The New York Metropolitan Transportation Authority, recently downgraded, is expected to hit the market with a bond offering north of $700 million, providing a litmus test to a trepidatious market as to its appetite for recovery and willingness to absorb risky debt.

Jefferies is set to price the MTA's $704 million green bond issuance Tuesday. Premarketing wires indicate three bullet maturities, in 2045, 2050, and 2055, respectively yielding 5.00% with a 4.75% coupon, 5.15% with a 5% coupon, and 5.30% with a 5.25% coupon. Those levels are more than 300 basis points higher than triple-A benchmarks, with the high spreads attribitubleable to several recent downgrades by various raters due to coronavirus-led 90%-plus ridership losses.

“What the market (and dealers) agree doing now is ‘start the deal cheap as an issuer can stomach. Get some price talk going and find out where the investors might take the bid’,” a New York trader said. “The structures of these deals is becoming difficult in that what the issuer wants — longer-dated paper — is different from what the market, the investor wants, and that is security in 10 years they’ll have an income.”

That philosophy makes somewhat sense as the U.S. Treasury is poised to bring back its 20-year bonds. Hedging is what the buy side is looking for, sources said.

Meanwhile, a $1 billion taxable bond deal is set to be priced from one of the largest "state schools in the U.S., and Illinois will drop $1.2 billion of short-term notes on the market.

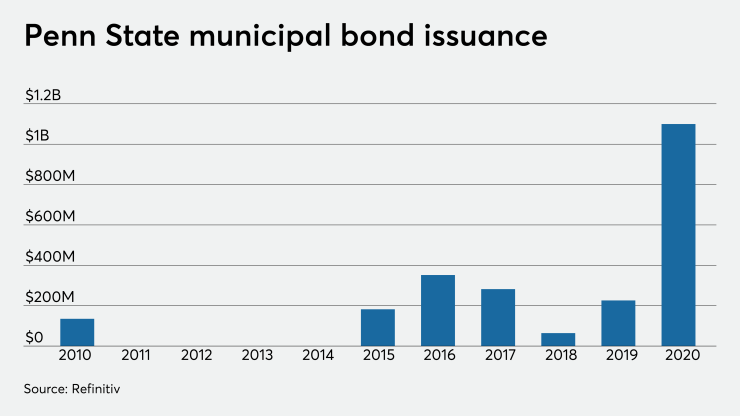

On Tuesday, Barclays Capital is set to price Pennsylvania State University’s (Aa1/AA//) $1.07 billion of taxable bonds and $61.1 million of tax-exempts.

Since 2010, the university has sold about $2.8 billion of bonds, including Tuesday’s issuance.

The university was last in the market on Feb. 4, when Barclays priced the $411.54 million of taxables and exempts. That deal saw the taxable piece priced at par to yield from 1.449% in 2020 to 2.509% in 2035, 2.758% in 2040 and 2.88% in 2050; the exempts were priced as 5s to yield from 0.82% in 2021 to 1.78% in 2040 and as 5s to yield 1.95% in 2045 and as 4s to yield 2.20% in 2050.

On Friday, the 5% exempt bonds of 2040, originally priced at 129.37 to yield 1.78%, were trading at a high price of 122.362, a low yield of 2.427%, in two trades totaling $30,000, according to data on the MSRB’s EMMA website.

How a university system the size and scope of Penn State, with its 45,000-plus pre-corona population on its main campus in University Park alone, and its 110,00-person-populated football stadium, without a team on the field, led some to question why university debt in general has fared well enough during this crisis. Harvard (its endowment fund at $40 billion) already sold bonds last month and many other educational facilities have been trading decently. Penn State may prove it is not only the Ivys that can carry their debt load.

"There, of course, is a hope in this market, in this world, that we will see and be able to congregate in that large of a place again," a trader said.

Also on Tuesday, Morgan Stanley is expected to price the Knox County Health, Educational and Housing facility’s (NR/BBB/BBB/NR) $169 million of revenue bonds for the University Health System Inc. BofA Securities is set to price the Rhode Island Commerce Corp.’s (A21/AA-//) $161 million of grant anticipation notes for the state’s Department of Transportation.

And BofA is ready to price the University of Notre Dame’s (Aaa///) $155 million of taxable corporate CUSIP fixed-rate bonds.

On Wednesday, Illinois will competitively sell $1.2 billion of one-year general obligation cash flow certificates in three offerings.

In Monday's trade, municipals resumed the rally that began last week. Trading got off to a smooth start even as the Treasury and equities markets continued to see volatility.

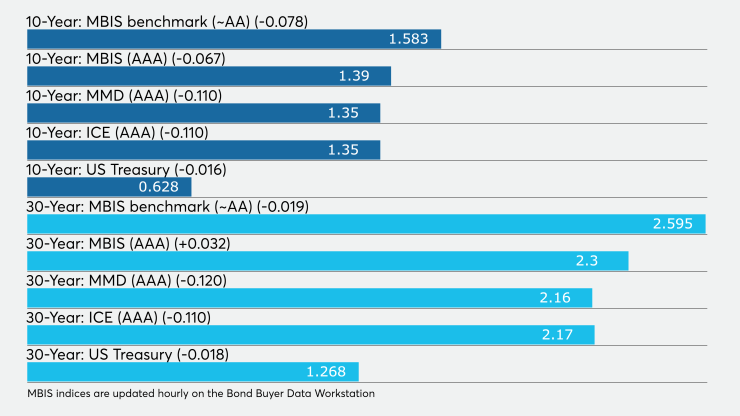

After last Friday’s rally where yields fell as much as 12 basis points, municipalities continue to strengthen after two weeks where prices eroded. Yields were down as much as five basis points late in the day, according to readings from Refinitiv Municipal Market Data, ICE Data Services and BVAL.

Treasury yields were drifting ahead of this week’s quarterly refunding.

Almost $100 billion will be coming back to municipal investors over the coming months as the annual reinvestment season gets underway. Of that total, $6, sources said $8 billion is principal and $31 billion is interest. Muni investors have $20 billion to put to work this month, framing some positive technical backdrop for exempts. Muni-U.S. Treasury ratios remain elevated, signaling cheaper valuations for tax-exempts vs. their taxable counterparts.

Further tailwinds for tax-exempts have been coming from crossover and non-traditional buyers, as Fed involvement in other fixed income areas has clouded valuation.

On Wednesday, the Treasury Department is set to add a 20-year bond to its auctions of three-, 10-, and 30-year securities.

Treasury Secretary Steve Mnuchin is expected to unveil a record amount of debt sales, which are needed to help finance the $4 trillion COVID-19 aid package.

The Treasury hasn’t sold 20-year bonds since 1986. It had been slated to begin auctioning them later in the year, but increased funding requirements due to the coronavirus pushed up the schedule.

On Monday, Treasury announced its borrowing needs for the April through June and the July through September periods.

In April–June, Treasury expects to borrow $2.999 trillion in privately held net marketable debt, assuming a cash balance of $800 billion at the end of June. The borrowing estimate is $3.055 trillion higher than announced in February.

Treasury said the increase is due to the impact of the COVID-19 outbreak, “including expenditures from new legislation to assist individuals and businesses, changes to tax receipts including the deferral of individual and business taxes from April – June until July and an increase in the assumed end-of-June Treasury cash balance.”

In the July–September 2020 quarter, Treasury expects to borrow $677 billion, assuming an end-of-September cash balance of $800 billion.

In late trading, the three month was yielding 0.109%, the two-year was yielding 0.188%, the five-year was yielding 0.362%, the 10-year was yielding 0.644% and the 30-year was yielding 1.299%.

Equities made a late day turnaround to finish higher after trading down in triple-digit numbers for moist of the day as the U.S. and China traded barbs over the pandemic’s cause and response and investor Warren Buffet’s pessimistic weekend words weighed on investor sentiment.

At the close, the Dow was up 0.11%, the S&P 500 was up 0.42% and the Nasdaq was 1.23% higher.