CHICAGO — Ohio State University is coming to market this week with at least $300 million of taxable general receipts bonds that feature 100-year maturities, marking the first time a public university has floated century bonds.

The bonds will have a single bullet payment due in 2111. The structure represents a shift from the school’s tradition of issuing serial bonds with 20-year maturities to large bullet maturities and long-end amortizations.

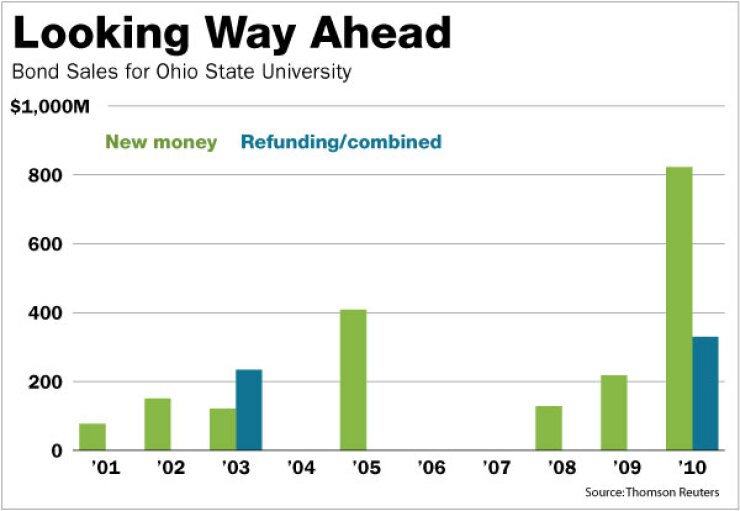

Last year, OSU sold $800 million of 30-year Build America Bonds with bullet maturities. The BAB sale, combined with this week’s borrowing, will nearly double the university’s debt load, and reduce the amount of variable-rate paper in its portfolio to less than 20%.

The issue is tentatively scheduled for Thursday, and could rise to as much as $500 million.

One of the largest universities in the country, the double-A rated OSU is a Big 10 school and one of the country’s top research institutions. This week’s debt offering comes as the university is in the midst of an effort to privatize its parking system, a move that would represent another first for a public university.

Bond proceeds will finance a $2 billion capital campaign that includes a $1.1 billion expansion of the Ohio State University Medical Center. The plan features new cancer and critical care hospitals and is the largest construction project in the state.

With the borrowing, OSU will have financed the bulk of its capital campaign, leaving about $300 million still to be issued through 2014.

Officials expect to sell that debt as serial bonds with shorter amortization schedules.

The school decided to head to market earlier than planned to take advantage of historically low rates, officials said.

The finance team had been considering 100-year bonds and decided to move as long-end yields continued to drop and as it watched the pricing of a pair of century bond sales offered by two top-tier universities earlier this year, said Michael Papadakis, vice president of financial services and treasurer at OSU.

Massachusetts Institute of Technology and the University of Southern California earlier this year both floated 100-year bonds.

Double-A rated USC saw an interest rate of 5.25% on its $300 million issue — the lowest rate ever paid for a century bond. The $750 million, triple-A rated MIT issue saw a 5.65% yield.

“It’s something that we had been thinking about for awhile, and the market became so attractive from a coupon perspective that we decided if we’re ever going to do it, now is the time,” Papadakis said. “The MIT and USC deals getting done piqued our interest.”

The shift to bullet maturities and long-term debt comes with a relatively new finance team at the school.

Papadakis, a former investment banker at KeyBanc Capital Markets, joined OSU in June. The university’s chief financial officer, Geoffrey Chatas, took the position in February 2010. Before that, he was managing director of the infrastructure investments fund at JPMorgan Asset Management.

“We’re taking a fresh look at things,” Papadakis said. “We haven’t traditionally taken advantage of the full yield curve, and that’s why we decided to do BABs last year and century bonds this year. We’re taking advantage of the best opportunities in the market and where the best rates are.”

Barclays Capital, which was senior manager on the MIT issuance, is joint book-running manager on the OSU deal with Goldman, Sachs & Co. KeyBanc Capital Markets, RBC Capital Markets, Loop Capital Markets and PNC Capital Markets LLC are also on the underwriting team. Bricker & Eckler LLP is bond counsel.

The finance team expects overseas and Canadian interest in the taxable debt and is marketing the bonds to large institutional investors like pension funds and insurance companies.

A conference call with investors with an online road show was scheduled for Tuesday afternoon. The finance team was also talking one-on-one with investors through the planned pricing on Thursday, Papadakis said.

“There’s a very limited universe of folks that can issue century bonds,” he said. “It says a lot about the institution that investors are comfortable that we’ll be here in 100 years.”

Moody’s Investors Service and Fitch Ratings noted there are risks attached to the century bonds as well as the larger shift in the school’s debt portfolio, but added that OSU’s historically conservative approach to managing its debt would, if maintained, offset the risks.

“Fitch acknowledges that the university’s increasing use of less traditional bond structures adds an element of risk not previously present in the credit,” analyst Douglas Kilcommons wrote in a report on the bonds, which Fitch rates AA with a stable outlook.

The OSU’s strong reserves and ability to refinance if necessary mitigate some of that risk, according to Kilcommons.

“As specifically related to the century bond financing, Fitch viewed favorably the ability of senior financial leadership to communicate its rationale for the debt issuance and its plan to manage the borrowing on an annual basis,” he wrote.

Moody’s analyst Edith Behr warned that the inability to call the bonds without paying a potentially large penalty could limit the school’s financial flexibility in the future.

However, the risk is offset by the relatively low rates the school expects to pay on the bonds, she said. Current management seems prepared to manage large bullet payments as they come due, and has continued to build debt-service reserves annually.

“This conservative approach to managing debt is a strong mitigant to the risk generally associated with large bullet maturities,” Behr said. “Any move away from this practice would be a credit negative.”

Moody’s rates the bonds Aa1 with a stable outlook. Standard & Poor’s rates them AA.

For the OSU finance team, the current market’s low rates offset the risk of not being able to call the bonds without paying a significant penalty.

“We’re comfortable that the rates are at historical all-time lows,” Papadakis said.

The bonds are secured by a pledge of nearly all of Ohio State University’s revenues except for state funding. State aid made up only 11% of the school’s revenue in fiscal 2011, and is expected to decline in the future.

Fiscal 2011 pledged revenue is expected to total $3.1 billion. Maximum annual debt-service coverage is expected to reach around $215 million, or about 4.4% of total operating revenue, according to credit analysts.

Meanwhile, OSU put out a request for qualifications last month for companies interested in entering into a long-term lease of its parking system, and is expected to select a firm in November.

If the proposed deal goes forward, it would mark the first time a university has entered into a long-term lease of its parking system.

Papadakis said the university talked about the plan with the major rating agencies, but added that the parking system — which generates $28 million annually, or less than 1% of the school’s overall revenues — has little impact on the university’s fiscal position.

The winning firm needs to offer at least $375 million in upfront cash for the long-term lease — money that the school would put into research and development.

“We’re in an environment, like most public institutions, where state funding will stay flat or go down, and we need to be creative in looking at all of our assets,” Papadakis said.