Mayor Bill de Blasio's budget proposal drew criticism Thursday from the New York City Council and a budget watchdog for doing too little to gird against possible funding cuts under the Trump administration.

The $84.86 billion fiscal 2018 executive budget released by the mayor at City Hall on Wednesday featured the largest reserves in city history. It includes $1 billion each year in the general reserve, $4 billion in a retiree health benefits trust fund, and $250 million in every year of the four-year capital stabilization reserve plan that de Blasio's administration established.

The new proposal also makes new investments in education, public safety and housing affordability.

In its response to the mayor’s $84.67 billion preliminary budget unveiled in January, the council earlier this month added $134 million in spending while calling on the administration to build up reserves as worry about funding cuts by the Trump Administration in Washington looms over the budget process.

Since taking office Jan. 20, Trump has championed a health care bill that would cut back Medicaid, threatened to cut off federal funds to sanctuary cities such as New York, and floated a federal tax proposal that would eliminate the deduction for state and local taxes.

De Blasio echoed that concern on Wednesday, saying the fiscal climate is "plagued with uncertainty," but adding that the city would not be deterred in spending on what it needs.

"The city's future depends on investing the right priorities today, which is exactly what this budget does," de Blasio said on Wednesday.

“We applaud the administration for incorporating several of the recommendations outlined in our fiscal 2018 preliminary budget response,” said City Council Speaker Melissa Mark-Viverito and Council Finance Chair Julissa Ferreras-Copeland in a joint statement “We commend Mayor de Blasio for identifying city savings, increasing the city’s capital investments and funding key services to protect and support our communities.”

But the council members continued to advocate for an increase in city reserves.

“…the Council remains concerned that the mayor’s proposal does not increase the city’s reserves -- which is an important measure under the current national political uncertainty -- fails to secure more summer youth employment program slots and does not provide additional funds for senior services,” Mark-Viverito and Ferreras-Copeland said. “…We look forward to working with the mayor in the coming weeks to negotiate a budget that protects our vulnerable communities and uplifts families across the city.”

One watchdog, Citizens Budget Commission, said the budget should have had more spending limits in the environment of political and economic uncertainty.

“Despite reductions in the tax revenue forecast and minor reductions in state aid, the budget adds more than $700 million in new agency needs in fiscal year 2018,” CBC President Carol Kellermann said in a statement. “This spending growth is not accompanied by any additional increase to the city's budget reserves, and budget gaps projected in future years have grown.”

De Blasio said despite the uncertainty at the federal level, the city must continue to fund those projects and areas it deems necessary and vital.

“We will not be paralyzed because Washington, D.C., is paralyzed,” he said. “We’ll deal with Washington, but we’re not going to wait.”

The fiscal 2018 executive budget is 3.4% higher than the final $81.2 billion fiscal 2017 budget that was approved last year. By law, the 51-member City Council must vote on the fiscal 2018 budget by July 1, when the new fiscal year starts. Last year’s approval by the council on June 14, marked the earliest time in 15 years that the two branches of city government had agreed on a plan.

“If approved, the proposed budget would increase the size of the budget by $12.4 billion, or 17%, since Mayor Michael Bloomberg's final budget in November 2014.” Kellermann said. “Similarly, the size of government would grow by more than 30,000 positions to approximately 327,000 full-time and full-time equivalent employees.”

De Blasio said that he expected criticism of his financial plan in these uncertain times.

"Look, I have a great deal of respect for the Citizens Budget Commission. They do very good work and they're a great part of the civic construct that helps us think about a host of issues,” he said. “I think it would be an interesting survey to see how many mayoral budgets over the last decades they approved of wholesale. I think it's their nature to criticize mayoral budgets. It's their nature to oppose any new spending. It's who they are, that's fine ... They're doing their job and we're doing our job."

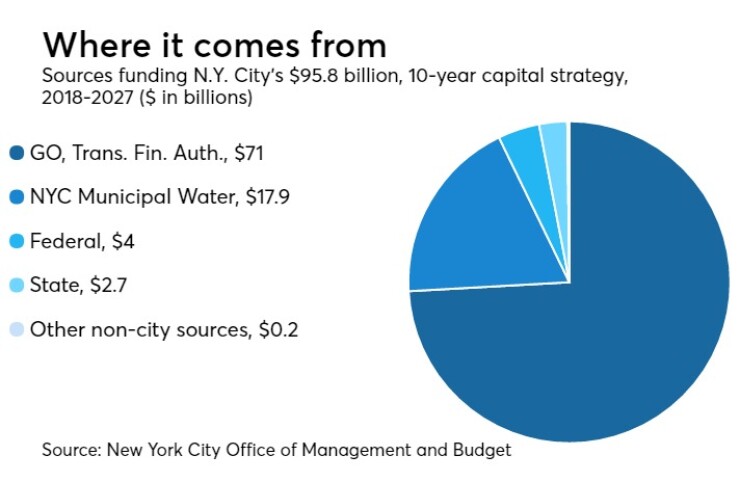

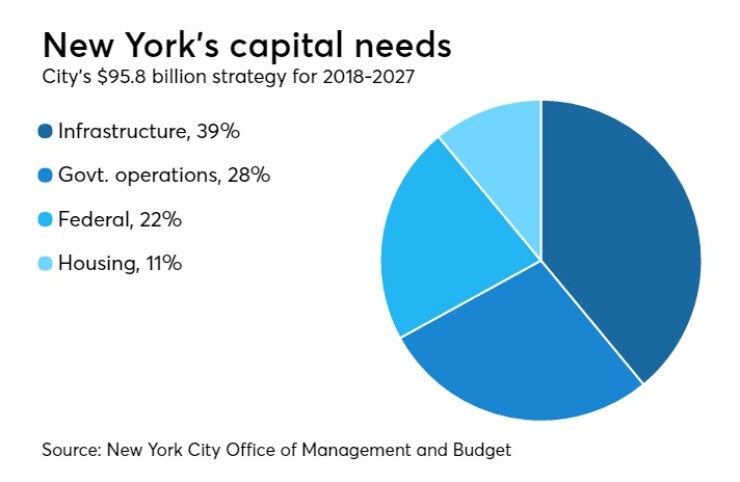

The 10-year capital budget from 2018 to 2027 totals $95.85 billion. Spending in the capital proposal is up from the $89.6 billion proposed in the preliminary budget.

“We don’t know what’s going to happen with the Trump infrastructure plan, but we have funding needs right now that are quite clear, and a lot of them are the invisible needs, our water supply and maintaining bridges, things that a lot of people don’t talk about. We believe this is an affordable plan,” de Blasio said.

The CBC, however, said the financial plan features a dramatic increase to the program.

“The five-year commitment plan will grow by $5 billion to $78 billion and the 10-year strategy will reach $96 billion,” Kellermann said. “The significant expansion does not demonstrate strategic and sensible prioritization of the city's investments to ensure that debt service remains manageable and affordable, particularly if revenues begin to decline.”

However, the Independent Budget Office said the capital plan met the standard of affordability. The budget watchdog is both city-funded and nonpartisan.

“Mayor de Blasio’s new budget includes a substantial number of new capital projects, from a $100 million extension of the Greenway on Manhattan’s East Side to $1.9 billion to increase affordability levels in his housing creation and preservation program,” said Doug Turetsky, IBO’s chief of staff. “Because of these new and other ongoing projects, the city’s annual debt service costs are projected to rise by about $2 billion by 2021 and reach nearly $8.4 billion. Yet as a share of city tax revenues, annual debt service costs remain under 15% of city tax revenue, a typical measure of affordability.”

“It’s an election year,” said Howard Cure, director of municipal bond credit research for Evercore Wealth Management. “It explains why there aren’t any unpleasant cuts in this budget.”

He said he was looking at the possible impact of a potential aid cut from the federal government in two specific areas.

“I am looking at the city hospital system and at what effect cuts, such as to the Medicaid program, could have on a system that’s already not doing well,” he said.

He added that that housing and homelessness were also special areas of concern.

“[Cuts] could hinder the city’s efforts to maintain or even expand public housing,” he said.

He also said the mayor should be looking to bolster the city’s reserves.

“How much does the city need to put into its reserves? I don’t know,” he said. “But I hope the buildup will be big enough to counter any federal aid cuts.”

Moody’s Investors Service rates the city’s general obligation bonds Aa2, while S&P Global Ratings and Fitch Ratings rate them AA. All three agencies assign stable outlooks to the credit. The city has $37.8 billion of GO debt outstanding as of Sept. 30, 2016.

Paul Burton contributed to this report.