CHICAGO – Illinois' budget assumptions of $400 million in fiscal 2019 savings from pension buyouts remain uncertain as the state’s largest fund is preparing to launch the bond-financed programs in the second half of fiscal 2019.

The Teachers' Retirement System board at its monthly meeting last week discussed a draft of administrative rules that would govern implementation of two new “accelerated pension benefit payment” programs.

“While TRS is preparing to implement these accelerated payment options in 2019, as yet no funding is in place for the lump-sum payments. Money for the programs depends on the sale of $1 billion in state bonds by the Governor’s Office of Management and Budget,” TRS said in a statement.

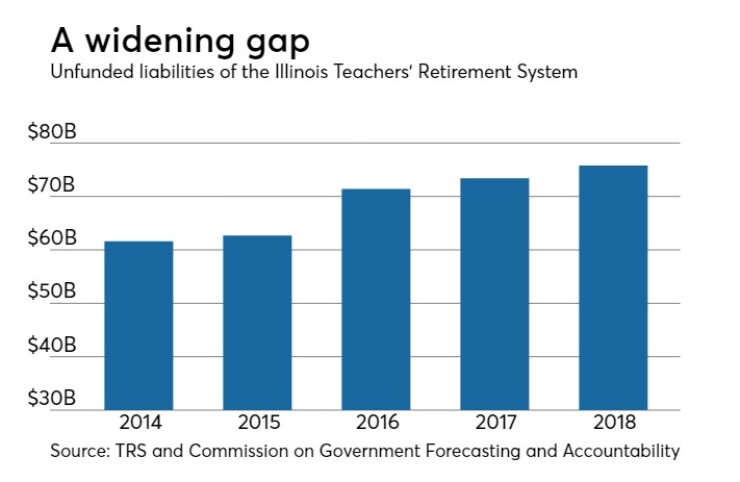

The board also approved a preliminary $4.81 billion fiscal 2020 state contribution — a 10.6% increase that remains billions shy of actuarial funding. Trustees were told the TRS’ unfunded fiscal liability grew by 3.04% to $75.8 billion in fiscal 2018 from $73.4 billion while its funded ratio held nearly steady at 40.7%.

The most recent fiscal 2017 unfunded tab for all five of the state’s funds totaled $129 billion for a collective funded ratio of 39.9%.

The first program would partially “buy out” inactive members who are eligible for an eventual pension, offering them a lump sum equal to 60% of their expected lifetime benefits.

The second program presents an option to retiring members of the system's Tier 1, employees in place before reduced benefits were approved in 2010 for new hires. They can trade in their 3% automatic annual pension increase for a 1.5% cost-of-living adjustment and a lump-sum check equal to 70% of the difference between what they would receive in retirement.

“Our timetable is to make the buyout programs available within the first six months of 2019,” before the end of fiscal 2019 June 30, said TRS spokesman Dave Urbanek. The retiring Tier 1 program will come first followed by the inactive member program.

Both programs run through June 2021 and were among pension changes approved by lawmakers and signed into law by Gov. Bruce Rauner in May as part of the $38.5 billion fiscal 2019 budget.

The Rauner administration included a disclosure of the planned pension borrowing in its last general obligation offering statement saying it would occur in the latter half of the fiscal year after the programs were implemented.

“Timing has not been determined yet, but the issuance will not be this year,” the administration said Monday when asked for an update.

The last bond offering statement also warned that the “state can provide no assurance” that the expected savings can be realized from the buyouts.

The budget relies on $382 million under the Tier 1 buyout and $41 million for the buyout of inactive employees.

TRS said it does not yet have any savings estimates.

“Until we get some actual data from members after the programs begin, we cannot accurately estimate what future participation will be,” Urbanek said.

For valuation purposes, TRS actuaries relied on estimates used by the legislative sponsors, who projected 22% of inactive members and 25% of retiring Tier 1 members would take the offers. “However, no one has been able to independently verify the accuracy of those estimates,” Urbanek said.

The state employees fund told the Civic Federation of Chicago that it planned to implement the buyouts late this year for one and spring for the other.

The TRS contribution request is based on a formula tied to the state’s 1995 pension funding ramp legislation. It will fall more than $3 billion short what would be the $7.9 billion actuarially based contribution and will mark the 80th year that contributions have fallen short of such a mark.

“The future viability of TRS is directly dependent on continued state support that adequately meets the cost of benefits and pays off the unfunded liability,” TRS executive director Dick Ingram said in a statement.

TRS recorded an 8.45% return on investments in the last fiscal year. Its 40-year return rate was 9.2%, better than its 7% assumed rate.

The contribution is preliminary and will be reviewed by the state actuary before being finalized for inclusion in the next state budget typically unveiled in February.

Tuesday's election will decide who will be the governor proposing the fiscal 2020 budget. Rauner is seeking a second term against venture capitalist J.B. Pritzker.

Rauner supports pension measures that include asking employees to take a COLA cut in exchange for future raises counting toward their pensionable salary and shifting some costs over to local districts and universities. Pritzker has proposed pouring more money upfront into the system and leveling out the 50-year payment schedule set in 1995 but he has not provided specifics on how to fund the changes.