Munis continued to grind higher due to lack of supply and strong demand for tax-free yield.

“Adding fuel to the fire is concern that fallout from the U.S.-China trade dispute will spur further reallocation from equities into fixed income,” ICE Data Services said in a Wednesday afternoon market comment. “With Treasury yields at low levels, investors are likely to see tax-free muni bond yields as an attractive alternative. Fed Vice Chair Richard Clarida indicated that if no agreement is reached, the Fed would take that into account when formulating future policy.”

ICE said its muni yield curve was lower by 1.5 to 2 basis points.

“The two-year/10-year spread has ratcheted in to 26 basis points,” ICE said. “Yields on tobacco bonds are down one- to two basis points in tandem with the high-yield sector. Taxables were within one basis point of yesterday as the market focuses on the negotiations.”

Muni yields and percentages keep moving down, unabated from a combination of continuous inflows to funds, low supply, falling equities, and geopolitical/trade concerns.

"At some point, the music has to stop — but it is hard to say what will cause it," a Tennessee-based trader said. "Eventually, inflows will slow down or stop and maybe supply will pick up, but we are heading into heavy reinvestment months."

He added that one catalyst could be the reintroductive of advance refundings since they were taken away with tax law changes. "I am not overly optimistic about how quickly a resumption might happen, absent a bipartisan infrastructure bill."

Primary Market

Citigroup priced the Pennsylvania Commonwealth Financing Authority’s (A1/A/A+; AGM 2038: A2/AA/) $389 million of Series 2019A taxable revenue bonds.

Morgan Stanley priced the Board of Regents of the University of Texas System (Aaa/AAA/AAA) $327.24 million of Series 2019A revenue financing system refunding bonds for institutions after holding a one-day retail order period.

JPMorgan Securities priced Energy Northwest’s (Aa1/AA-/AA) $274 million of Series 2019A Columbia Generating Station electric revenue and refunding bonds and 2019B taxable Columbia Generating Station electric revenue refunding bonds.

Wells Fargo Securities priced Charlotte, N.C.’s (Aa2/AA+/AA+) $101.11 million of Series 2019B refunding certificates of participation for cultural arts facilities.

Morgan Stanley priced the Massachusetts Water Resources Authority’s (Aa1/AA+/AA+) $144.47 million of Series 2019B general revenue bonds and Series 2019C general revenue refunding green bonds.

BofA priced the West Virginia Hospital Finance Authority’s (Baa1/NR/NR) $88.15 million of Series 2019A hospital improvement and refunding revenue bonds for the Charleston Area Medical Center.

On Tuesday, Massachusetts (Aa1/AA/AA+), competitively sold $700 million of general obligation bonds in four offerings. Morgan Stanley won the $400 million of Series 2019C GOs with a true interest cost of 3.726%; BofA Securities won $100 million with a TIC of 2.9516%; RBC Capital Markets won $100 million with a TIC of 3.5151%; and JPMorgan Securities won $100 million with a TIC of 1.7421%.

State officials said the sales generated about $825 million of bond proceeds at an historically low cost of funds. The combined transaction priced at a TIC of 3.47%, with an average life of around 20 years.

The state said it is taking advantage of low-interest rates now amid strong investor demand to lock-in attractive long-term financing for its capital projects.

“We are very pleased with the number of bids and aggressive pricing that we received today,” Treasurer Deborah Goldberg said late Tuesday. “The competitive bidding for each of the series demonstrates the broad demand for the Commonwealth’s bond offerings and I am grateful to our investors and investment banker partners”.

Wednesday’s bond sales

Tuesday's Massachustts GO sales

ICI: Muni funds see $2.1B inflow

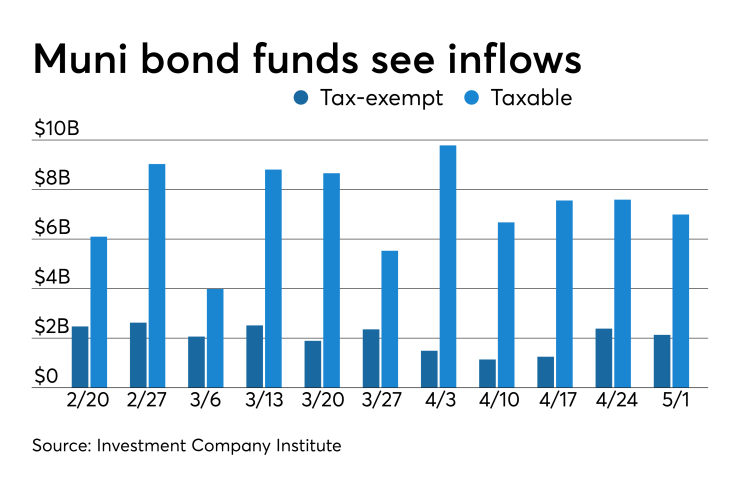

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.134 billion in the week ended May 1, the Investment Company Institute reported on Wednesday.

It was the 17th straight week the funds saw inflows and followed an inflow of $2.384 billion into the tax-exempt mutual funds in the previous week.

Long-term muni funds alone saw an inflow of $1.718 billion after an inflow of $2.006 billion in the previous week; ETF muni funds alone saw an inflow of $416 million after an inflow of $378 million in the prior week.

Taxable bond funds saw combined inflows of $6.993 billion in the latest reporting week after inflows of $7.592 billion in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $510 million after outflows of $6.692 billion in the prior week; equity funds were the biggest losers as they experienced $5.95 billion of outflows.

Secondary market

Munis were stronger on the

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the both the 10-year muni GO and the 30-year muni fell by one basis point.

Treasuries were weaker as stock prices moved higher

The 10-year muni-to-Treasury ratio was calculated at 72.7% while the 30-year muni-to-Treasury ratio stood at 85.6%, according to MMD.

Previous session's activity

The MSRB reported 34,220 trades on Tuesday on volume of $10.47 billion. The 30-day average trade summary showed on a par amount basis of $12.36 million that customers bought $6.13 million, customers sold $4.05 million and interdealer trades totaled $2.17 million.

California, Texas and New York were most traded, with the Golden State taking 17.907% of the market, the Lone Star State taking 11.853% and the Empire State taking 10.037%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp.’s Restructured Series A-1 5s of 2058, which traded 78 times on volume of $63.2 million.

Treasury sells $27B 10-year notes

The Treasury Department auctioned $27 billion of 10-year notes with a 2 3/8% coupon at a 2.479% high yield, a price of 99.083877. The bid-to-cover ratio was 2.17.

Tenders at the high yield were allotted 3.82%. All competitive tenders at lower yields were accepted in full. The median yield was 2.430%. The low yield was 2.357%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.