DALLAS – The Oklahoma Turnpike Authority is joining the year-end rush to market Wednesday with $410 million of toll revenue bonds, including what may well be the authority’s last advance refunding.

Included in the issue are $94.2 million of advance refunding bonds. Such refinancings would be banned next year by Congressional tax bills awaiting reconciliation and final approval. The authority is among numerous issuers trying to advance refund outstanding debt for savings before the year-end deadline.

“If the current tax reform bill becomes law, this will be the last advance refunding the authority will ever do,” said OTA municipal advisor Michael Newman, senior vice president of First Southwest Co.

"It's a very crowded calendar with advance refundings," one trader said. "There's a lot of paper flying around."

Another congressional vote that could affect the refunding is a decision to raise or suspend the debt limit by Dec. 8. Absent that vote, the Treasury Department is likely to suspend State and Local Government Securities, or SLGS, commonly used in escrow accounts for advance refundings. OTA does not expect the SLGS issue to affect the advance refunding, as escrow agents have arranged to buy securities on the open market.

This week’s deal comes in two tranches as 2017 C and E. The $315.3 million C tranche will provide new money for projects under OTA’s Driving Forward program. The E tranche advance refunds $94.2 million of bonds maturing through 2031.

Plans for a $276 million Series D current refunding bonds to take out OTA’s interest-rate swaps were scrapped as they are out of the money under current conditions.

“We hope market conditions will make that possible in the future,” Newman said. The notional amount of each of the three remaining swap agreements is $93.6 million, and the authority’s mark-to-market value estimate for all three totaled $42.2 million as of Nov. 1.

RBC Capital Markets is OTA’s book runner, led by managing directors Jon Moellenberg, and Tom Yang.

Hawkins Delafield and Wood is bond counsel. Closing is expected Dec. 21.

The bonds are rated Aa3 by Moody’s Investors Service, and AA-minus by both S&P Global Ratings and Fitch Ratings.

The rating is based on the “stable, well-established turnpike system that serves as an essential inter and intrastate connector, though it is separate from the federal interstate system,” Moody’s analyst Earl Heffintrayer said.

“The stable outlook is based on the expected maintenance of financial metrics with the increase in leverage due to planned rate increases,” he added. “We think that the authority is well positioned to withstand either elasticity to higher rate increases or weakness in the local economy and has flexibility in managing its future capital spending given the very good condition of system assets.”

The $315.3 million of new money bonds will go toward OTA’s $1.1 billion Driving Forward program, designed to accelerate tollway development in major corridors. The series 2017C bonds are expected to have a final maturity date of Jan. 1, 2047 with amortization beginning in 2029 and structured to maintain level annual debt service.

“The debt service coverage ratios are expected to remain fairly stable through the sizable Driving Forward capital plan given the multi-year rate increase passed by the board that requires no further action to implement rate increases through 2018,” Heffintrayer wrote.

The authority expects to issue an additional $274.6 million in 2018 to fully fund the Driving Forward Program.

The OTA system consists of 10 turnpikes, carrying in-state and interstate traffic and serving as a transportation crossroads with major interstates. With about 605 miles of roadway, OTA ranks as the nation’s second-largest in the nation.

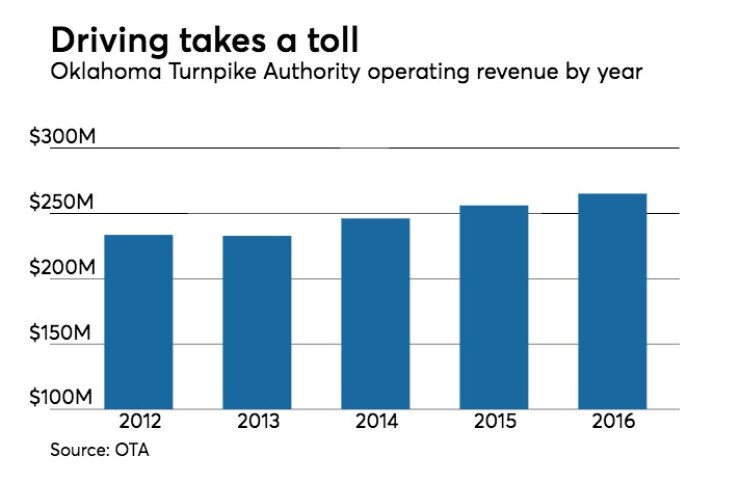

“The lack of competition in Oklahoma for long-distance travel and the system's essentiality contribute to an established and stable traffic demand base,” Fitch analyst Tanya Langman wrote. Since 2006, traffic has grown at a 3.2% rate.

OTA is able to raise rates without legislative approval and plans annual toll increases over the next three years. Tolls go up 12% in 2017 and 2.5% each in 2018 and 2019.

“Toll rates remain competitive compared with Fitch's rated portfolio, with an average toll per transaction of $1.44 in 2015, and demand was observed to be relatively inelastic for past toll increases,” Langman said.

For the toll road sector in general, Moody’s has shifted its outlook to stable from positive.

“We expect toll road traffic (as measured in tolled transactions) and revenues to normalize after the strong growth seen in the early phases of the recovery from the recession as economic growth matures, the labor force nears full employment, and gasoline prices rise modestly from their 2015 low,” analysts said in a Nov. 29 report.

Moody’s expects median traffic growth of 2% to 3% for rated toll roads in 2018, based on a 2017 year-to-date sample showing traffic growth significantly below growth rates a year ago.

Toll rate increases, including the growing use of annual or indexed adjustments, will support revenue gains of 3% to 4% in 2017 and 2018. About 51% of Moody’s rated toll roads, including roads in Colorado, Florida and Texas, have implemented annual toll increases or increases indexed to inflation.

The US Energy Information Administration forecasts that vehicle miles traveled will grow 2.5% in 2017 and 1.7% in 2018. The EIA also forecasts that gas prices will increase modestly in 2017 following a four-year decline.

“We could move to a negative outlook if traffic growth falls to 0% or below, or revenue growth falls below 2%,” Moody's said. “Our outlook would change to positive if transaction growth exceeds 3% or revenue growth exceeds 5%.”