Municipal market anticipation for a billion dollar-plus New Jersey deal ramps up this week as traders get ready to see $7.5 billion of supply come their way.

“It was a relatively quiet week and the market seems to be somewhat stable [last week],” Howard Mackey, managing director at NW Financial Group in Hoboken said late Friday. “The big news is the N.J. Transportation Trust Fund Authority deal for $1.5 billion,” he said of the financing, in which his firm is a co-manager with lead Citigroup.

“There will be a large focus on this New Jersey deal,” as there has been a lack of state paper lately.

Mackey says demand should be strong for both 5% and 5.25% coupons because they are a favorable structure in the current rate scenario because of their defensiveness.

Meanwhile 4% coupons will able be snatched up by hungry investors. “In this environment when you have yields above 4% could see demand for 4s at a discount,” he said.

Depending on the structure crafted by the syndicate group at the pricing, “those are two scenarios I envision might materialize,” he added.

There has been evidence of strong demand for New Jersey paper lately — including NW Financial’s own $15 million Bergen County deal last week which was triple-A rated and was two to three times oversubscribed. “There’s just no Jersey paper out there,” he said. “For major buyers who approve the paper, I suspect demand will be pretty strong,” he added.

Citi is slated to price the N.J TTFA’s $1.56 billion of Series 2018A transportation system bonds ib Wednesday. Proceeds of the sale will refund outstanding bonds.

The deal is rated Baa1 by Moody’s Investors Service, BBB-plus by S&P Global Ratings and A-minus by Fitch Ratings.

Prior week's top underwriters

The top municipal bond underwriters of last week included Wells Fargo Securities, Bank of America Merrill Lynch, Barclays Capital, Ziegler and Citigroup, according to Thomson Reuters data.

In the week of Sept. 23 to Sept. 29, Wells Fargo underwrote $479.0 million, BAML $436.million, Barclays $384.22 million, Ziegler $277.9 million and Citi $272.4 million.

Primary market

Volume for the week is estimated at $7.5 billion, consisting of $5 billion of negotiated deals and $2.5 billion of competitive sales.

In the competitive arena on Tuesday, the Dormitory Authority of the State of New York is selling over $1.7 billion of tax-exempts and taxables in six separate offerings. Proceeds will be used for various state programs.

Public Resources Advisory Group and Backstrom McCarley Berry are the financial advisors; Hawkins Delafield and Golden Holley James are the bond counsel.

Additionally, the California Public Works Board is competitively selling $104.235 million of Series 2018C lease revenue bonds on Tuesday. Proceeds will be used to finance and refinance a portion of the costs of the design and construction associated with various correctional facilities projects.

KNN Public Finance is the financial advisors; the bond counsel is Stradling Yocca and the State Attorney General.

The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

Also on Tuesday, Raymond James & Associates is set to price the Texas Public Finance Authority’s $168.065 million of general obligation refunding bonds.

And JPMorgan Securities is expected to price the Indiana Finance Authority’s $162.075 million of hospital revenue bonds for Parkview Health consisting of Series 2018A and Series 2018C tax-exempts, Series 2018B taxables and Series 2019A forward delivery bonds.

Bank of America Merrill Lynch is set to price the Maine Municipal Bond Bankl’s $129 million of Series 2018B bonds on Tuesday.

BAML is also expected to price the Kentucky Bond Development Corp.’s $101 million of convention facilities revenue bonds for the Lexington Center Corp. on Tuesday.

Bond Buyer 30-day visible supply at $11.59B

The Bond Buyer's 30-day visible supply calendar increased $1.81 billion to $11.59 billion for Monday. The total is comprised of $4.57 billion of competitive sales and $7.02 billion of negotiated deals.

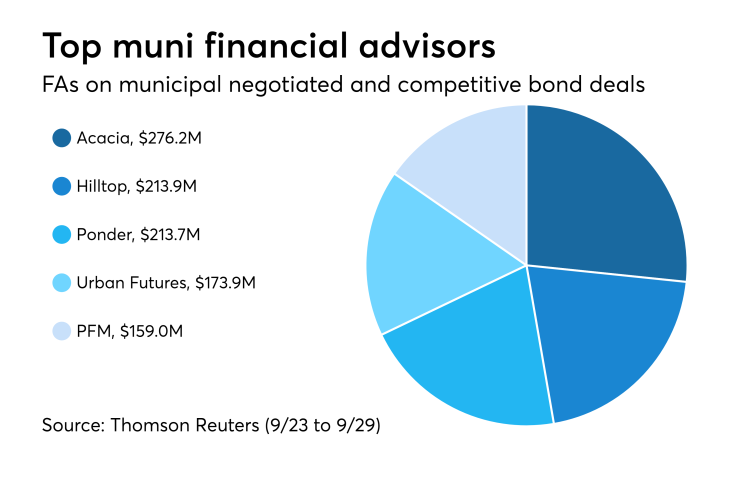

Prior week's top FAs

The top municipal financial advisors of last week included Acacia Financial Group, Hilltop Securities, Ponder & Co., Urban Futures Inc., and PFM Financial Advisors, according to Thomson Reuters data.

In the week of Sept. 23 to Sept. 29, Acacia advised on $276.2 million, Hilltop $213.9 million, Ponder $213.7 million, Urban $173.9 million, and PFM $159.0 million.

Secondary market

Municipal bonds were mostly stronger on Monday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- and two-year and seven- to 30-year maturities, rose less than a basis point in the three- to five-year maturities and were unchanged in the six-year maturity.

High-grade munis were mixed, with yields calculated on MBIS' AAA scale falling as much as one basis point in the seven- to 11-year, 13- and 14-year and 26- to 30-year maturities, rising as much as one basis point in the one- to six-year, 12-year and 17- to 25-year maturities and remaining unchanged in the 15- and 16-year maturities.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining unchanged while the yield on 30-year muni maturity rose as much as two basis points.

Treasury bonds were weaker as stock prices traded higher.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 84.6% while the 30-year muni-to-Treasury ratio stood at 99.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Market activity was rather quiet on Friday, with some saying munis were seeing little action altogether.

“The market seems to just be trudging along, following the Treasury market,” Peter Delahunt, managing director at Raymond James & Associates said on Friday afternoon.

“New money gets invested and then the market goes back to watching the Kavanaugh debacle or the Ryder Cup,” Delahunt said.

Previous session's activity

The Municipal Securities Rulemaking Board reported 32,583 trades on Friday on volume of $9.57 billion.

California, New York and Texas were the municipalities with the most trades, with the he Golden State taking 15.015% of the market, the Empire State taking 11.566%, and the Lone Star State taking 11.183%.

Prior week's actively traded issues

Revenue bonds comprised 56.66% of total new issuance in the week ended Sept. 28, up from 56.65% in the prior week, according to

Some of the most actively traded munis by type in the week were from Puerto Rico, Minnesota and Pennsylvania issuers.

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2053 traded 23 times. In the revenue bond sector, the Minneapolis Health Care System 4s of 2048 traded 59 times. And in the taxable bond sector, the Pocono Mountains Industrial Park Authority, Pa., 5.05s of 2049 traded 24 times.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.