New York's Metropolitan Transportation Authority will go to market on Wednesday with a $250 million sale of Triborough Bridge and Tunnel Authority bonds after Moody's Investors Service downgraded the TBTA's bonds last week.

Bond proceeds will further finance the capital plan of the TBTA, a division of the MTA that operates seven bridges and two tunnels in the New York City area.

Moody's lowered the general revenue senior 2012A serial bonds to Aa3 from Aa2 and its subordinate-lien bonds to A1 from Aa3. The rating agency adjusted its outlook to stable from negative. Affected are $6.9 billion of senior-lien and $1.8 billion of subordinate-lien bonds.

"The downgrade reflects lingering uncertainty regarding the regional economic recovery, low liquidity levels and lack of a debt-service reserve fund," Moody's said in its report, while acknowledging that monthly deposits to debt service accounts help ensure bondholder protections.

The new rating, according to Moody's, also reflects the legal requirement of the TBTA, known commonly as MTA Bridges and Tunnels, to subsidize the MTA's transit and commuter railroad systems.

"After paying debt service and making these transfers, the TBTA has a very thin operating margin," Moody's added.

Standard & Poor's and Fitch Ratings rate the bonds AA-minus. The bonds will mature from 2013 to 2042.

"Authority bridges and tunnels are very profitable, generating consistently strong debt-service coverage on both a senior-lien and a combined basis," Standard & Poor's said.

MTA countered Moody's by saying that bridge and tunnel crossings in the area are up. According to spokesman Aaron Donovan, the authority expects to handle 286 million crossings this year, generating more than $1.5 billion in revenue. He also noted that first-quarter crossings in the first quarter were up from the previous year and that MTA Bridges and Tunnels forecasts a $464 million cash surplus.

"Generating these annual surpluses strengthens bondholder security," Donovan added.

Bridges and Tunnels has a 2012 operating budget of $406 million, according to financial statements. Its bridges are the Robert F. Kennedy (formerly Triborough), Throgs Neck, Verrazano-Narrows, Bronx-Whitestone, Henry Hudson, Marine Parkway-Gil Hodges Memorial, and Cross Bay Veterans Memorial. Its tunnels are the Brooklyn-Battery and Queens Midtown.

Nixon Peabody LLP is bond counsel. Lamont Financial Services is the authority's financial advisor.

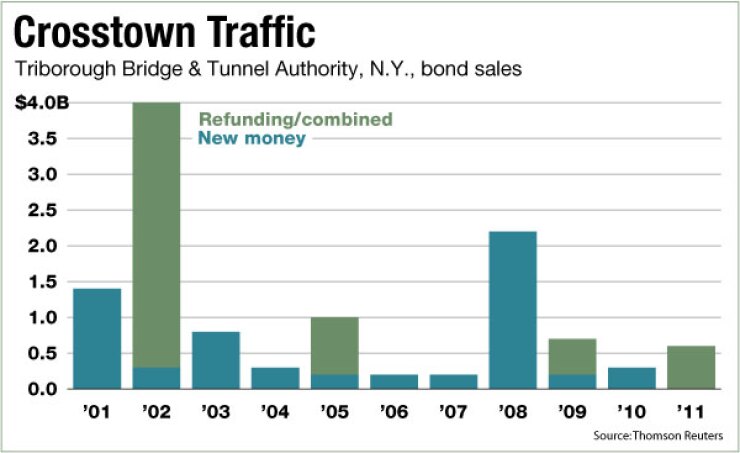

Finance manager Patrick McCoy told the MTA's finance committee last week that adding a refunding component to the bond deal would have been counterproductive. The MTA plans a TBTA refunding later in June, according to McCoy. "An advance refunding runs the risk of negative arbitrage and we prefer to avoid that," he said.

McCoy, other MTA officials and Lamont representatives recently met with investors during a road show it held in several cities. Deputy finance director Olga Chernat, deputy general counsel Katherine McManus and assistant finance director Lara Muldoon accompanied McCoy to San Francisco, Chicago, Philadelphia, Boston and New Hampshire. Lamont president Robert Lamb and managing consultant Renee Boicourt also made the trip.

"We anticipate significant capital markets activity throughout the year and we wanted to get out in front and meet with investors," McCoy said. The MTA has its presentation up on its website.

"Our key theme is transparency and openness and we want to keep our communications with the investor community open," he said.

Overall, the MTA expects to sell $4 billion in bonds in the third quarter — $1 billion in transportation revenue new money bonds, $2.7 billion in refunding and $285 million in remarketing — and $3.2 billion in the fourth, $2.7 billion of which is refunding, the rest in remarketing.

The $5.4 billion of refunding is for debt service savings across all four MTA credits, according to the authority.