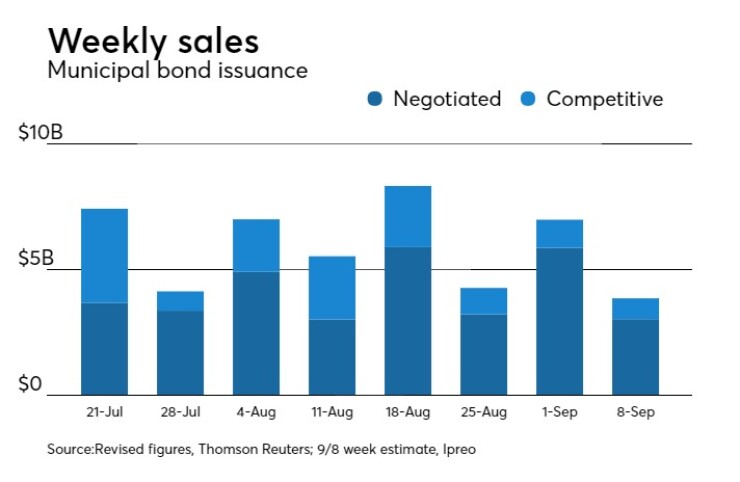

Volume in the primary municipal bond market is expected to decline to fewer than $4 billion of bonds issued, a typical slowdown following a holiday weekend.

Ipreo estimates volume will fall to $3.86 billion from the revised total of $7.02 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the Labor Day-shortened week ahead is composed of $3.03 billion of negotiated deals and $828 million in competitive sales.

There are only five scheduled sales that are $100 million or greater in size, all coming from the negotiated arena.

“I don’t see the lack of participants impacting performance because supply is on the low side,” said Jim Colby, senior municipal strategist at VanEck. “Demand has been strong and that should continue, although with less bonds available for grabs next week, I am sure not everyone will get as many as they want.”

Colby said that lower volume is normal in a holiday-shortened week and coming off relatively strong issuance in August, September could go one of two ways.

“Once everyone is back, the first full week of September should be telling,” he said. “Issuers are being cautious but seeing we're at the ninth month of the year and getting close to quarter-end, that can sometimes push bankers to get deals done. So we will have to see how that plays out.”

Morgan Stanley is expected to price the week's largest deal: the New Jersey Economic Development Authority’s $595 million of motor vehicle surcharges subordinate revenue and taxable bonds. The deal is rated Baa2 by Moody’s Investors Service but some of the bonds are expected to be insured by Build America Mutual.

Bank of America Merrill Lynch is scheduled to price the City and County of Honolulu, Hawaii’s $350 million of rail transit project and floating rate general obligation bonds expected on Tuesday. The deal is rated Aa1 by Moody’s and AA-plus by Fitch Ratings.

Goldman Sachs is on the docket to price the Regents of the University of Texas’ $350 million of taxable system revenue bonds on Thursday following indications of interest on Wednesday. The deal is rated triple-A by Moody’s, S&P Global Ratings, and Fitch, and it is anticipated to come as a bullet maturity in 2047.

In the competitive arena, the Pennsylvania Higher Educational Facilities Authority is scheduled to sell a total of $128.79 million in three separate sales on Wednesday. The taxable and tax-exempt state system of higher education revenue refunding bonds are rated Aa3 by Moody’s and AA-minus by Fitch.

Secondary market

Top-shelf municipal bonds were weaker on Friday as the market wound up trading on a quiet note ahead of the three-day holiday weekend for Labor Day.

Bonds weakened after the release of the unemployment report for August. Non-farm payrolls rose 156,000 last month while the unemployment rate rose to 4.4% from 4.3%. Economists surveyed by IFR Markets had expected non-farm payrolls to rise by 184,000 and the jobless rate to remain at 4.3%.

The yield on the 10-year benchmark muni general obligation rose two basis points to 1.88% from 1.86% on Wednesday, while the 30-year GO yield increased one basis point to 2.71% from 2.70%, according to the final read of Municipal Market Data's triple-A scale.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 87.2%, compared with 87.7% on Thursday, while the 30-year muni-to-Treasury ratio stood at 97.9% versus 99.1%, according to MMD.

Lipper: Muni bond funds see inflows

Investors in municipal bond funds continued to put cash into the funds in the latest week, according to Lipper data released late Thursday.

The weekly reporters drew $344.518 million of inflows in the week of Aug. 30, after inflows of $750.500 million in the previous week.

Exchange traded funds reported inflows of $80.152 million, after inflows of $126.924 million in the previous week. Ex-EFTs, muni funds saw $264.366 million of inflows, after inflows of $623.576 million in the previous week.

The four-week moving average was positive at $578.250 million, after being in the green at $528.082 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $248.440 million in the latest week after inflows of $464.851 million in the previous week. Intermediate-term funds had inflows of $35.870 million after inflows of $159.635 million in the prior week.

National funds had inflows of $339.475 million after inflows of $708.408 million in the previous week.

High-yield muni funds reported inflows of $184.234 million in the latest week, after inflows of $235.522 million the previous week.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended Sept. 1 were from California, Texas and Illinois issuers, according to

In the GO bond sector, the California 4s of 2047 were traded 173 times. In the revenue bond sector, the Texas 4s of 2018 were traded 67 times. And in the taxable bond sector, the Chicago Board of Education 6.138s of 2039 were traded 26 times.

Week's actively quoted issues

Illinois and Georgia names were among the most actively quoted bonds in the week ended Sept. 1, according to Markit.

On the bid side, the Chicago Board of Education taxable 6.319s of 2029 were quoted by 67 unique dealers. On the ask side, the Metropolitan Atlanta Rapid Transit Authority revenue 3.25s of 2039 were quoted by 237 dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 27 unique dealers.