CHICAGO – Chicago Mayor Rahm Emanuel received a rating agency warning over the risks posed by pension borrowing while his successor was cautioned against a slip backward on Emanuel's budget and pension funding progress.

The warnings from S&P Global Ratings extend to Chicago Public Schools’ fiscal progress. S&P laid them out in an initial review of Emanuel’s proposed $10.7 billion 2019 budget. The budget is Emanuel’s last as he’s not seeking re-election in the 2019 municipal elections.

“Financially speaking, we expect that 2019 will be a period of near-term stability for Chicago, but we think that the following three years will test the city's willingness and ability to manage its budget in a sustainable manner,” S&P said in the commentary published Thursday labeling the budget a “status quo” spending plan.

“We expect that the next city administration will need to make difficult policy choices, and Chicago's rating trajectory will depend on whether it continues its policies emphasizing structural solutions,” said the report from analysts Carol Spain and Helen Samuelson.

Pension pressures that loom in 2020 cast a wide shadow over the proposed budget that is balanced without new taxes or fees.

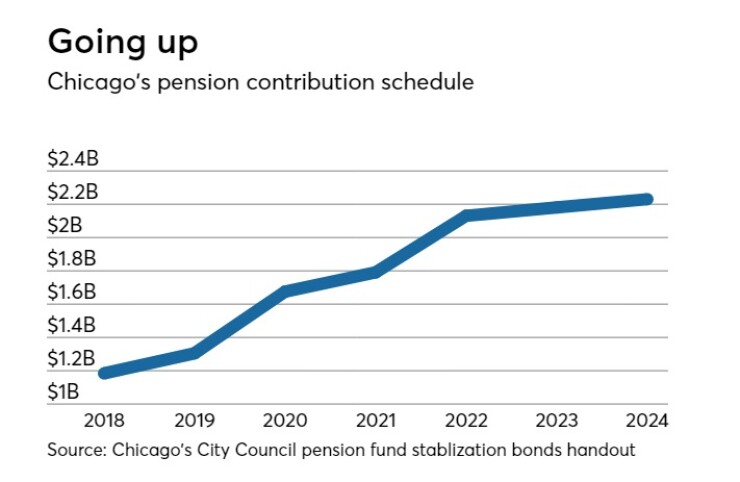

Contributions jump by nearly $300 million in the 2020 budget, payment year 2021, when a five-year ramp up in contributions to an actuarially required or determined contribution – referred to as an ARC or ADC -- ends for police and firefighter funds. Another spike of $310 million occurs in 2022, payment year 2023, when the ADC hits for the municipal and laborers funds.

In 2020, the city will also have to fund pay raises for police and firefighters that are under negotiation and GO debt service is scheduled to rise, S&P said. The rise in debt service may be offset by the use of a higher-rated securitization program to refund the city's lower-rated GOs.

S&P warned that the ADC could be underestimated and the lengthy 40-year amortization period to reach a 90% funded ratio under Emanuel plans now set in state statute pose long-term risk.

“The city will be locked into negative amortization for several decades, meaning that the unfunded liability will continue to grow even as contributions increase, and the plans will remain vulnerable to adverse experience and at risk of insolvency in a recession or market downturn,” S&P warned.

“We still view structural solutions to close the fiscal 2020 gap as feasible, but a change in political will (particularly uncertain in light of pending administration changes) and further increases to the budget gap, including escalation of pension costs, could change our view,” S&P warned.

PENSION BONDS

The review marked the first published commentary on a potential $10 billion pension obligation deal and it signaled the city needs to proceed with caution to preserve its rating. Rising interest rates have dampened such a deal’s prospects with bankers saying it’s lost its value, but the Emanuel administration insists it’s still on the table.

“Generally, we believe that along with the issuance of POBs comes risk. The circumstances that surround an issuance of POBs, as well as the new debt itself, could have implications for the obligor's creditworthiness,” S&P said.

“S&P Global Ratings views POB issuance in environments of fiscal distress or as a mechanism for short-term budget relief as a negative credit factor,” S&P said. “Depending on the structure of the POBs and whether or not the city would make changes to its pension funding discipline, issuance could have rating implications for Chicago.”

City fiscal chief Carole Brown has said the city would funnel all proceeds to the system to bring up funded ratios to more than 50% form 26.5% and the city would adhere to an ADC schedule.

BUDGET

The "status-quo" budget reflects recently implemented fiscal adjustments that include tax hikes and the contribution-ramp up to deal with the city's pressing challenges,, wrote S&P, which rates Chicago GOs BBB-plus with a stable outlook.

The budget moves closer to structural balance but S&P said $73.5 million in debt service savings, account sweeps, changes in revenue projections, and tax-increment financing surplus funds “fall short of what we consider ongoing revenue given uncertainty and annual fluctuations.” Analysts added they won’t fully consider the budget structurally balanced until pension contributions hit actuarial levels.

Any change in the rating agency’s view on Illinois or Chicago Public Schools could also add to the city’s budget struggles. The school district’s fiscal challenges are linked to the city's as the mayor is vested in the district through his oversight of board members and top administrative officials and the city has helped the district out financially.

S&P recently upgraded CPS' junk rating one notch to B-plus with a stable outlook. S&P rates Illinois BBB-minus with a stable outlook. "Backsliding on fiscal progress by either entity could have repercussions for Chicago's budget," S&P warned.