New York made its debut in the growing prepay energy bond market last week, a deal two years in the making.

The market has seen a

The New York Power Authority's deal on Thursday offered New York investors their first chance at triple-tax-exempt prepay electricity bonds, but to bring the deal to market took two years of work, NYPA Chief Financial Officer Adam Barsky said.

Although this is the first prepay deal issued in New York, it's not the first one from a New York power authority. The Long Island Power Authority issued prepay bonds last year in Alabama with the Pacific Life Insurance Co. as the borrower.

"We're able to lock in these savings today, and that will enable us to accommodate these power purchase agreements that our customers are entering into for renewables, and be able to give them an opportunity to save 10% off of the price of those renewables," Barsky said. "Given everything that's going on in Washington, with losing tax credits and other incentives for mostly solar projects, this will be a good way to help keep those costs down."

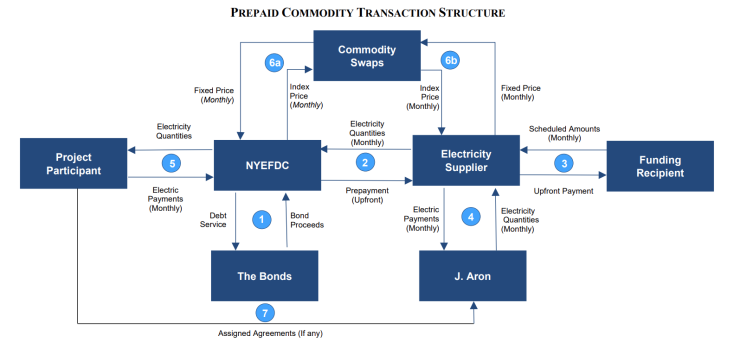

The deal was issued by the New York Energy Finance Development Corp., a conduit the state created for this transaction.

"This important initiative is set to deliver a significant cost savings for our NYPA energy customers, showcasing our commitment to financial efficiency and exceptional customer value,” said NYPA President Justin E. Driscoll.

The $944 million deal achieved a true interest cost of 4.6%. The bonds carry a final maturity date of 2056 but are callable in 2033.

Goldman Sachs was the lead manager. Academy Securities, Ramirez, Siebert Williams Shank and Wells Fargo were co-managers. PFM and HilltopSecurities were co-municipal advisors. Nixon Peabody and Hardwick Law Firm were co-counsel.

The borrower was Athene Annuity & Life Co. The deal was rated A1 by Moody's Ratings.

Barsky credits the deal's novelty for its good performance. New York bond funds were able to diversify their portfolios with a tax-exempt credit that is, for now, one of a kind.

"We had people putting in orders for over $100 million at a shot, buying up significant chunks of the deal, because they knew that it was new, different and an opportunity to diversify their portfolios," Barsky said. "There's a scarcity effect there that really helped and made a big difference."

Although the deal was unique within New York, everything else about it was by-the-book for

The deal's size, maturity, and credit rating are all pretty par for the course. The borrower, Athene, has

There were more than

Moody's rated

The volume for prepay deals is dependent on the ratio of tax-exempt munis to Treasuries, Barsky said. If there's a significant spread between tax-exempt and taxable rates, power authorities will be able to achieve savings through pre-pay transactions.

NYPA was ready to bring this deal earlier this year, but the market's reaction to Liberation Day meant the savings wouldn't have been viable, Barsky said.

"The spread differential really went away, and so many others in this particular space had to basically go to the sidelines and wait until the market came back in our favor," Barsky said. "Only recently have we seen that."

The recent favorable market conditions have encouraged other power providers to jump into the market, including the $834 million

NYPA felt that issuing in New York would create more savings, and the two years of work that it took to create the New York Energy Finance Development Corp. would be worth it, Barsky said.

Using an issuer in Alabama or California would have been "taking the easy route," Barsky said.

"It's been very difficult, in general, to get things like this done," according to Barsky. "It took some time to create this new entity, to get everybody comfortable with that."

Now that New York has a conduit issuer for its prepay deals, NYPA and LIPA — or authorities from out of state — will be able to use it for prepay deals whenever they want. But Barsky doesn't expect to issue prepay deals very often.

NYPA has nothing on the calendar in the near future, Barsky said. The authority may borrow for its transmission projects, but he expects those deals to be priced in 2026 at the earliest.

Barsky has an idea for another "innovative" use for the new conduit and how it can help the state reach its goals to lower emissions.

"We're talking about building one gigawatt of nuclear," Barsky said. "Having this new financing vehicle out there, we believe will have lots of future applications for other interesting financings."