In the aftermath of the highly anticipated Federal Reserve announcement of higher rates on Wednesday, there was a mixed tone in the municipal market early Thursday, with tepid response from the retail crowd, and municipals underperforming and lagging Treasuries in a quiet backdrop with little activity, according to municipal traders and underwriters.

“From our perspective the market feels technically strong, but sentiment seems weak given the strong economy and the hawkish Fed,” Michael Pietronico, president of Miller Tabak Asset Management said on Thursday morning.

“We would anticipate yields to slowly grind higher as we get closer to the end of the quarter,” he added. “Retail demand seems steady, but far from overly enthusiastic.”

One New York trader, meanwhile, described the tone in the municipal market Thursday as firm and strong with very little supply -- and extremely quiet at midday.

He said investors are being “apprehensive” about the front end of the yield curve due to the highly aggressive yields. “The yields are too low [in 2019 and 2020] so everyone is running for cover,” he said.

“Accounts are extremely patient and not really willing to pay up a few basis points from where the bid side was yesterday,” a second New York trader said. “They are tentative and not getting sucked in. We have not really seen any robust buying activity, and apathy is really high.”

While Treasuries had “a good tone” municipals were trailing behind their counterparts on the heels of the interest rate hike, according to the second trader.

“You had a pretty strong, hawkish rhetoric from the Fed yesterday, with global weakness,” he said Thursday morning.

“Right now, Treasuries got the bid, but munis are lagging in spots -- the market is stronger inside three to four years, and 15 years out it’s modestly better,” he added. “The word of the day is underperformance,” he added. “It’s all about Treasuries.”

Secondary market

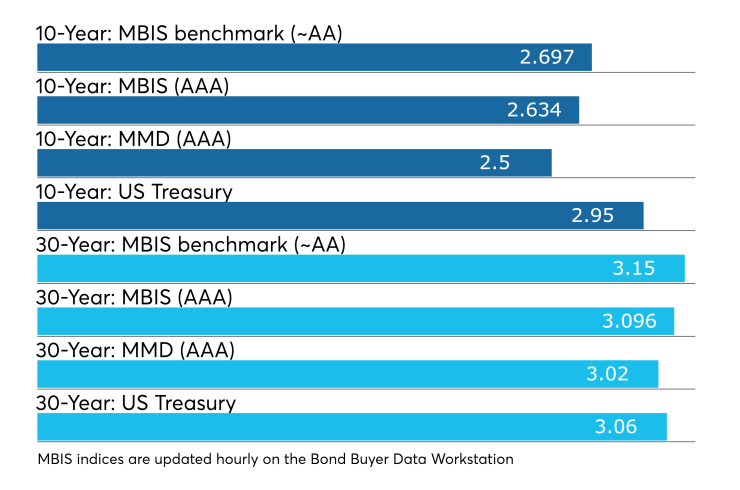

Municipal bonds were stronger on Thursday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the two- to 30-year maturities and rose less than a basis point in the one-year maturity.

High-grade munis were mixed, with yields calculated on MBIS’ AAA scale falling in the two- to four-year and eight- to 11-year and 14-year maturities, rising in the one-year, five- to seven-year and 17- to 30-year maturities and remaining unchanged in the 12-and 13-year and 15- and 16-year maturities.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed yields rising as much as one basis point in the 10-year muni general obligation and gaining as much as one basis point in the 30-year muni maturity.

Treasury bonds were stronger as stock prices were little changed.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 83.9% while the 30-year muni-to-Treasury ratio stood at 97.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,421 trades on Wednesday on volume of $15.10 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 13.755% of the market, the Empire State taking 12.107% and the Lone Star State taking 7.494%.

Primary market

The N.Y. Metropolitan Transportation Authority competitively sold $1.6 billion of transportation revenue bond anticipation notes in two sales consisting of $800 million of Series 2018B-1 and $800 million of Series 2018B-2.

The deals are rated MIG1 by Moody’s Investors Service, SP1-plus by S&P Global Ratings, F1-plus by Fitch Ratings and K1-plus by Kroll Bond Rating Agency.

The deals were won by a variety of groups.

Eight groups won the Series 2018B-1 bonds: UBS Financial, Barclays Capital, Jefferies, Goldman Sachs, Citigroup, Morgan Stanley, RBC Capital Markets and JPMorgan Securities.

Five groups won the Series 2018B-2 bonds: Jefferies, Citigroup, TD Securities, Morgan Stanley and Bank of America Merrill Lynch.

Public Resources Advisory Group and Backstrom McCarley Berry are is financial advisors on the deal while Nixon Peabody and Seaton & Associates are bond counsel.

Bond Buyer 30-day visible supply at $5.49B

The Bond Buyer's 30-day visible supply calendar decreased $1.16 billion to $5.49 billion on Thursday. The total is comprised of $3.24 billion of competitive sales and $2.26 billion of negotiated deals.

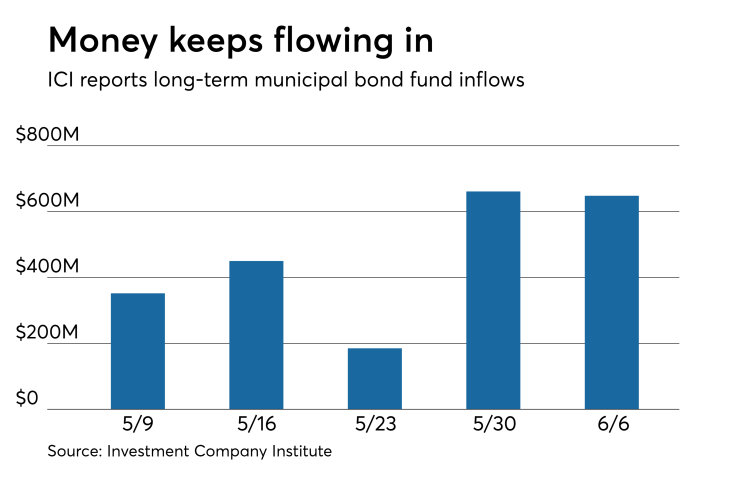

ICI: Long-term muni funds see $648M inflow

Long-term municipal bond funds saw an inflow of $648 million in the week ended June 6, the Investment Company Institute reported.

This followed an inflow of $661 million into the tax-exempt mutual funds in the week ended May30 and inflows of $185 million, 450 million and $352 million in the three prior weeks.

Taxable bond funds saw an estimated inflow of $727 million in the latest reporting week, after seeing an inflow of $1.57 billion in the previous week.

ICI said the total estimated outflows to long-term mutual funds and exchange-traded funds were $4.16 billion for the week ended June 6 after inflows of $7.15 billion in the prior week.

Tax-exempt money market funds saw outflows

Tax-exempt money market funds saw outflows of $1.96 billion, lowering total net assets to $137.69 billion in the week ended June 11, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $389.8 million to $139.65 billion in the prior week.

The average, seven-day simple yield for the 202 weekly reporting tax-exempt funds fell to 0.64% from 0.66% the previous week.

The total net assets of the 830 weekly reporting taxable money funds fell $2.08 billion to $2.690 trillion in the week ended June 12, after an inflow of $35.04 billion to $2.692 trillion the week before.

The average, seven-day simple yield for the taxable money funds decreased to 1.41% from 1.42% from the prior week.

Overall, the combined total net assets of the 1,032 weekly reporting money funds fell $4.04 billion to $2.828 trillion in the week ended June 12, after inflows of $34.65 billion to $2.832 trillion in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.