New York is reaching out to retail investors with a website launched to coincide with a $1.1 billion personal income tax bond deal next week. The deal is the first to appear on the site, which went live last month, and with a glut of year-end issuance driving muni rates sharply higher recently, extra marketing couldn’t hurt.

The Empire State Development Corp. will issue the bonds on behalf of the state as a mix of tax-exempts, taxable Build America Bonds, and traditional taxable bonds. The ESDC is also known as the Urban Development Corp.

“Since the fall of 2008, we’ve seen an increasing importance in the role of retail investors in the state’s bond sales,” Division of Budget spokesman Erik Kriss said in an e-mail. “With the intent to extend the state’s retail investor network, we launched the website specifically designed to provide investors — and potential investors — with a single source of information on the types of bonds that are sold on behalf of the state.”

The ESDC plans to offer the bonds to retail investors on Nov. 30, followed by institutional sales on Dec. 1.

“The state plans to advertise on the Internet and direct potential investors to this site, where they can find useful information on the offering as well as instructions to make a purchase, if interested,” he said. “Hopefully, this will drive more retail participation in the offering.”

Retail orders have traditionally accounted for 25% to 40% of state bond transactions, he said. With interest rates at historically low levels last month, Kriss said that retail participation was “muted” in a Dormitory Authority of the State of New York $1.32 billion PIT deal that priced on Oct. 5. A $550 million PIT deal by the New York State Thruway Authority in September had about 33% retail participation, he said.

The site,

As issuers have rushed to market to beat a year-end deadline for selling BABs, and with California selling billions in a matter of days, yields spiked higher last week. Municipal Market Data’s triple-A benchmark for 30-year bonds had risen to 4.5% on Thursday, compared to 3.86% on Nov. 1.

The ESDC deal consists of three series: the tax-exempt 2010A bonds with a par of $427.2 million; traditional taxable 2010B bonds with a par of $328.4 million; and $349.3 million of BABs in Series 2010C.

Morgan Stanley will be book-runner on the Series 2010A bonds. Citi will be book-runner on the Series 2010B and 2010C bonds.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo PC is bond counsel.

A preliminary structure was not available last week.

“We are currently planning to structure the transaction consistent with the state’s approach on prior PIT deals,” Kriss said on Friday. “However, we may adjust the structure prior to pricing if market conditions warrant. No changes are being considered at this time, though.”

The state last sold PITs through DASNY on Oct. 5, when the conduit issuer priced $1.32 billion of taxable and tax-exempt debt. The deal included $549.4 million of BABs with maturities from 2021 through 2024, and term bonds in 2033 and 2040. The BABs priced to yield between 155 and 190 basis points over comparable Treasury yields. The deal also included $149.6 million of traditional taxable bonds.

On the tax-exempt side, DASNY priced a $555.9 million series with maturities from 2011 through 2030, and term bonds maturing in 2035 and 2040. Yields ranged from 0.40% with a 2% coupon in 2011 to 4.02% with a 5% coupon in 2035. It also sold a $54.4 million series with maturities from 2011 through 2028 and term bonds in 2030 and 2035.

The state plans to use the bond proceeds from the ESDC PITs to finance grants, programs, and a range of projects including the equipping of a computer chip research and development center at the State University of New York at Albany, redevelopment of Governors Island, and the construction of a video lottery facility at the state-owned Aqueduct Racetrack in Queens.

Standard & Poor’s rates the state’s outstanding PIT bonds AAA and Fitch Ratings rates them AA. Both have stable outlooks.

The bonds are secured by a pledge, subject to appropriation, of 25% of state personal income tax receipts. Personal income tax receipts declined in fiscal 2010 to $34.8 billion from $36.8 billion in the preceding fiscal year. In fiscal 2011, which began on April 1, personal income tax receipts are projected to mostly recover, reaching $36.6 billion.

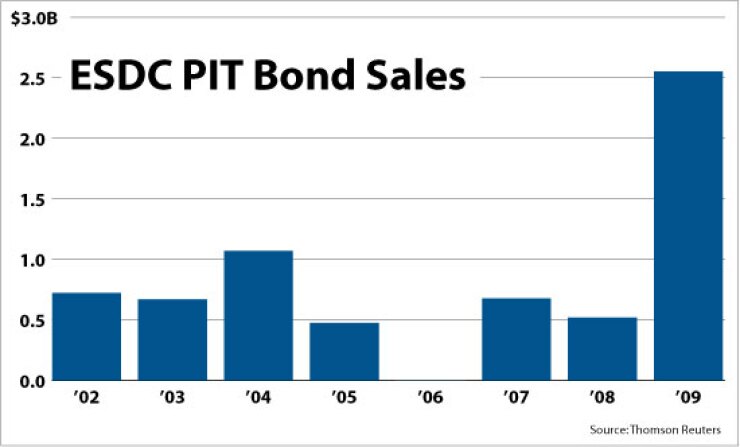

PIT bonds — which can be issued through five public authorities — are the state’s primary vehicle for debt issuance. The state has sold $19.83 billion of new-money PIT bonds since the credit was introduced in 2002, according to Thomson Reuters. By comparison, the state has sold $2.3 billion of general obligation bonds. New York has $56.63 billion of state-related debt outstanding, according to the POS.

Comptroller Thomas DiNapoli said last week the state’s general fund balance at the end of October was $185.3 million over mid-year projections but that heightened spending pressures and “optimistic” year-end revenue targets could produce a sizeable deficit.

“General fund tax collections will have to grow more than 10% for the rest of the year to meet year-end projections,” DiNapoli said in a press release. “Based on current trends, the general fund deficit could approach $1 billion by the end of the fiscal year, if corrective action is not taken.”

Wall Street is on pace for its sixth most profitable year in inflation-adjusted dollars in the last 30 years. The comptroller’s office projected that New York’s securities industry would earn $19 billion in calendar 2010, compared to $61.4 billion in 2009. The profits follow record losses in 2007 and 2008 totaling $54 billion. DiNapoli credited federal bailouts with the industry’s quick revival. Despite the gains, the industry is downsizing in response to the economy and new regulations.

“New York needs Wall Street to do well, but the securities industry is still losing jobs,” DiNapoli said in a press release. “The state can’t rely on a full recovery of Wall Street to resolve its budget shortfall.”

Gov. David Paterson last week called an extraordinary Legislative session for Monday, Nov. 29, to deal with the current-year deficit and take up lame-duck agenda items such as confirming government appointments.

Governor-elect Andrew Cuomo last week announced further picks to his transition team, as he has to ready a budget for January that needs to close a projected $9 billion deficit. Cuomo created committees for health and education, transportation and infrastructure, and state and local government reform.