Aiming to strengthen its specialty public finance business, Minneapolis-based Piper Jaffray & Co. continues to expand its coverage with four new hires and two new offices.

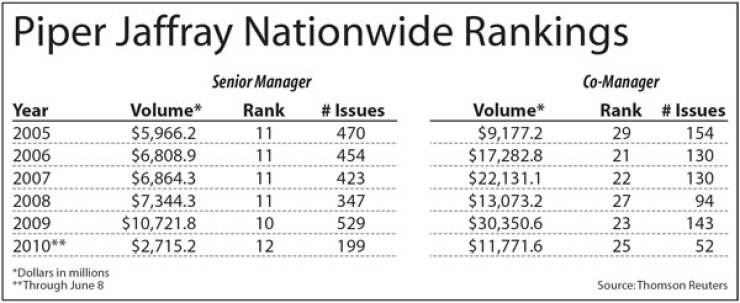

The investment bank and securities firm has senior managed 199 deals worth $2.7 billion so far this year, ranking it 12th nationwide, according to Thomson Reuters. It ranked 10th in 2009 with 529 deals worth $10.7 billion.

While some of the bigger firms have consolidated operations in recent years, Piper has opted to be closer to issuers by having specialists in different locations around the country.

The firm now has around 125 public finance professionals, including more than 60 bankers, in 22 regional locations. Sales and trading operate mostly out of Piper’s bigger offices in Minneapolis, New York, San Francisco, and Kansas City.

“It’s certainly different from what we see Wall Street doing,” said Frank Fairman, head of public finance services. “Our goal is to achieve coast-to-coast coverage with our public finance specialty businesses. The Northeast and Southeast are two important markets where we were previously underpenetrated.”

Matt Weaver, a senior vice president who specializes in health care and senior-living issues, will lead the new office in Jacksonville, Fla. He was previously an executive vice president at Praxeis LLC, a retirement community development and management company, where he directed new business development from 1998 to 2010. That stint was preceded by eight years at Force Financial LLC, the founding company of Praxeis. Weaver’s career began in 1983 at Drexel Burnham Lambert, the former investment bank.

Piper currently ranks ninth among health care underwriters and Weaver’s new role there is to lead expansion efforts for hospitals and senior-living facilities in the Southeast.

He is joined by investment banking associate Matt Hinson, a former colleague at Praxeis, where he was a development manager for three years.

Weaver described the hospital sector as “robust,” noting that issuers “are feeling more confident now” and “starting to pursue some of those projects they had put on hold” during the worst of the economic crisis.

By contrast, he said the retirement community sector is still in the planning stage.

“You basically have borrowers that want to do projects, but from a credit standpoint are struggling with lower occupancy on their independent living,” he said. “There’s starting to be some pent-up demand — the question is, when will the economy fully recover and get those occupancy levels back?”

In the Northeast, 11-year industry veteran Tim Kelly opened up a new office in Saratoga Springs N.Y. , near Albany, where he will focus on higher education issuance. Piper is currently ranked 11th in the sector, having senior managed nine deals this year worth $173 million.

Kelly recently worked as a director with Janney Montgomery Scott. From 2007 to 2009 he was an executive director at JPMorgan, and before that he was a director at UBS Securities for two years. His municipal career began at First Albany, where he spent six years.

Kelly said it is an opportune time for the private education sector, noting that most of the market turmoil is over and schools are preparing new projects.

“It’s a great time to build, with long-term fixed rates just off their historical lows, combined with construction costs that are still at attractive levels,” he said. “Most institutions have worked in all of their budgetary cuts and are now strategizing on ways in which to remain competitive over the long-term.”

In the Southwest, the firm also hired Brian Garcia as an assistant vice president in its Dallas office. A former banker at RBC Capital Markets and Citi, Garcia is charged with enhancing support of independent school district issuing clients.

“We’re particularly focused on building relationships with some of the smaller and mid-tier schools,” Kelly said. “These institutions are often lost in the shuffle with some of the bigger shops and these are the ones that are most in need of comprehensive banking assistance.”